Firstmac and its loans.com.au has grown to be Australia’s 14th biggest lender

A tiny lending business started in Brisbane has grown into a financial powerhouse thanks to the ideas of its founder and now his daughter who like to fly under the radar.

QBM

Don't miss out on the headlines from QBM. Followed categories will be added to My News.

To the extent that it’s possible for a company which runs loans books worth $13bn from penthouse offices in Eagle Street with a signed Pink Floyd guitar in the foyer to fly under the radar, Firstmac has.

But that might be about to change as the private financial company founded in Brisbane by Kim Cannon marks 41 years in business with a burst of acquisitions and new products.

Son takes over rich-lister dad’s $1.5bn construction empire

How a 105-year-old Brisbane firm survived wars, depression and now COVID-19

Cannon, who had been spending more time enjoying pursuits like swimming with whale sharks overseas, is now back on the tools a bit more to steer Firstmac through COVID-19. Daughter Marie Mortimer is also on hand as managing director of loans.com.au.

Together they are Australia’s 14th largest lender and also own carloans.com.au, savings.com.au and recently bought car concierge business georgie.com.au. Digital banking – where with a press of a smart phone button someone can switch financial products in an instant – is next on their list.

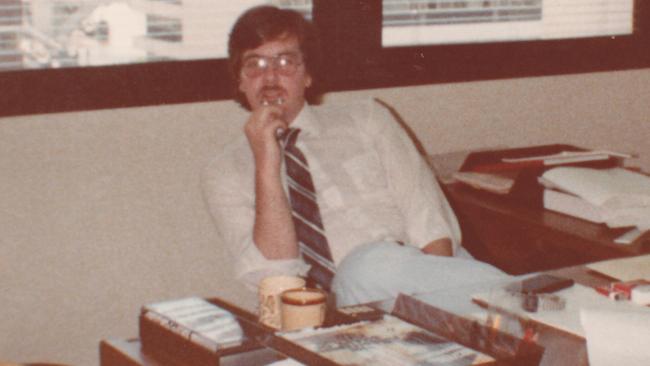

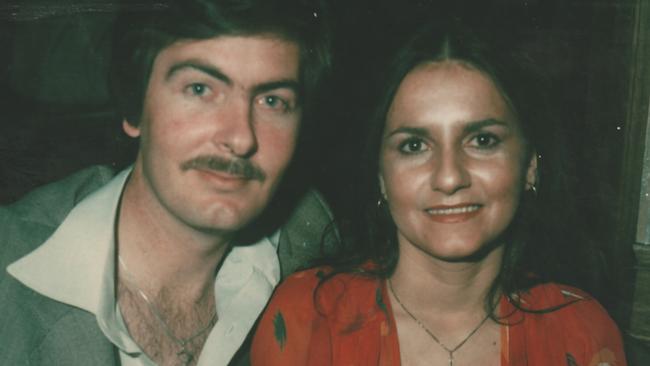

The constant evolution comes from Cannon, 65, who insists businesses must totally reinvent themselves every seven years – a mantra he has abided by since starting out “by accident” in 1979 as an equipment finance broker while working for Dunlop.Originally from Blacktown in Sydney’s western suburbs, he moved to Brisbane with wife Sia, who was from Biloela in central Queensland.

“It was a two-person show with Sia for a number of years. We used to work seven days a week. I’d travel in the early days up to north Queensland to do earthmoving equipment and she’d do all the documents and lodging all the applications when I got back,” Cannon says.

“Then in the late ’80s I started travelling to the US, learning what the Americans were doing in home loans and lending and securitisation.

“I then put together one of the first programs in 1990 with a small bank in those days called the Primary Industry Bank (that later became Rabobank that then sold the loan book to ANZ) and started from there doing non-bank home lending.

“In the early 2000s we started to do our own funding and securitisation, away from the bank balance sheets.

“We’ve done hundreds of thousands of home loans over the years and stayed alive.

“It (COVID) is like when the GFC hit. You’re supposed to get one of those in a lifetime and now with COVID it’s two in a lifetime and you have to manage the business through it.

“I am your typical person that had no education other than high school. Never worked in a bank. Aim for the stars and see where we get.”

Today, investors who ride up the 40 levels to Firstmac’s offices in the Riverside Centre get a cacophony of paintings, mosaics, Pink Floyd paraphernalia and a set of stairs to the very top where a large deck affords views of the entire city and bay.

“For a lot of years we flew under the radar – a lot of people didn’t actually know we existed,” Cannon says.

“But in recent years, I suppose since we got the Broncos sponsorship and a bunch of other deals, people suddenly go, who the hell are you?

“But before that you wouldn’t hear about us or what we achieved. In general we just fly under the radar and it suits us to do that.

“People often ask me – who are you? Well when they come here, they know,” Cannon says of the way the office is fitted out.

And why not. With no shareholders to appease, it is investors and customers that Firstmac must chase.

Enter daughter Marie Mortimer, the 38-year-old FinTech Australia board member who, after a degree at QUT and four years working across IT projects in investment banking in London, came home to start a revolution.

“In 2011 I built a website loans.com.au. It’s a very pink website and it was a bit of a trial for Firstmac at the time. A lot of people at the time weren’t keen on my new website. We had a lot of people, internally and externally pretty hesitant about it,” Mortimer says.

Loans.com.au is now almost half the Firstmac business with a $6bn loan book and about 43,000 quality customers, says Mortimer, which is important to investors looking to buy Firstmac’s bonds.

“As a female in a professional position we can sometimes talk ourselves down and put our achievements down to luck and you know, I’ve built a $6bn loan book and carloans.com.au. That isn’t luck. So it’s just a lot of hard work and having a plan for the future.

“When people think non-bank (lender) they think subprime lender and it’s just not what we are. We are a prime lender. We are taking customers off the major four banks, and it’s their prime customers – our hardship figures (loan repayment deferrals due to hardship) have been a lot lower than the big banks.

“We create competition in the market which is really important for Australia. We just keep competing online. We’ve been able to sustain it for nine years, because everything (loan software and online banking systems) is built in-house. We know where and when to spend our money to get customers.

“The term fintech is really popular these days but we had a fintech before that term existed.”

It will be Mortimer who shepherds Firstmac to the next era and both she and her father insist they will continue to reject all the private equity buy out offers. “It’s down to me to create a sustainable future for Firstmac,” she says.