QBiotics has just pocketed $50m in a drive to get $75m in new funding for cancer treatments

A promising Brisbane biotech outfit focused on fighting cancer has just launched its biggest capital raising to date, aiming to rustle up $75m.

QLD Business

Don't miss out on the headlines from QLD Business. Followed categories will be added to My News.

BIOTECH WINDFALL

A promising Brisbane biotech outfit focused on fighting cancer has just launched its biggest capital raising to date, aiming to rustle up $75m.

Loss-making QBiotics Group revealed on Tuesday that it had already secured $50m of the dough from Sydney-based fund manager TDM Growth Partners, which is now considered a cornerstone investor.

Existing stakeholders have also been invited to tip in more at 90 cents a share, the same price forked out by TDM.

The cash infusion comes at a critical juncture for the company, which launched in 2004 and has only recently started commercialising one of its products overseas.

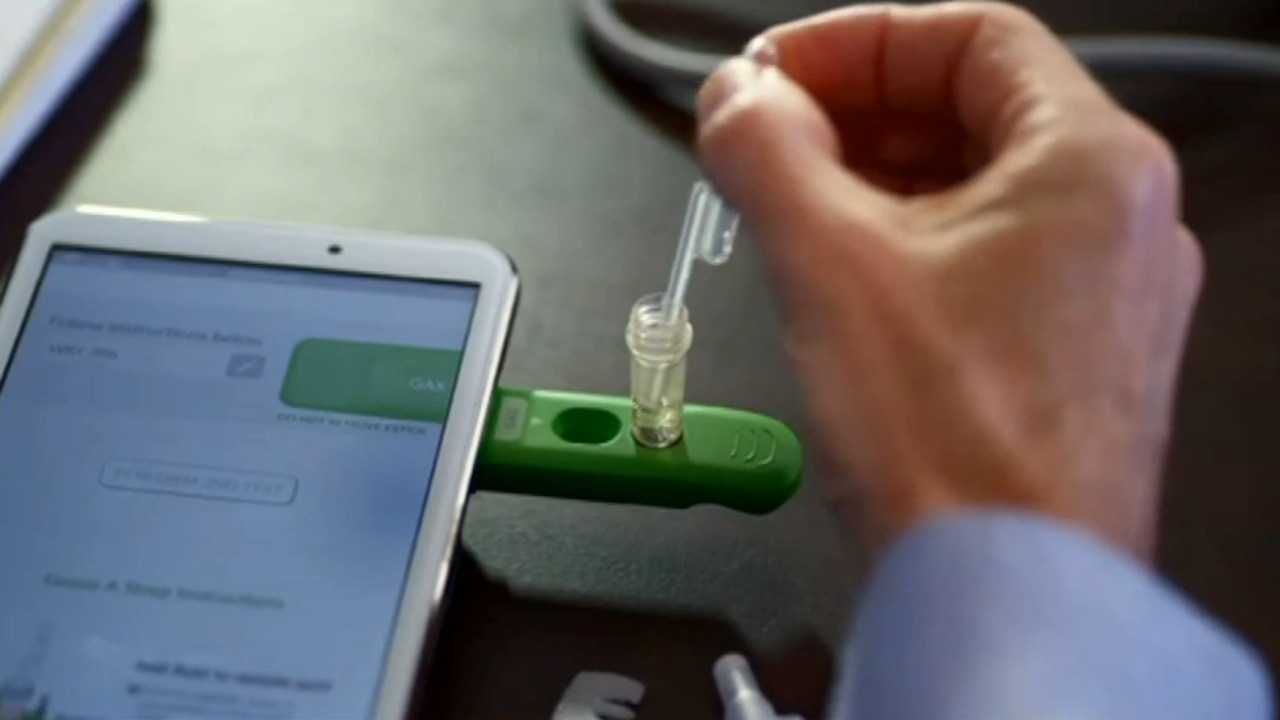

QBiotics won a coveted approval from US regulators in November for distribution of its drug Stelfonta, a liquid injection capable of snuffing out tumours in dogs. The first shipment arrived there late last month.

Clinical trials found that the drug, sourced from blushwood trees in the Atherton Tablelands, could cure 75 per cent of dogs with a single shot, while 88 per cent needed a second dose to wipe out the disease. It’s already in use in the UK and Europe.

Not surprisingly, human trials are well-advanced and, to speed up the work last year, the firm teamed up with global pharmaceutical giant MSD, otherwise known as Merck. Work is under way on wound-healing treatments, as well.

QBiotics, headed by Dr Victoria Gordon, also added a bit of firepower to its board last month when Nick Moore, took on a non-executive director’s role.

Moore, of course, spent a decade at the helm of Macquarie Bank, before retiring in 2018. All up he spent 33 years at the investment bank commonly referred to as “the millionaire’s factory’’.

TDM co-founder Hamish Corlett predicted that QBiotics could become the next CSL, the only truly successful global specialty biotech company founded in Australia.

It’s an intriguing move by TDM, an astute mob which remains Guzman y Gomez’s biggest shareholder with a 35 per cent stake. They have also previously invested in Spotify, Tyro and Pacific Smiles Group.

But, like other investors, they’ll want to start seeing revenue lift from the paltry $1.6m generated in the last financial year.

Net losses amounted to $11.8m in that time, continuing a non-stop cash-burn since day one at QBiotics.

The company, which received $5m in government grants, now has accumulated losses of $66m, according to the annual report obtained by City Beat.

Despite these daunting figures, Gordon said in the report that the company has $23.4m in cash in the bank and is “currently in a sound financial position’’.

She also once again flagged plans for a long-touted IPO. That goal has long remained elusive for the firm, which scrapped a previous tilt at the boards in 2016.

HIGH FIVES

There were high-fives aplenty on Tuesday inside the boardroom of Brisbane mining minnow State Gas.

The company, which is production testing three coal seam gas wells at one of the most promising fields in the Bowen Basin, celebrated results that far exceeded expectations.

“Last week I advised we had ‘cracked the code’ at Reid’s Dome and these results truly confirm it,’’ chairman Richard Cottee crowed. “This is very exciting.’’

Reid’s Dome, about 30km outside of Rolleston, was first discovered in 1955 and remains one of Queensland’s biggest untapped gas fields.