Smaller businesses seeking space in the Brisbane CBD are the busiest part of the leasing market

SMALL tenants wanting less than 1000sq m of space have a big impact on leasing market in Brisbane’s CBD.

Prime Site

Don't miss out on the headlines from Prime Site. Followed categories will be added to My News.

SMALL tenants are leading the leasing charge in the Brisbane CBD as business confidence improves in Queensland, according to research.

JLL research found total net absorption in the Brisbane CBD was 33,200sq m last year, with small tenants making up over 80 per cent of that occupier demand.

And in a separate survey by Colliers International the trend has continued in the first quarter of this year with inquiries for up to 1000sq m of space up 148 per cent more than the previous quarter, with the “sweet spot” in the 100sq m to 300sq m range.

JLL’s senior research analyst Tom Broderick said the transition in the Queensland economy from a reliance on mining investment to a broader-based growth trajectory has boosted confidence for 2018.

“The economic recovery is now reaching maturity, with strong growth and job creation over the past 12 months and this has led to an improvement in office leasing demand in the Brisbane CBD, with above-average net absorption over the past two years,” he said.

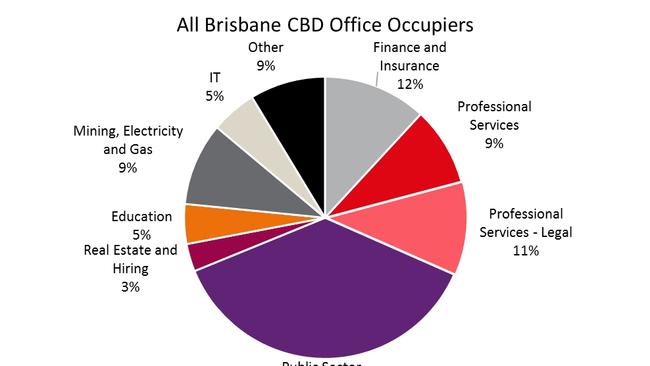

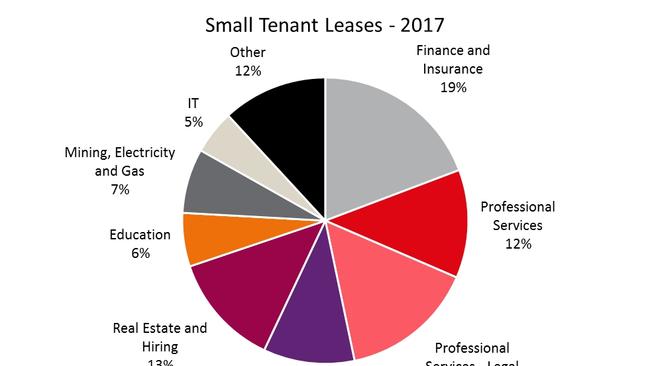

An analysis of activity in 2017 found that the finance, professional services and legal firm sectors made up almost half of the space taken by small tenants.

When looking purely at new entrants to the Brisbane market, law firms accounted for almost 30 per cent of demand.

According to JLL figures released this week total net absorption in the Brisbane CBD in the first quarter of 2018 was 15,300sq m, bringing vacancy down from 15 per cent to 13.9 per cent. Prime vacancy was 8.5 per cent, down from 13.1 per cent a year ago.

JLL director of Queensland leasing James Montague said owners speculatively fitting out floors into smaller suites has encouraged smaller firms to move from serviced offices.

“Landlords are now providing small businesses with a viable alternative to serviced offices and sublease opportunities,” he said.

“Tenants seeking fully fitted accommodation have the ability to establish a direct relationship with institutional landlords and partner with real estate providers that will be able to accommodate their growth needs as their businesses expand.