‘People don’t realise’: Why Aussies are missing out on pay for a HECS debt already paid off

A common mistake has taxpayers continue to have money withheld from their pay even after their HECS debt is paid off.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Australians are unknowingly continuing to have money withheld from their pay for HECS/HELP repayments despite having already paid off the loan.

A common method used to pay off student debt in Australia is to have your employer withhold money from your pay – but a “very common mistake” made under this process can have “significant” financial impacts, a Sydney accountant warns.

It may seem obvious that your employer would stop withholding this money from your pay once your HECS/HELP debt is all paid off, but that does not automatically happen.

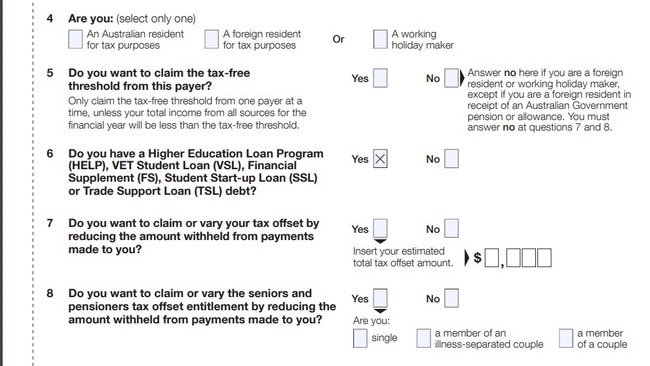

When you first sign on with a new employer, you will fill out a TFN Declaration, where you simply tick a box to disclose you have HECS debt and as a result your employer withholds money from your pay to contribute towards your debt.

It means many Aussies can give little attention to their student debt for years without trouble.

“This declaration kind of works like a ‘set and forget’ process, but the issue is many people tend to forget about the declaration they’ve made even after their HECS debt is paid off,” founder of chartered accounting firm Hive Wise Hripsime Demirdjian told news.com.au.

“This is a very common mistake taxpayers make because people assume their employer knows the details about their HECS debt. The truth is, they only know what you tell them,” Ms Demirdjian said.

She urged taxpayers to keep an eye on their HECS balance through their myGov account and check their pay slips for the STSL (Study and Training Support Loans) tax, as not doing so could cost you.

“The financial impacts of this [making HECS repayments while in credit] are significant, as your net take-home pay will be lower which means less cash in your hands,” she Ms Demirdjian said.

“This could amount to thousands of dollars by the end of the financial year.”

If you have overpaid your HECS/HELP debt, you can only get it refunded once you lodge your tax return, and you must have no other tax debts.

“You could be waiting months to see this money land in your pocket because you can only lodge your tax return after the end of the June 30 financial year,” Ms Demirdjian said.

An Australian Taxation Office spokespersom told news.com.au there was no data available on the number of taxpayers who have STSL amounts taken out of their pay with no HECS/HELP debt remaining.

There is also no data on the number of Australians who have overpaid their HECS/HELP debt, or how many Australians were refunded in their tax return because of an overpaid HECS/HELP debt.

The ATO did confirm “employees are responsible for advising employers” when their student debts are paid in full.

Giving the ATO an ‘interest-free loan’

An Aussie mum posted in a Facebook group asking for advice this week after she realised she was having money taken out of her pay for her HECS debt four years after it was all paid off.

Others then admitted they kept up the payments via their employer deliberately as a way of forced saving, to then get a large tax return.

Ms Demirdjian told news.com.au she “strongly” advises against this.

“Many people claim they do this because they have poor saving habits and so they prefer to have the money locked away with the ATO to receive a chunky refund in their tax return,” she said.

“What people don’t realise is that they are essentially providing the ATO with an interest-free loan. Considering how high interest rates are these days, this isn’t the wisest financial decision.”

Ms Demirdjian said there were better ways to grow your savings and manage your finances, and that education was key.

“You could be putting that money to other uses and investing it elsewhere,” she said.

“I always say ‘it’s better in your pocket than the ATO’s’.”

To stop the payments, employees must complete the Australian Taxation Office’s ‘withholding declaration’ form and answer ‘no’ to question 6: whether they have a HECS/HELP debt.

Almost three million people had an outstanding HECS/HELP debt in 2022–23, owing the government $78 billion.

Once Australians are earning above the threshold ($54,435 for 2024-25) they are required to make compulsory payments towards their debt.

Even though employers can withhold tax each time employees are paid, the ATO does not immediately apply this as a repayment towards a HECS balance.

The repayment is applied against a taxpayers’ balance after they have lodged their tax return.

More Coverage

Originally published as ‘People don’t realise’: Why Aussies are missing out on pay for a HECS debt already paid off