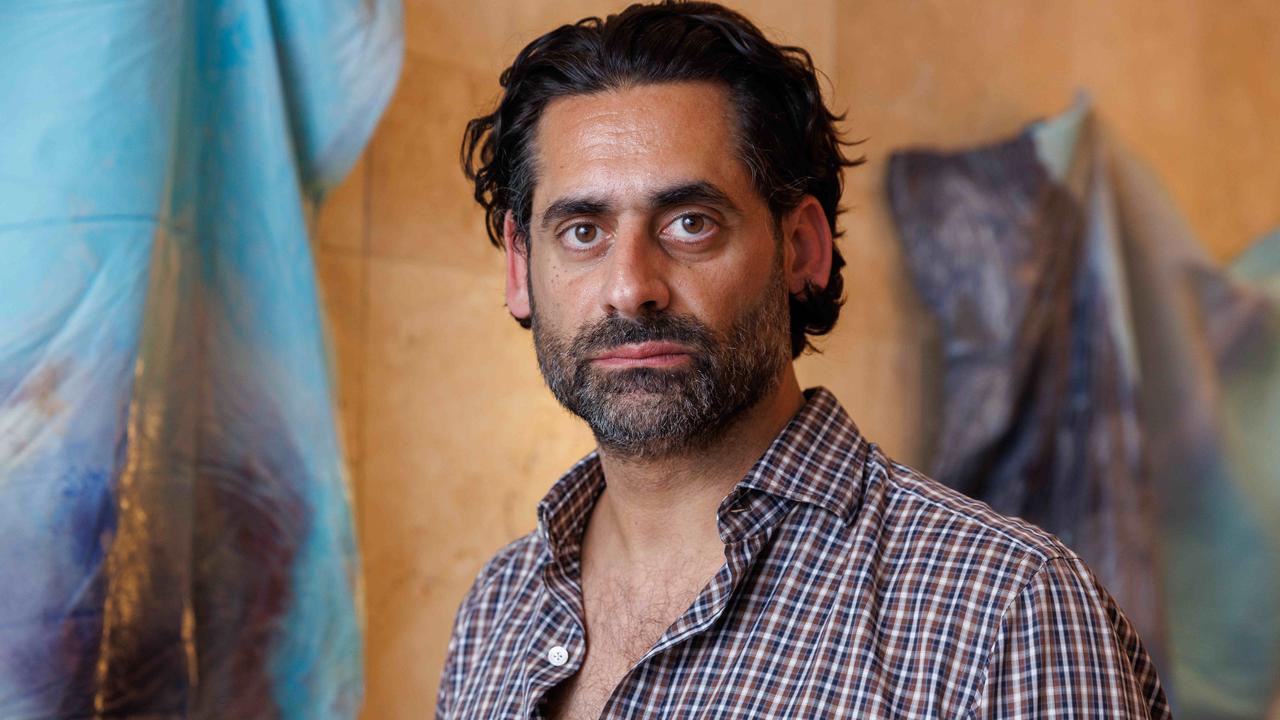

‘Outsider’ plots new thinking at financial watchdog

The former Treasury official takes charge of the powerful banking watchdog as risks are building in the financial system.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

By joining the dots across banking super and insurance and with tough enforcement, the nation’s new top financial regulator has promised to keep the system safe.

A career treasury official John Lonsdale has been named the new chairman of the Australian Prudential Regulation Authority, stepping into the role after a three-year stint as the regulator’s deputy chair. It also marks a subtle cultural shift for the regulator.

Lonsdale said he has a strong clarity of purpose for the regulator and will ensure “the financial interests of Australians are protected, and that we’ve got a stable competitive and efficient financial system”.

The appointment of Lonsdale marks the first time a relative outsider takes the top job at APRA. He replaces Wayne Byres who previously announced he would step down by the end of this month after eight years in the job. Previous chairs have been APRA insiders or have come to the regulator from the Reserve Bank.

Treasurer Jim Chalmers on Friday said the elevation of Lonsdale, along with two new appointments to bolster the APRA board will bring “fresh thinking” to the regulator. The elevation of senior APRA directors Suzanne Smith and Therese McCarthy Hockey mean four of APRA’s five top board roles will now be women.

Lonsdale takes charge of APRA during a time of upheaval for the financial system. Banks and super funds are set to face their biggest test since the global financial crisis as interest rates around the world are hiked to curb inflation. Technology is speeding up payments and digital currencies are introducing new risks into the financial system. Banks and insurers in particular are facing bigger cyber security threats, with private health insurer Medibank recently being caught out by a massive loss of data. At the same time APRA has been criticised as being too reactive towards the entities it regulates, while its obsession with secrecy often results in negotiated outcomes happening behind closed doors.

A three-decade veteran of Treasury, Lonsdale has worked closely with both sides of politics and was appointed to the deputy chair role of APRA in 2018.

Prior to then former Treasurer Joe Hockey appointed him to run the secretariat for the David Murray-led Financial System Inquiry in 2014 which also looked at APRA’s role in regulation.

Following that he headed up the powerful markets group at Treasury which oversees the financial system and consumer and foreign investment policy. Part of this included developing policy for the bank levy in 2017 which applied to the nation’s biggest banks and was much criticised by the industry.

Former Treasurer Josh Frydenberg appointed Lonsdale as a joint deputy chairman of APRA to help bolster the regulator following criticism coming out of the Hayne financial services royal commission. Much of his initial work was around rebuilding APRA’s relationships with other financial regulators including ASIC, the ACCC and financial crimes regulator Austrac.

Those who have worked with him describe Lonsdale as a straight shooter, credible and a safe choice to lead the regulator.

“He is the financial services bureaucrat from central casting,” a former colleague said, adding that Lonsdale has strong links and is trusted through Canberra.

An early insight into how Lonsdale was looking to change APRA’s culture was from a speech he gave shortly after he joined where he argued the regulator needed to become more transparent. Much of APRA’s culture of secrecy stems from legal restrictions preventing it from discussing specific institutions.

At the time Lonsdale argued that openness shouldn’t be seen as a potential obstacle to fulfilling its mandate, rather it should be seen as a tool to better protect the community from financial losses.

While there is a long way to go, he promised to open up APRA’s actions, decisions and assessments of the companies it regulates to drive accountability and deliver greater influence over behaviour.

On Friday Lonsdale said the financial services royal commission has shifted APRA’s mindset on enforcement which needs to be “constructively tough”.

“It’s a lot more forward looking. It’s a lot more outcomes based, and we’ve been taking action where entities have not been adhering to prudential standards. There were learnings and we’ve now got to keep applying that,” he said.

Meanwhile he says APRA will need to take a look at the bigger picture of what is taking place in the financial system across banking, superannuation and insurance.

“APRA, has a whole system view and joining-the-dots more, getting the insights and applying those insights is very, very important”.

On cyber risks he said APRA is currently talking to boards about their security and ability to respond when threats happen.

“Some (regulated organisations) are better prepared than others, but we’ve got a very robust standard that applies to all of them and we make sure that we try to make sure that they’re adhering to that standard”.

Originally published as ‘Outsider’ plots new thinking at financial watchdog