‘Out of reach’: Aussies could be $243,422 worse off on 40-year loans

Australian mortgage holders could be saddled with hundreds of thousands of dollars in continuing debt if they make one choice every homeowner is faced with.

Super

Don't miss out on the headlines from Super. Followed categories will be added to My News.

The cost-of-living crisis and soaring house prices means Aussies are facing the double whammy of longer mortgage terms and a retirement in debt.

Aussies say they are willing to take out 40-year mortgage terms in exchange for cheaper monthly repayments.

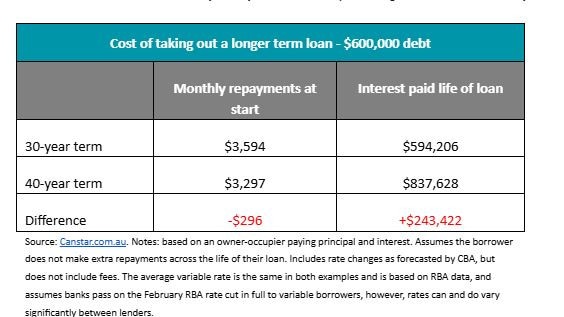

But an expert warns on the average $600,000 home loan, these people will be saddled with an extra $243,422 in total repayments.

Canstar data insights director Sally Tindall said a 40-year loan term could be attractive on paper but it might be a costly decision in the long run.

“The monthly repayments on a 40-year loan, as opposed to a 30-year one, will be lower, and could potentially enable borrowers to take out a larger loan, although this will depend on the lender’s risk appetite,” she said.

“However, the downsides to a 40-year loan are significant and should not be glossed over. Not only could it see you shackled to a mortgage for an extra 10 years, in this additional time, you’re likely to end up shelling out tens of thousands, if not hundreds of thousands in extra interest charges to your bank.

According to Canstar’s data, a typical $600,000 mortgage, a 40-year loan, as opposed to a 30-year one, with the same interest rates would see a $296 a month lower payment.

However, over the 40 years, mortgage holders could end up handing an extra $243,422 of hard earned post tax dollars over to the bank in additional interest charges.

While Aussies are willing to take out longer term loans, experts warn it will have an impact on their retirement as quitting work while still in debt becomes the new norm.

The Super Member Council says more than 40 per cent of Aussies approaching retirement still have a mortgage, and the figure is only going up.

Of those with a mortgage, more than 40 per cent of single households and a third of couple households would exhaust their entire superannuation balance paying off this debt, while about half of households would deplete more than 50 per cent of their superannuation balance.

Allianz Retire+ head of technical services Justine Marquet told NewsWire that one in two Aussies were now retiring with more than $200,000 in mortgage debt.

“The trend has been increasing and I think that we can expect that will continue. The proportion of people in debt, in mortgage debt at retirement, will continue going up,” Ms Marquet said.

Aussies look to take out longer loans

This problem of debt in retirement is only likely to grow, with Aussies willing to take out longer mortgage terms in exchange for cheaper monthly repayments.

Finder research shows one in three Australians would take out a 40-year loan if it reduced their monthly repayments to a more affordable level, even though it would cost them hundreds of thousands in the long run.

It would mean the average first-home buyer, at age 36, would still be paying off their home well into retirement or need to work longer.

It comes as housing affordability deteriorated to a three-decade low following the Reserve Bank’s barrage of interest rate hikes over 2022 and 2023 to stem Australia’s surging inflation rate post Covid pandemic.

Surging house prices have also played a major factor, with PropTrack data showing that between March 2020 and January 2025, property prices nationally grew 45 per cent. This means the median home now costs $769,000.

It is worse still for those living in Sydney or Brisbane, with the median home value setting Sydneysiders back $1,101,000, while those in Brisbane are now looking at paying $871,000.

Finder head of consumer research Graham Cooke said paying mortgages from now until 2065 had its pros and cons.

“Owning a home has felt out of reach for an increasing number of Aussies. A 40-year loan can help some buyers get into the market sooner by reducing monthly repayments,” he said.

“While these loans may have lower monthly repayments, they typically end up costing a lot more over time.”

While the RBA did not stipulate further rate cuts, its forward estimates based on market expectations showed there could be a further 65 basis points in mortgage relief, bringing the official cash rate to 3.45 per cent.

Following the meeting, Reserve Bank governor Michele Bullock said she had received letters from struggling homeowners suffering through an extended period of crippling interest rate rises.

“I understand you are hurting, and I understand mortgage rates have increased a lot … but we need to get inflation down because that is the other thing that is really hurting you,” she said.

“If we don’t get inflation down, interest rates won’t come down, and you’ll be stuck with inflation and high interest rates.

“We have to be patient. I understand it hurts, but it’s really important that we get inflation down.”

According to Finder, four lenders offer a 40-year mortgage, with three of them offering it to first-home buyers exclusively.

What can Aussies do about it?

While a lot of Aussies will be unable to pay off their mortgage by the time they retire, there are options available.

Ms Marquet said it was important for Aussies to try to take control of their financial futures.

“Our population is ageing and there is no guarantee that in 20 years the pension will be able to keep up with cost of living,” she said.

“Once a person retires they are on a fixed income and it could be hard to find the extra money sources.”

This starts with planning, with even small contributions to superannuation likely to make a large difference in retirement.

Ms Marquet said Aussies should seriously start planning their retirement in their 50s while they still had an income and could make lifestyle changes and contribution to superannuation if required.

She did, however, acknowledge it could be a hard choice for Australians between the now and saving for the future due to cost-of-living pressures.

For those in debt in retirement, products such as an annuity can give a guaranteed amount of income for a person’s life.

Ms Marquet said “there are options and all is not lost”, suggesting Australians just “need to get more comfortable with using these products”.

Originally published as ‘Out of reach’: Aussies could be $243,422 worse off on 40-year loans