No room for Suncorp in Bendigo’s better bank strategy

Bendigo boss Marnie Baker has spent years running hard to make her bank more investment-friendly. A big acquisition would up-end everything.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Since taking charge five years ago Bendigo Bank chief executive Marnie Baker has been running hard to make her $5bn regional lender a more investment-friendly proposition.

And behind this is a plan to turn Bendigo into a lower cost, higher returning, more disciplined bank built on a strong digital option.

This has involved substantial untangling of the bank whose first instinct has been to grow through acquisitions – there’s been nearly 30 of them in as many years – rather than spend the time extracting more from the markets in front of it.

There is more work to do on business and agribusiness lending, but Bendigo is on the cusp of delivering on its better bank reinvention within the next two years.

All this raises the question why it would want to undertake an expensive and highly complex merger with Queensland’s Suncorp Bank.

To match ANZ’s $4.9bn proposed acquisition for Suncorp would require Bendigo to undertake a monster one-for-one capital raising and face years of distraction and earnings dilution on a complex integration. It would be a leap of faith for investors to back and some big investors have quietly expressed reservations.

Bendigo made top level approaches to Suncorp’s board for a potential regional bank merger early last year, but Suncorp instead struck a sales deal with ANZ.

Baker on Monday declined to be drawn on Suncorp noting that there is a competition tribunal process likely to play out. However Baker offered a broader comment that any strategic acquisitions have to deliver a benefit for all stakeholders.

“I know how much they take to integrate … So you really do need to have a really good strategic reason to undertake (mergers),” she told The Australian.

Under Baker, Bendigo has tackled baked-in costs, so far reducing the number of expensive core banking systems from eight to four. From November, it will start to move to a new single Bendigo-wide lending platform that promises to significantly speed up processes and pull down costs even more, and cutting back the amount of brands it is running from 13 to seven, with more cuts to come.

The regional bank has also reduced the number of separate IT systems by 40 per cent and has been moving its operation onto the cloud that has allowed it to actually decommission a costly data centre in recent months.

And now even a feel good bank like Bendigo has taken a leaf from its big four banking rivals by cutting back on its large branch footprint and slashing staff numbers.

All this is helping the historically high-cost bank start to generate better returns, which should be even more noticeable in coming years. This is noticeable in mortgage lending where net interest margins have improved as Bendigo sat out of offering mortgage cashbacks despite a period of intense competition.

“What we’re looking to show is that you can run a company, give a fair return to shareholders, a good customer experience, and giving back into the communities in which we serve and operate,” Baker says.

‘New bank’

Bendigo on Monday posted a 15.3 per cent jump in full-year cash earnings to a record $576.9m. It also posted a slightly better than expected dividend of 61c while boosting customer numbers by 10 per cent.

Return on equity is increasing and is now running ahead of cost of capital. Inflation-linked expense growth remains a weak spot, although Bendigo says it was hampered by some issues including an explosion in broader fraud claims. At the same time, it has quietly slashed more than 16 per cent of its workforce over the past year as it targets a cost-to-income ratio of 50 per cent in the next few years. Lending losses are drifting up as the economy turns, although from a low base.

Baker says Bendigo is delivering on its promises to reduce complexity and investing more where returns are best. These are across digital, data and risk management

“We are building the bank of the future today,” she says.

One big opportunity in front of Bendigo is digital and this substantially flattens the playing field against big rivals when it comes to securing new deposit and lending customers. And Bendigo has been ruthlessly targeting the 18 to 35-year-old market with its digital secret weapon, the banking application Up.

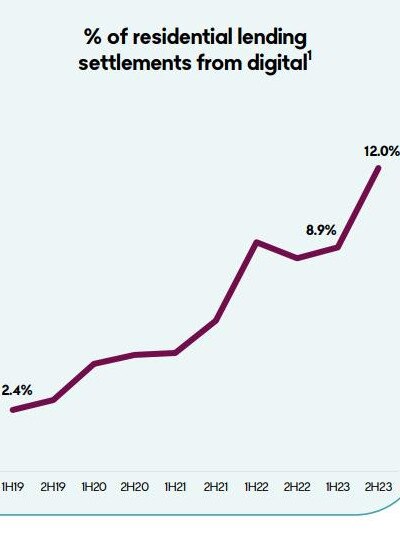

So far a little over one in 10 mortgage loans are now written across all of Bendigo’s digital channels, that are powered by the Tic:Toc platform and this number is expected to lift quickly.

Up lending has only been under a soft launch for the past 12 months, but has already amassed $74m in home loans. Since launch in 2018, Up has now grown to 700,000 customers and $1.5bn in deposits. This is consistent with Baker’s mantra of “digital first and plastic optional”.

Up’s growth compares with Bendigo’s Community Bank franchise that has 900,000 customers, although this bigger operation remains a massive source of low-cost deposits that can be tapped.

Even so, Bendigo is playing in one of the toughest markets in the world to be a regional bank. From above it is facing intense pricing competition from four mega-lenders from CBA to Westpac, while lower cost non-bank lenders and tech-backed payments giants are cherry picking key markets. Bendigo has shown a glimpse of where it plans to attack and that’s by going it alone with a digital future.

Lendlease’s challenge

Not all offices are equal. That’s the view of Lendlease global boss Tony Lombardo who is deep in the process of steering his real estate and construction business through one of the toughest commercial property markets since the global financial crisis.

He has nearly $17bn of direct exposure to retail and commercial properties managed by Lendlease, while his $8bn construction pipeline also partly depends on longer-term confidence in the office market. That comes as valuations are being written down and vacancy rates are running at the highest level in three decades with hybrid working taking off. Lendlease slashed nearly 7 per cent of the value from his investment portfolio mostly on the office market crunch.

“There’s still strong demand for the right products,” Lombardo tells The Australian.

The focus on sustainability and green buildings has been critical to the office strategy. That means for tenants who have set themselves net zero targets, Lendlease’s towers are in high demand.

Lombardo points to the $2bn Salesforce tower that is now a prominent landmark on Sydney’s Circular Quay completed last November that is more than 90 per cent leased in a soft market. This is the flight to quality underway between the premium offices versus older holdings, he says.

Lombardo too has an exposure, albeit relatively small, to one of the toughest office markets in the world in San Francisco, a city that has been slammed by a combination of working from home, soaring rents, concerns around safety and heavy staff cuts across Silicon Valley’s tech giants. That project slated for delivery has been paused as Lendlease looks for anchor tenants, although the bulk of returns will hinge on the sale of 333 apartments.

“I’m still a believer in San Francisco. It will bounce back accordingly,” Lombardo says.

He was talking as Lendlease fell to a $232m loss as it was hit by higher writedowns across British operations following a shock decision by the UK government earlier this year to make builders liable for defects for 30 years, up from six years.

Targets

As Lombardo navigates the office market he has had the extra challenge of pinning himself down on his own targets, which he set down shortly after taking charge in 2021. The world has changed dramatically since then with surging interest rates playing havoc on property valuations and inflation eating away at the bottom line.

This was built around hitting $70bn of property assets under management by 2026. He also wants more than $8bn worth of projects launched by 2024 and a return on equity target of between 8 per cent to 11 per cent.

Lombardo expects to meet the returns target next year at the low end of the range, although this looks likely to be boosted by the sale of his Australian housing estate business that is on the block. The development pipeline is on track to beat $8bn. Funds under management looks more challenged in a higher interest rate environment with the scorecard currently sitting at $48bn.

The funds target is important because Lombardo is trying to rebuild Lendlease away from highly volatile development and construction income and turn it into a more predictable earnings business. If it can pull off the transformation it would give it a higher rating among shareholders.

Still Lombardo is being pushed to move faster with two activist investors – David Di Pilla’s HMC Capital and John Wylie’s Tanarra Capital – also wanting Lendlease to cut costs deeper as well as exit tougher areas, including its risky construction arm.

Lombardo last year took $170m of annualised costs out of the business and is eyeing another $150m this year. He upped his plans on staff cuts, which now extends to 10 per cent of the global workforce.

He has declared the construction business will be increasingly prepared to pass over marginal jobs and is seeking to skew its client base to more steady government work where clients pay the bills.

“ I’m not trying to be the biggest construction business. I would like to be the most profitable construction business,” Lombardo says, noting that his business remains profitable in a market where others have posted deep losses or some have simply collapsed under the weight of cost blowouts.

johnstone@theaustralian.com.au

More Coverage

Originally published as No room for Suncorp in Bendigo’s better bank strategy