Nationwide cashless protest flops early figures show

A nationwide protest, which expected to see two million Aussies withdrawing cash from banks and ATMs, did not live up to its hype.

Costs

Don't miss out on the headlines from Costs. Followed categories will be added to My News.

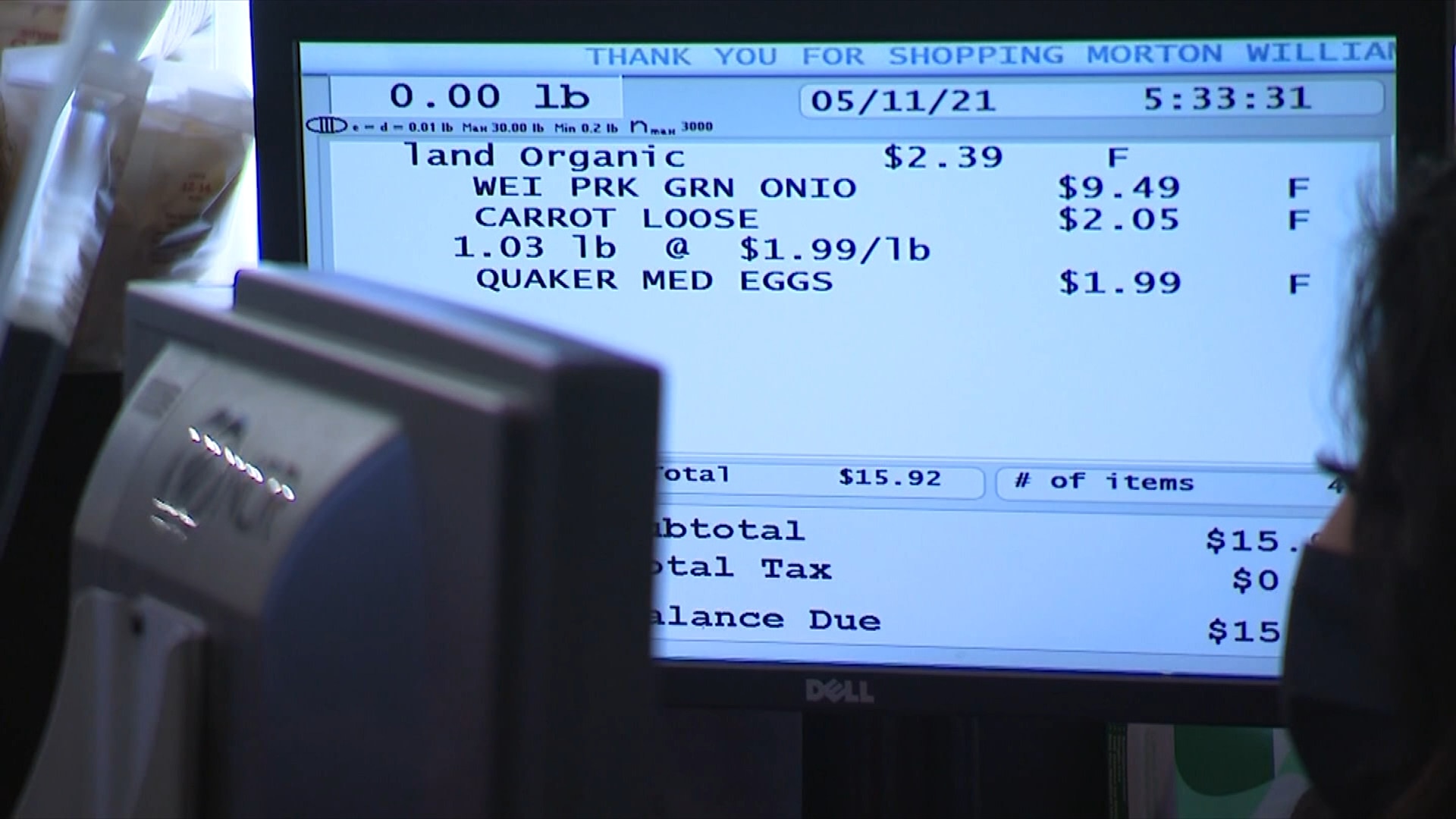

A nationwide protest calling for Aussies to withdraw large sums of cash and stand up against Australia’s shift towards a cashless society, didn’t quite make the impact it had hoped, early figures suggest.

Two million Aussies were expected to withdraw cash from banks and ATMs on Tuesday April 22 – a day dubbed Cash Out Day – to send a clear message there is still a demand for cash.

“Cash Out Day is our chance to show the banks and politicians that Australians expect to be able to access and use cash,” Jason Bryce, founder of Cash Welcome, told 7News last week.

“Physical cash is our legal tender, banks need to give us access to our cash and all retailers must accept cash.”

However, news.com.au understands preliminary figures from three of the four major banks show that cash withdrawals on Tuesday April 22 were 20 to 30 per cent lower than Tuesday the week prior.

Withdrawals were also lower than those recorded on Tuesday April 2, 2024 – the date of last year’s Cash Out Day protest.

Ms Bryce said last year’s Cash Out Day was a “major success”, claiming there was a $500 million jump in the value of banknotes on issue on and around April 2, 2024.

In a change.org petition promoting this year’s protest, he wrote ATM companies and banks noticed “a big spike in the numbers of withdrawals” during last year’s event.

“They got the message that millions of Australians do NOT want cash to disappear.”

The Australian Banking Association (ABA) said last year there was “no material difference in withdrawals of cash” on April 2.

“Whilst Australians are using less and less cash, we are not going to be cashless,” an ABA spokesperson said at the time.

Speaking to news.com.au, Mr Bryce said the recent passing of Pope Francis may have impacted awareness of this year’s protest.

“Cash Out Day this year was overshadowed by the sad news of the death of Pope Francis, I had many interviews bumped on the morning so that was possibly a factor,” he told news.com.au.

Mr Bryce also suggested the government’s cash mandate – which is set to come into effect in 2026 and will require businesses to accept cash for “essential items”- could have impacted the protest.

“97 per cent of Australians support a government cash mandate, which was announced after last year’s Cash-Out Day, so the same urgency about this issue is not around this year,” he said.

The incoming cash mandate will likely apply to supermarkets, pharmacies, dentists, GPs, hardware stores, insurers, pet stores, vets, service stations and mechanics.

Speaking about the mandate in December, Assistant Treasurer Stephen Jones said cash was a “lifeline” for many Australians.

“Mandating cash for essential purchases means those who rely on cash will not be left behind,” he said.

While this year’s Cash Out Day protest didn’t exactly have its desired effect, Mr Bryce is continuing to push for Australians to have access to cash.

“What the government decides in 2025 is going to be the way we pay for things for a long time,” he said.

“The banks must accept their responsibility for paying for cash distribution and retailers simply need accept cash. The system only works efficiently when cash is circulating. Notes in pockets and change in tills makes the economy goes round.”

‘Australians using less and less cash’

Statistics from the Reserve Bank of Australia (RBA) show that in 2010 more than 60 per cent of purchases were made with cash compared to just 13 per cent in 2022.

By 2030, cash usage is projected to drop to just four per cent, ABA reports.

“We are, as Australian(s) using less and less and less cash,” ABA chief executive Anna Bligh told 2GB last week.

Ms Bligh added the predicted drop in cash use by 2030 has “massive implications for what our branches are doing”.

“If people aren’t coming in anymore to withdraw or deposit cash, then that really changes you know what a branch is and what it might look like in the future.”

About 36 per cent of bank branches in regional Australia have closed since 2017.

The Big Four banks earlier this year agreed not to close any more regional branches until at least 2027 under an agreement with the government.

“Part of the reason for that is to sit down with the Government, with Australia Post and to think that what is it that people still need face-to-face services for? Because increasingly, it’s not cash,” said.

Originally published as Nationwide cashless protest flops early figures show