More Australians becoming insolvent and bankrupt as cost of living and business failures hit

The worst rate of business failures since the GFC and cost of living pressures are resulting in a growing number of Australians becoming bankrupt.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Business failures tracking at the highest rate since the aftermath of the global financial crisis combined with mortgage and cost of living pressures are seeing a rapidly rising number of personal insolvencies.

And it is expected more Australians will declare bankruptcy in the months ahead as the cost-of-living crisis continues to bite and business failures trigger a ripple effect through the economy.

Figures from the Australian Financial Security Authority show there have been 9737 personal insolvencies up to April 30 in this financial year, compared with 7991 during the same period a year ago.

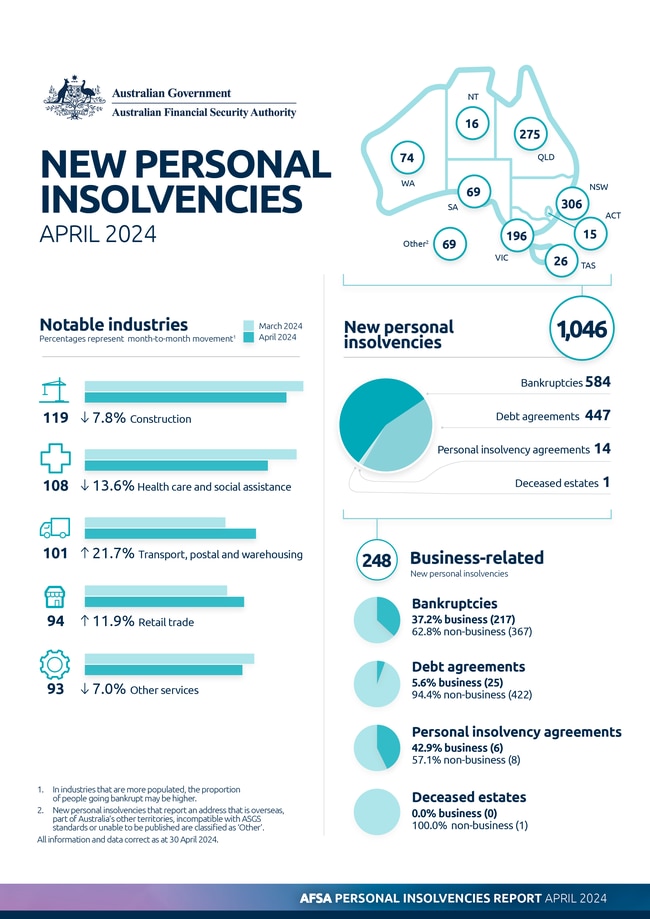

The AFSA data showed there were 1046 people who entered a formal personal insolvency, up from 980 in March. Of the new personal insolvencies, 584 were bankruptcies, 447 were debt agreements, 14 were personal insolvency agreements, and one was an insolvent deceased estate.

Throughout the period, 248 people who entered a formal personal insolvency were also involved in a business, with that cohort making up 37.2 per cent of all bankruptcies in the month.

Jirsch Sutherland turnaround specialist and partner Malcolm Howell said it was not surprising a growing number of personal insolvencies were connected to people who have been involved in a business failure.

“There’s been a marked increase in corporate insolvencies and the domino effect continues to reverberate across personal insolvencies,” he said.

“It’s almost a guaranteed cycle: following a period of business failures there’s often a spike in personal (or consumer) insolvencies months down the track as creditors ‘call in their markers’.

“But there’s also a lot of non-business-related causes, and in the current economic environment the number of financially distressed individuals has been ‘turbo-boosted’ by high interest rates, tax debt and cost of living pressures.”

It comes as S&P Global reports NSW and Victoria have reported the sharpest uptick in borrower stress with mortgage arrears at 1 per cent nationally by the end of March, up from 0.95 per cent a year ago.

Figures from the Australian Securities & Investments Commission show there have been 8742 insolvency appointments up to April 30 in this financial year, compared with 6200 during the same period a year ago.

The current financial year is shaping up to be the highest rate of external administration and controller appointments since 2011 when 10,757 businesses went under.

NSW had the most personal insolvencies in April at 306, just as it did with corporate insolvencies. Queensland was just behind at 275, followed by Victoria at 196.

Western Australia and South Australia had 74 and 69 personal insolvencies respectively, while Tasmania, NT and ACT had less than 26.

Mr Howell said there had been a 19 per cent increase in the number of debt agreements since the start of the year as people look to settle debt without going bankrupt.

“It must be remembered that they don’t release you from all debts and can affect your ability to obtain future credit,” he said.

Those working in construction were most likely to have gone insolvent in April at 119, followed by health care at 108 and transport, postal and warehousing on 101.

The cost-of-living crunch has seen households cut back on retail spending to instead pay for essential items such as food, power and housing – all of which have skyrocketed in cost in recent years.

Mortgage holders have also been slugged with the most aggressive run of interest rate rises on record. Analysis from RateCity.com.au showed that between the first rate hike in May 2022 and the last increase in November 2023 — the average $500,000 loan has increased $1210 a month and $2420 on a $1m loan.

Originally published as More Australians becoming insolvent and bankrupt as cost of living and business failures hit