Men earning over $180,000 the big winners from ‘Stage 3’ tax cuts

A specific group of Australians stand to benefit the most from a new round of tax cuts due to come into force soon.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Blokes who earn over $180,000 a year are the big winners from tax cuts due to come into force in 2024, and men are set to secure double what women get in relief because their salaries are higher.

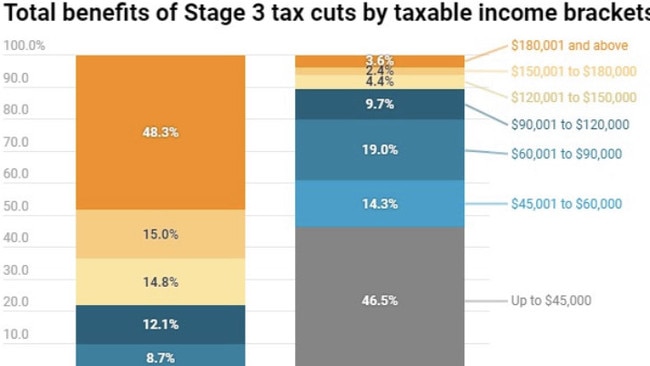

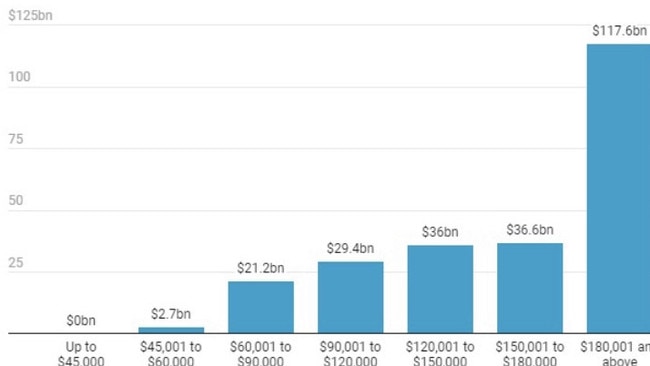

A new analysis prepared by the independent Parliamentary Budget Office has sorted out the winners and losers from the monster tax cuts worth $243 billion over the next decade.

Commissioned by the Greens, who want the Prime Minister Anthony Albanese to repeal or amend the legislated tax cuts, the research predicts men will take home nearly two-thirds of the benefit of the stage-three tax plan between 2024-25 and 2032-33.

While the tax cuts will deliver $243.5 billion in relief to workers over the next decade, an estimated $160.6 billion will go into the pockets of men and just $82.9 billion to women.

The reason is simple – the gender pay gap means that men tend to earn more even when doing the same job as women, as they can negotiate higher salaries with management and also have less time out of the workforce to raise children.

Even in the first year, men get more than women under the tax relief plan known as the ‘Stage 3’ tax cuts because they are the final stanza of the Coalition’s tax reform plan.

Stream more finance news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

For example, while the tax cuts would put $17 billion back into the pockets of workers in 2024, only $5.8 billion would be delivered to female workers.

By contrast, $11.9 billion in tax cuts in the same year will be delivered to male workers.

Prime Minister Anthony Albanese has been accused of leaving “wiggle room” over calls to repeal tax cuts for the rich that will deliver a worker on $200,000 a year a whopping $9000 tax cut.

Mr Albanese has insisted that he “inherited” the Morrison government’s legislated tax cuts and that his government had not changed its mind on the 2024 timetable.

It comes amid speculation that the Albanese government could leave the tax cuts in place but slap a deficit levy over the top for high income earners.

The stage three cuts create a flat tax rate of 30 cents in the dollar for anyone earning between $40,000 and $200,000.

According to the Australia Institute, a registered nurse on $72,235 will get a tax cut of $681 under the changes while a politician, on a base salary of $211,250, will get a tax cut of $9075.

Scrapping the tax cuts could save $243 billion in the budget over the next 10 years but would break an election promise.

The tax cuts will deliver just $300 million in tax relief to workers earning between $45,000 and $60,000 in 2024.

However, they will deliver $7.5 billion in tax relief to people earning over $180,000 a year.

The Stage 3 tax cuts which take effect from July 1 2024 involve:

• removing the $120,000 to $180,000 tax bracket

• increasing the top tax bracket threshold from $180,000 to $200,000

• reducing the marginal tax rate faced by the $45,000 to $200,000 tax bracket from 32.5% to 30%.

The research assumes the tax cuts will have no discernible impact on people wanting to work more boosting productivity.

“Studies indicate that some people would choose to work more in response to a lower marginal tax rate, while others would work less,’’ the research states.

“There is considerable uncertainty regarding the direction, magnitude, and timing of these effects on labour supply.

The tax cuts would cost the budget $17 billion in the first year of operation rising to $243 billion over 10 years.

Speaking in Canberra, Treasurer Jim Chalmers brushed off suggestions the Albanese Government might impose a deficit levy on high income earners.

The Abbott Government introduced a deficit levy for workers earning over $180,000 in 2014, which delivered a temporary increase to the top personal income tax rate from 45 per cent to 47 per cent.

“That’s not something I am working up,’’ Dr Chalmers said today.

Victorian Liberal MP Russell Broadbent has broken ranks to urge the Coalition to reconsider support for the tax cuts.

But Liberal leader Peter Dutton has rejected that option insisting he backed the Stage 3 tax cuts.

“Under this system 95 per cent of Australians pay 30 cents or less in the dollar, which is an incentive for people to work more,’’ he said.

Originally published as Men earning over $180,000 the big winners from ‘Stage 3’ tax cuts