Melbourne, Sydney CBD retail vacancies surge in Covid fallout

The number of empty shops across Australia’s central business districts has soared as retailers are lashed by the fallout from the pandemic.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The number of empty shops across Australia’s central business districts has soared as retailers are lashed by the fallout from the pandemic and the rise of online retailing that is emerging as a more permanent challenge.

City retailers and major chains are bracing for deeper fallout from Covid-19 restrictions with the growing Sydney outbreak to drive down economic activity nationally.

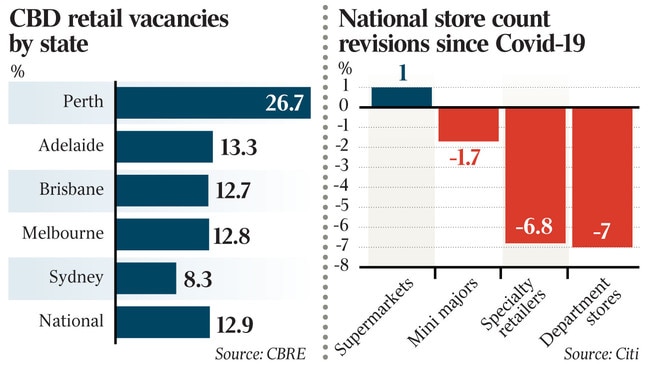

While Sydney fared best in the June half with a vacancy rate of just 8.3 per cent it is expected to be hard hit as lockdowns tightened in July. The vacancy figure is expected to shift higher with the city’s lockdown set to be extended by four weeks.

While Melbourne is the middle of the pack in terms of vacancies at 12.8 per cent in the June half according to CBRE figures, the city has seen the sharpest growth during the pandemic given the long duration of lockdowns. Leading in to the Covid-19 pandemic Melbourne’s CBD had a retail vacancy rate of just 2.7 per cent, the CBRE figures showed.

Perth – which had been hit harder by a property downturn in the lead-up to the pandemic – is already struggling as vacancy surged to 26.7 per cent, as more than one in four of the city’s shops were empty. Other markets also had stubbornly high CBD retail vacancy rate with Adelaide at 13.3 per cent followed Brisbane at 12.7 per cent.

“A range of CBD retailers, mainly those in the clothing and soft goods industries, have closed their bricks and mortar stores and moved to a more online-centred platform in response to lower CBD foot traffic,” CBRE Research analyst Gus McConnell said.

Sydney CBD’s 8.3 per cent vacancy rate was well ahead of the agency’s last recorded figure of 3.7 per cent in June 2019. Vacancy surged in this 24-month period as clothing and soft goods were hit with 32 fewer CBD stores in this category.

Brick-and-mortar stores are also shifting online, with a 1.7 per cent decrease in total retail employment in NSW since February 2020.

Dominique Lamb, chief executive of the National Retail Association, said segments of the nation’s CBD were in a catastrophic state while in parts of the country, such as Brisbane and Perth, the trading environment and foot traffic in the cities was much better, but not great.

“Even if you look at places like Brisbane or Perth that have had a pretty good run during Covid and had less lockdowns than other places, they are still seeing a slow return to back to those CBD locations,” Ms Lamb said.

“In fact at our last check it was around 70 per cent of a pre-Covid period, in Brisbane and Perth, but when you look at places like Melbourne and Sydney it is almost catastrophic for some of those locations,” she said. Melbourne retail is reopening but faces lingering restrictions on its operations.

Ms Lamb said the continued trend of work from home and hot desking had thinned out the use of city office space and major companies have indicated they will take a flexible approach to bringing staff back.

The dire state of city retail has spilt over to major suburban malls, where big chains are not opening as many new stores, rationalising their networks and department stores are looking to close some locations.

The economic fallout has prompted calls from retailers for the federal government restore JobKeeper and the leasing code that saw landlords support them earlier in the pandemic.

The prospect of further pain from Sydney’s indefinite lockdown has already prompted economists to lower forecasts for state and national economic output.

AMP Capital chief economist Shane Oliver put the cost of nationwide lockdowns since May at $12bn, resulting in a contraction in Australia’s September quarter GDP of about 0.7 per cent and risking a return to recession, although he remains upbeat about an eventual recovery.

“The renewed surge in coronavirus cases poses a short-term risk to share markets and other cyclical trades like the Australian dollar. However, there is a danger in over emphasising this as we remain of the view that the economic recovery globally and in Australia will continue as lockdowns end in the short term and increased vaccination allows a more sustained reopening over the next 12 months,” AMP Capital chief economist Dr Oliver said.

He said the delta variant of Covid was seen as driving easier for longer fiscal and monetary policy and US June quarter earnings results were again coming in far stronger than expected.

But on the ground major landlords are coming under pressure as listed retailers roll out fewer stores and close some outlets in the wake in the pandemic with high-rent paying specialty tenants, and department stores most likely to cut space, Citi analysts said.

In a sign of how deeply the pandemic and lockdowns are biting the analysis found that expectations among retailers to roll out new stores had roughly halved since Covid emerged.

Most of the weakness was in specialty retailers that are now expected to reduce store count by about 7 per cent, according to the bank. These stores are much sought after by landlords as they pay the highest rents in big centres.

The pain is not confined to small shops with department stores and discount department stores also expected to close sites.

“We believe the data analysed indicates that demand for retail space remains under pressure, particularly in larger centres. This should place downward pressure on rents and values,” Citi analysts Adrian Dark, Suraj Nebhani and Akshat Agrawal said.

Landlords are also at loggerheads with tenants in the most recent lockdowns in the absence of codes to guide their actions.

“Sadly, it seems as though good faith needs to be legislated before landlords come to the table with meaningful assistance,” Savills director, retail services, occupier services, Leighton Hunziker, said.

The main driver of CBD vacancy had been in shopping centres and arcades, with a smaller proportion of the vacancy in CBD strip locations.

The rise in office workers returning to the major cities in the first half of the year underpinned a lift in retail turnover and tenant demand. But this was before city retailers were crunched by the Sydney and Melbourne lockdowns.

CBRE head of retail leasing Leif Olson also noted that while retail vacancy had increased across the country, opportunistic retailers had sought to capitalise by shifting to new CBD digs.

Melbourne’s CBD was the hardest hit by the pandemic up to the end of June due to its extended lockdown period, low office occupancy levels and fewer international students.

Clothing and soft goods were hardest hit with the blow redoubled by international students leaving Australia.

Brisbane CBD’s retail vacancy, which is usually higher than Melbourne and Sydney, was relatively stable due to limited lockdown periods and the fact it has a lower proportion of clothing and soft goods retailers.

Perth’s vaulting vacancy rate of 26.7 per cent shows the ongoing issues that have hit the city retail market, with the vacancy rate climbing for the past decade. This dramatic vacancy is particularly evident in the city’s centres and arcades, with some of these locations having vacancy rates close to, or above, 50 per cent.

However, Mr McConnell noted there were there were signs of reinvigoration in the Perth CBD, with the city’s office occupancy level higher than Brisbane, Melbourne and Sydney and the WA government pouting $1.5bn investment into the CBD.

Adelaide CBD’s retail vacancy of 13.3 per cent is above the historic average of 7-8 per cent. But while the vacancy increased over the first half of the year, Mr McConnell said this upwards pressure had been softened by the diversity pool of retailers in the city.

Originally published as Melbourne, Sydney CBD retail vacancies surge in Covid fallout