Mega-projects’ threat to infrastructure industry outlined in new report

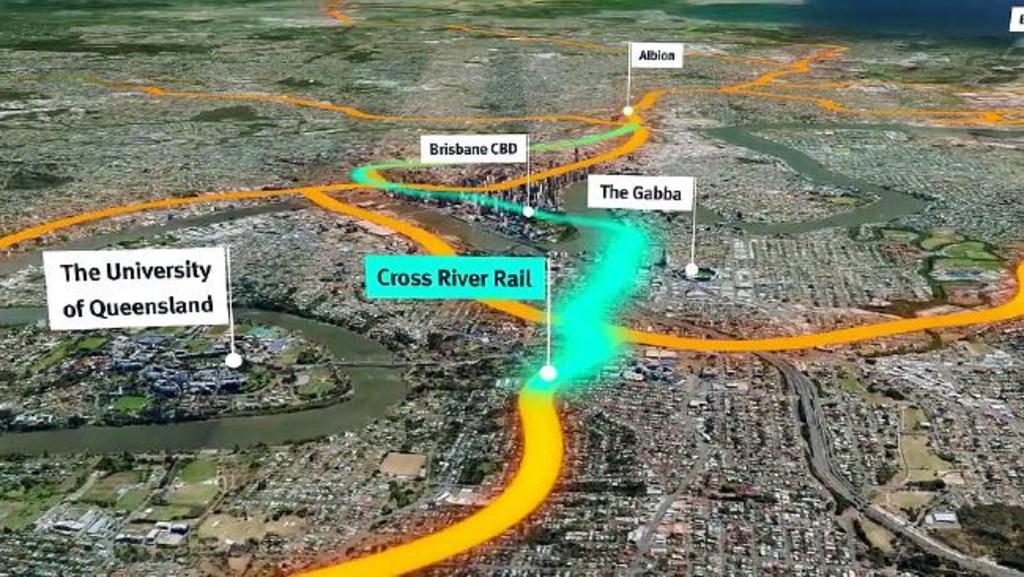

The dominance of mega-projects such as Cross River Rail and Brisbane Metro will threaten Queensland’s infrastructure industry, according to a new report. And that’s not the only warning it outlines.

QLD Business

Don't miss out on the headlines from QLD Business. Followed categories will be added to My News.

THE dominance of mega-projects such as Cross River Rail and Brisbane Metro will threaten the sustainability of Queensland’s infrastructure industry as small and medium contractors struggle to find work, a new report warns.

And a heavy reliance on rail initiatives could put the state on track to a skills shortage train wreck, according to experts.

Tenants forced to leave ahead of CRR construction

Cyclists get own lane alongside Brisbane Metro vehicles in Victoria Bridge revamp

Brisbane Metro at risk of cost blowout

The 2019 Queensland Major Projects Pipeline report, released today, warns that after a decline in work over the next couple of years, 2021-22 is predicted to be the sector’s busiest since 2014-15.

While that should be good news, it found 89 per cent of funded work forecast for that year is focused on a handful of extremely big-ticket initiatives, each worth $500 million or more.

“The high concentration of mega-projects in the pipeline threaten the sustainability of the construction industry here as they are only able to be undertaken by a small number of large contractors,” Queensland Major Contractors Association chief executive Jon Davies said.

“Many smaller and medium-sized contractors will struggle to find work following on from the predicted downturn next year.”

Infrastructure Association of Queensland chief executive Steve Abson said there were also concerns over cost blowouts on huge projects, with the risk of losses flowing down the supply chain to small businesses.

“We seem to have a growing problem delivering these complex mega-projects on time and budget, and without costly disputation. This can lead to substantial loss in shareholder value and to contractors exiting the Australian market, which is not good for industry, suppliers or taxpayers,” he said.

The report — which compiles all known major projects worth $50 million or more which are under construction, announced or flagged — forecasts that the value of funded projects will fall by 24 per cent from $6.1 billion this year to $4.6 billion in 2019-20.

By 2021-22, the funded pipeline will bounce back to $6.8 billion — the majority rail-related.

“Rail continues to offer the strongest outlook for growth in major project work activity from just $150 million in 2018-19, ballooning to just over $4 billion by 2021-22,” Mr Davies said.

That includes the Cross River Rail tunnel and underground stations network, the Inland Rail project, the start of the Beerburrum to Nambour rail upgrade and work on the Galilee Basin rail line to service Adani’s Carmichael coal mine.

“This Queensland boom overlays major rail work in southern states of New South Wales and Victoria and so creates an unusual spike in national demand, the likes of which we’ve not seen before,” Mr Abson said.

Mr Davies said sufficient professionals could not be trained in time to handle the demand and tightening of 457 visas meant it would be difficult to bring in skilled people from overseas.

The report does not include the proposal recently put forward by the SEQ Council of Mayors for a rapid rail network, which Mr Abson described as “a thought bubble at this stage”.

If it wins support from the state and federal governments, however, it would further exacerbate the demand for staff with rail expertise and experience.

The report calls for a greater spread of market-ready projects of varying sizes to be brought forward to smooth out the peaks and troughs over the next few years.

“Right now, there can sometimes be years between a project receiving a positive business case from (independent assessment agency) Business Queensland and tender documents being prepared by the agency,” Mr Abson said.

Of the total 194 projects identified over the next five years, 103 (worth $27.7 billion) are funded and 91 (worth $13.8 billion) are unfunded.

The funded projects are expected to employ 11,900 workers a year. Fully funding the pipeline would create an extra 5000 jobs per annum.

Just over half the projects are government-driven. The report says more collaborative approach could encourage more proposals for private investment or public private partnerships.

And it has identified a clear gap.

“We’re not seeing any projects originated in the pipeline that really adapt our state to the impacts of climate, such as cyclonic rains or droughts,” Mr Abson said.

The idea pitched last week by Sir Leo Hielscher and Sir Frank Moore for a new version of the Bradfield Scheme to create a series of dams and irrigation channels across Queensland was an example of the innovative thinking needed.