Bloodbath, world economy totally smashed

Global stocks are being smashed as confusion over Donald Trump’s tariffs wreaks havoc.

Markets

Don't miss out on the headlines from Markets. Followed categories will be added to My News.

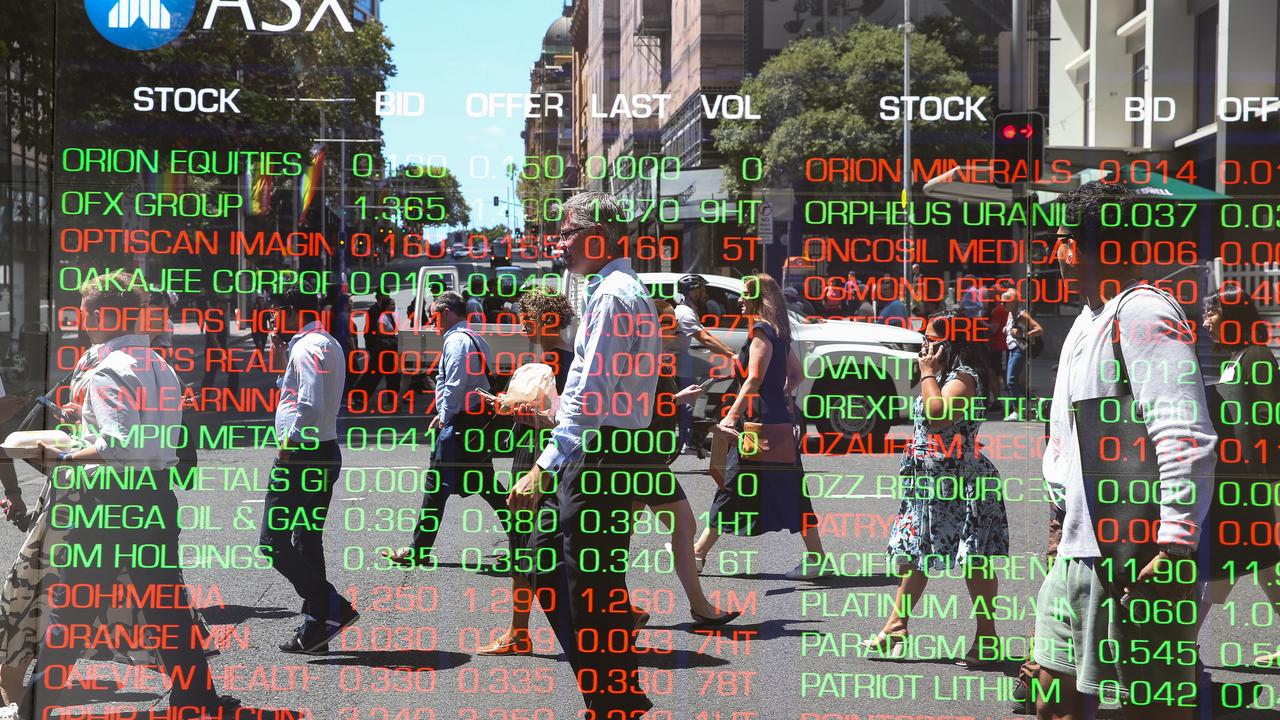

The Australian share market plunged to a six-month low on Friday, following Wall Street stocks which plunged amid ongoing chaos sparked by Donald Trump’s off-again, on-again tariffs.

The ASX 200 index was down nearly 1.6 per cent by midday, dipping below 8000 points for the first time since September.

Major US indices spent the entire day in the red on Thursday, shrugging off the President’s announcement of a temporary rollback to steep tariffs targeting Canada and Mexico, broadening a step announced on Wednesday that gave relief to the auto sector.

Stocks had rallied after the auto reprieve, but this time all three major indices dropped 1 per cent or more.

The S&P 500 fell 1.8 per cent, the Dow Jones Industrial Average lost 1 per cent and the Nasdaq Composite closed down 2.6 per cent, bringing the tech-heavy index into correction territory — a drop of more than 10 per cent from its December 16 high.

Share markets initially surged in the wake of Mr Trump’s election in November, with investors and businesses anticipating a wave of tax cuts and red tape reduction.

But the S&P 500 has now given up nearly all of its post-election gains.

Art Hogan of B. Riley Wealth Management said the uncertainty around trade policy was “affecting the real economy”, dragging down consumer sentiment and business investment.

“The longer that goes on, the more the economy slows,” he said.

Meanwhile, bond yields continued to climb, and the rise extended to Asia, with Japanese 10-year yields hitting 1.5 per cent for the first time in more than a decade.

The increase signals expectations of higher inflation and that governments, companies and consumers will need to pay more to borrow.

Mr Trump’s sweeping tariffs of up to 25 per cent on Canada and Mexico took effect on Tuesday, causing stock markets to tumble as economists warned that blanket levies could weigh on US growth and raise inflation.

Wednesday’s announcement of the tariff delay buoyed Asian stock markets, in particular lifting the auto sector.

The move “helped reinforce hopes there may be some flexibility in the new administration’s trade policy”, said AJ Bell investment director Russ Mould.

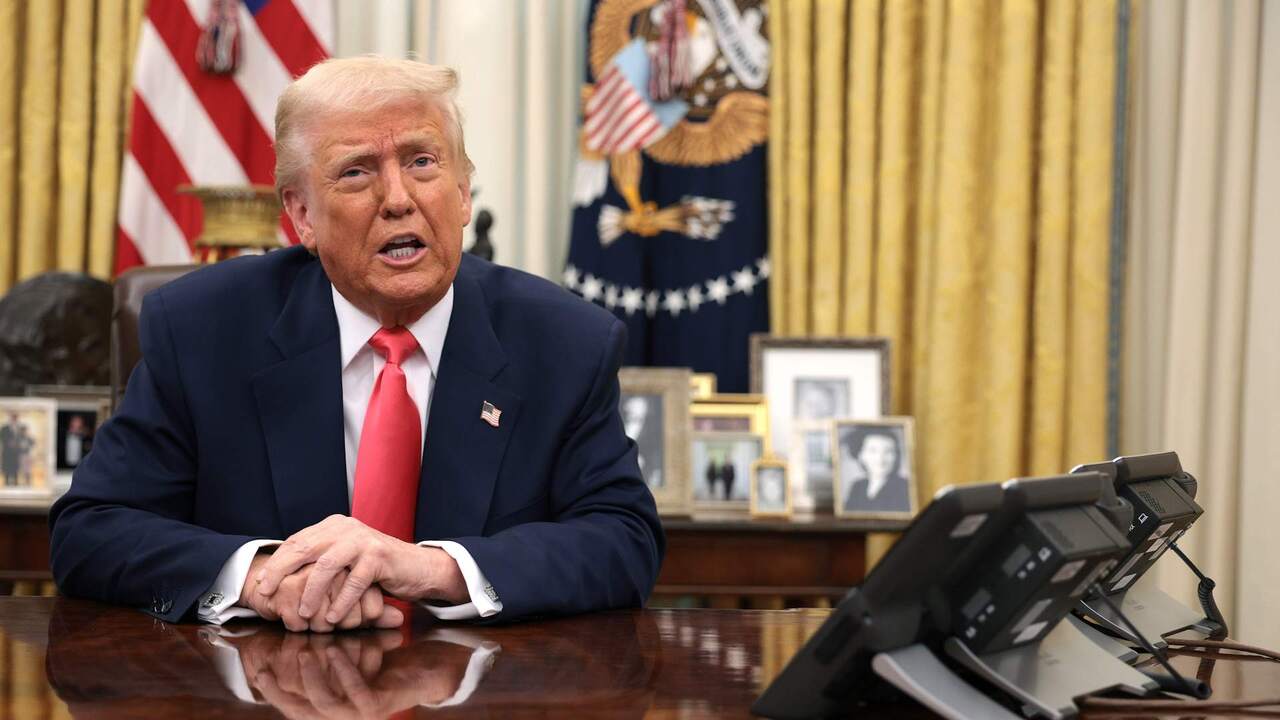

On Thursday, the President signed orders to delay fresh levies for Canadian and Mexican imports covered by a North American trade agreement, though he dismissed suggestions that his decisions were linked to market turmoil.

The halt lasts until April 2.

In response, Canada said it would hold off imposing a second wave of tariffs on $US125 billion in US goods.

“Canada will not proceed with the second wave of tariffs on $125B of US products until April 2nd, while we continue to work for the removal of all tariffs,” Finance Minister Dominic LeBlanc, who is leading Canada’s trade negotiations with its neighbour, posted on X.

Following talks with the “Big Three” US automakers Stellantis, Ford and General Motors, Mr Trump decided to give a one-month exemption on autos coming through the United States-Mexico-Canada Agreement (USMCA).

A White House official told reporters that about 62 per cent of Canadian imports will still face the new tariffs, although much of these are energy imports hit by a lower rate of 10 per cent.

About half of Mexican imports come through the USMCA.

The latest moves make conditions “much more favourable for our American car manufacturers”, Mr Trump said Thursday.

But he added that major moves would be unveiled on April 2, the date that he has promised “reciprocal tariffs” to remedy practices Washington deems unfair.

At that point, Canadian and Mexican goods could still face levies. The President also said he would not modify broad tariffs for steel and aluminium, which are due to take effect next week.

Mr Trump told reporters on Thursday in the Oval Office that he had a “very good conversation” with Mexican President Claudia Sheinbaum earlier.

He claimed “tremendous progress” on both illegal immigration and drugs coming into the United States — both reasons that Washington cited in imposing levies on Mexico, Canada and China.

His remarks stood in sharp contrast to the simmering tensions with Canadian Prime Minister Justin Trudeau.

Mr Trudeau said on Thursday that Ottawa will remain in a trade war with Washington for “the foreseeable future” even if there are “breaks for certain sectors”.

“Our goal remains to get these tariffs, all tariffs removed,” Mr Trudeau added.

Canada contributes less than 1 per cent of fentanyl to the illicit US supply, according to Canadian and US government data.

China, meanwhile, has pushed back on US allegations of its role in the fentanyl supply chain, calling this a domestic issue that tariffs will not resolve.

For Scott Lincicome, vice president of general economics at the Cato Institute, Mr Trump’s easing of tariffs was “a recognition of economic reality”.

The move was an acknowledgment that tariffs disrupt supply chains, that the burden of levies fall to consumers, and “that the market doesn’t like them and certainly doesn’t like the uncertainty surrounding them”, Mr Lincicome told AFP.

Since taking office for his second term in January, Trump has made tariff threats on allies and adversaries alike.

US Treasury Secretary Scott Bessent said on Thursday that he was not concerned Mr Trump’s tariffs would be inflationary, adding that any impact on prices would likely be temporary.

He told the Economic Club of New York that “access to cheap goods is not the essence of the American Dream”, saying this was instead rooted in the idea that citizens can achieve upward mobility and economic security.

Mr Trump has referred to tariffs as a source of US government revenue, and a way to remedy trade imbalances and unfair trade practices.

The US trade deficit surged to a new record in January, according to government data released Thursday.

The overall trade gap of the world’s biggest economy ballooned 34 per cent to $US131.4 billion, on the back of a jump in imports for the month.

Analysts say the US deficit was likely bolstered by gold imports, but that data suggests businesses were importing more goods to try to get ahead of tariffs.

Originally published as Bloodbath, world economy totally smashed