ASX rebounds as Middle East tensions fade

Markets regained their composure on Monday after an apparent easing in hostilities between Iran and Israel.

Markets regained their composure on Monday after an apparent easing in hostilities between Iran and Israel.

Market finishes in the black. Star ex-CEO Robbie Cooke recalls ex-lawyer to inquiry. Coal standout in South32’s mixed quarterly update. Eneco founder’s market manipulation sentence. ATO rues PwC failure to take tax leaks seriously.

Asian equity markets rattled by escalating Middle East tensions. AUD around US64c. Gold and oil rise. ASX 200 down 2.8 per cent this week. Star inquiry ends with allegations of ‘misleading’ regulators.

Firmer than expected unemployment data failed to ease concerns that the RBA will hold interest rates steady through to 2025.

ASX 200 shares close lower with utilities and communications the only sectors in the green. Aussie dollar falls below US64c. Optus faces new data breach legal threat. August retail sales softer. ASX Ltd gets first strike against exec pay.

The Bank of England has vowed it “will not hesitate” to hike interest rates again after the pound crashed to a record low on Monday.

ASX breaks a three-day losing streak on energy and materials. Aussie dollar rebounds, Link suffers downgrades, gloomy outlook hits REITs and Santos rises amid PNG offer.

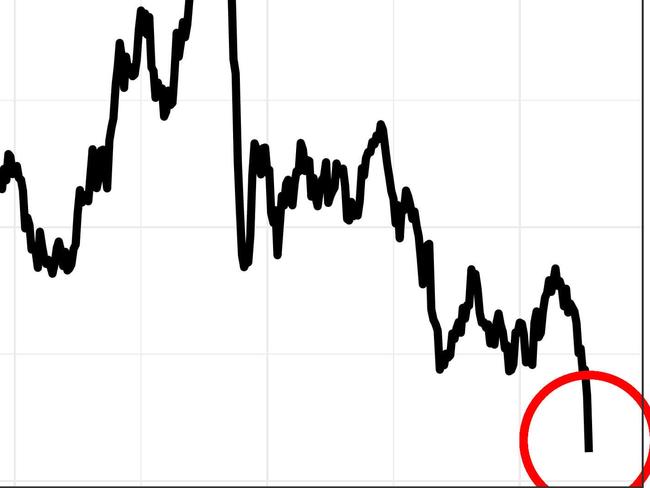

The British pound has crashed to an all-time low against the US dollar as the currency’s slump serves as a major warning for Australia.

The Aussie sharemarket has plummeted as fears of a looming global recession continue to grow.

ASX hits a three-month low as energy and miners plunge. Dollar hits 29-month low, New Hope leads coal losses, Costa smashed on CEO exit and health stock rally.

Wall Street neared bear market territory on Friday as stocks fell sharply to end the week with the Dow down more than 800 points.

All sectors down after sharp falls on ASX 200. Tech and discretionary hardest hit, coal miners buck trend, bond yields surge, MinRes loses lithium boss and OZ green lights mine.

Original URL: https://www.couriermail.com.au/business/markets/page/197