Market suddenly soared like an eagle for investors

After putting in a stinker for most of the year, financial markets staged a dramatic comeback in the last two months. It’s a good lesson for investors.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Anyone who’s ever played sport will remember a time you had a shocker, but then played just well enough at the end to bring you back next week.

The rest of your game stunk up the joint. For three quarters, you were, objectively, awful. You let yourself or your teammates down. Probably both. So embarrassingly bad were you that you wondered whether you should play this sport again.

But then you did something in the final stretch that gave you hope, maybe even signalled “redemption”. You drilled something so well, you surprised yourself.

For me, in my teens, it was golf. And golf is a sport notorious for exactly this. You can play terribly, cuss your lungs out all round, then hit a couple of good drives, maybe knock a five iron through the trees to three feet, or sink a long putt on the last few holes and it will be enough to bring you back next week.

Just remember some time that it happened to you.

That’s the year that was for investment markets. After putting in a stinker for most of the year, investment markets did something special in the final stanza. Redemption.

And there are important lessons to learn out of it. I’ll come back to these.

But first, what happened?

Upside down

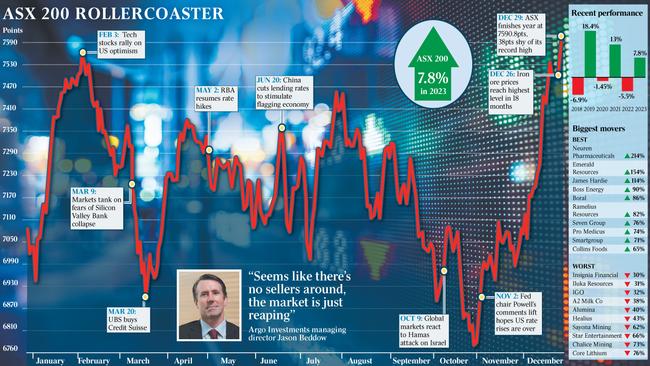

Without diving into the details too deeply – as the facts and figures will no doubt be covered to death elsewhere – Australia’s stock market started the year off pretty well in January.

That is, it opened with a nice drive, fired a lovely iron shot into the green and two-putted for par.

But from February through to the end of October – say holes two through 15 – every other hole contained a lost ball, a few duffed shots, or a hook out of bounds, leading to bogeys, even a few double bogeys.

Markets spent most of the year panicking about a few things. Largely inflation and where that inflation would take interest rates.

Investors couldn’t see a nice ending, or a path where central banks and governments could steer their economies out of trouble without too much pain.

Golf fans know of the famous “Amen Corner” – holes 11, 12 and 13 at Augusta National, where the US Masters is played each year. Notoriously difficult holes where potential tournament winners’ hopes can be dashed.

September and October were the market’s Amen Corner this year (let’s say roughly holes 12 to 15). Pessimism hit overdrive. The ASX/200 lost around 8 per cent.

At the start of November, the markets were standing on the 16th tee. And something snapped. Now they could see a way out of the mess. Those who see the glass as half full took over.

Through November and December, the ASX/200 added around 12 per cent in eight weeks.

But it wasn’t just Australia’s stock market. International markets and listed property markets started firing. Australian listed property, on it’s own, did roughly 24 per cent.

Bond markets, both in Australia and overseas, finally turned the corner after nearly two years of being in the dumps as it reacted to interest rate concerns.

It was a miraculous ending to the year for investment markets – the equivalent of a birdy-birdy-eagle finish.

It you looked at the whole of 2023, it was a pretty reasonable one for all investors, all things considered.

Riding the coat-tails

Investors who suffered through to the end of October hopefully got to Christmas party season and had an extra reason to celebrate.

And, if you take into account that most people have a superannuation fund, that should be nearly everyone. The rises in the last eight weeks were more than enough to offset what had occurred through the rest of the year and leave investors in positive territory.

Millions of Australians don’t pay any attention to their superannuation investments and have stayed invested in whatever default fund they were initially slotted into.

But for active investors, those who are actively managing their superannuation and non-superannuation investments, it felt like a rollercoaster.

Some mistakes might have been made along the way. There are definitely lessons to learn, or to have reinforced, when years like this occur.

Diversification a winner

No investment market performs smoothly. Some will shoot up, while others go through a tough spot. While some markets are stubbornly still, others will be waking from a slumber and going for a run.

A lot of self-directed investors, particularly self-managed super funds (SMSFs) in Australia have a “bar-bell” approach to their investments.

They hold a lot of Australian shares (high risk) and usually also hold a lot of cash (low risk). But they are missing out on a lot of asset classes that can help smooth, and potentially improve, their investment returns.

In 2022, Australian shares massively outperformed international shares. This year was the reverse. While Australia’s share markets finished the year up roughly 14-15 per cent including dividends, international shares, as a whole, were up around 24 or 25 per cent.

And unless you own a crystal ball that will tell you which asset class is going to perform best during a given year (and I can assure you, you don’t own one), diversification is the tool that will help smooth out your returns over time.

Constant investor

There’s a lot of psychology to investing. But it’s mostly fighting yourself.

People find it mentally hard to invest in falling markets but easier to invest in markets that have been rising for some time (because sentiment is good).

Obviously, doing the opposite of that would be a better option – buy when assets are low and sell when they are high. But it’s hard and as a result, a lot of novice investors underperform the averages.

There’s a way to beat that. Have a long-term, consistent, plan about your investing and make your investing automatic.

Invest regularly, preferably monthly, whether markets are going up or down.

Take the emotion out of trying to pick markets and just invest the same amount each month. It is usually easier when we’re talking managed investments, such as managed funds, or exchange-traded funds.

This is exactly what happens with most people and their super and why they will get the long-term average returns of your super fund.

Their employer sends money to their super each quarter, or each month, and the money is automatically invested.

Mean reversion

Mean reversion is a technical term that can be more simply put as “trends end”.

The direction of a market will eventually change course. And that applies to both strongly rising and strongly falling markets. And even markets that have been treading water for a while.

Don’t think that the current “birdy-birdy-eagle” finish to 2023 of markets will continue on forever. Markets are reacting to the change in sentiment in regards to interest rates.

Central banks are starting to indicate that inflation is getting back to where they want it to be. And that the peak of this interest rate cycle might have been reached.

And that’s the sort of thing stock, property and bond markets love.

Similarly, the plunge in markets in September and October were always going to end. It was overly pessimistic. And the news was never going to stay down-in-the-dumps forever.

How long markets continue on their run is a little harder to assess. There will be some that think there is a fair bit to go on it, while others will say it should have already ended.

Bond market traders are confident their run will continue for a bit. Bonds – which are loans to governments and companies – move more slowly than share and property markets, and tend to perform well when interest rates are falling, or likely to fall.

When in doubt …

Don’t panic. Stay invested. Trying to time markets is something professionals struggle to do well consistently. And being in markets, over longer periods, is generally going to be better than being out of them.

But that doesn’t mean that your current investments shouldn’t be reviewed. Some investments – particularly fad investments that have passed their use-by dates – are going to underperform no matter what.

And, in most cases, would be better replaced with an index-fund investment.

When the final investment numbers are tallied for 2023, many will be quite surprised at seeing a reasonably positive number, given most of the year was filled with bad news.

Enough to bring us investors back next year?

Of course!

Originally published as Market suddenly soared like an eagle for investors