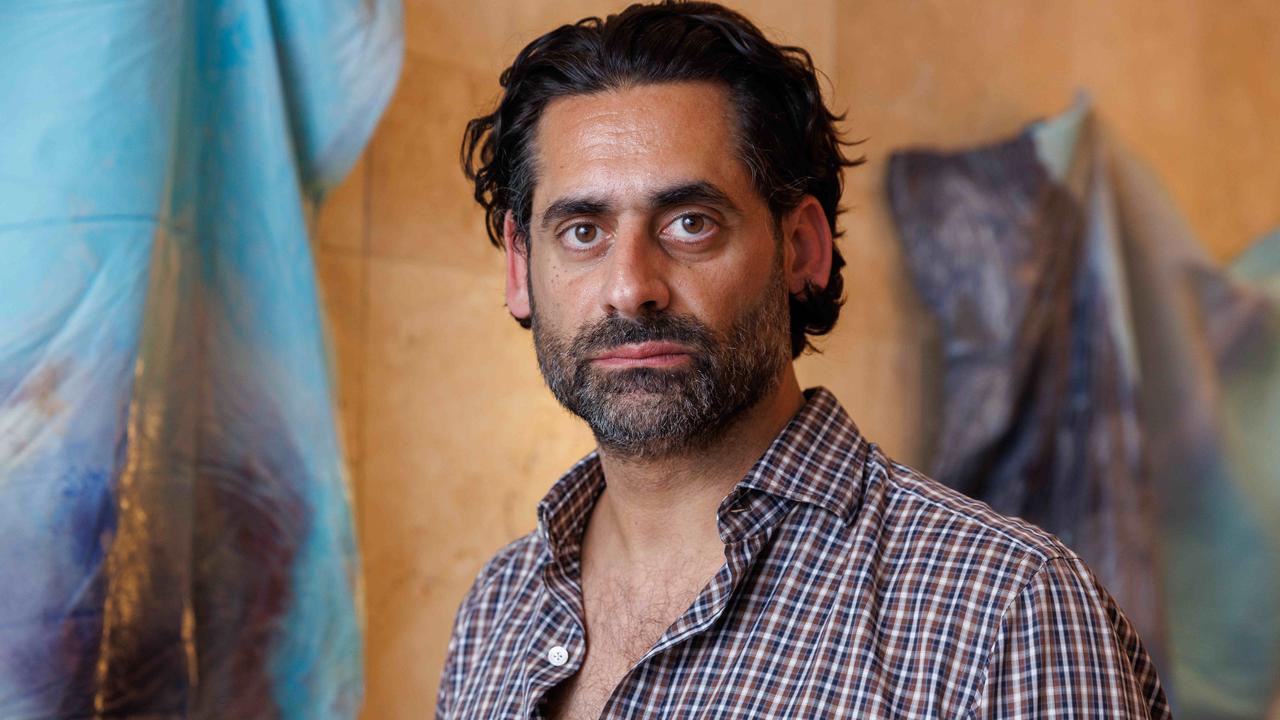

Magellan Financial CEO David George promises change after turmoil

Chief executive David George is confident he can restore the reputation of his firm after it lost $50bn in funds under management amid controversy and key personnel changes.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Magellan Financial chief executive David George is confident he can restore the reputation of his firm after it lost $50bn in funds under management amid controversy and key personnel changes.

Speaking at his first annual general meeting for Magellan since taking the reins in July, Mr George told the full house of about 120 shareholders he hoped the FUM figure had stabilised and the company was positioned to grow back to $100bn in five years.

“Magellan still has a good brand,” Mr George told The Australian after the AGM. “The reputational damage will be repaired. We have distribution and marketing that is outstanding and a great track record with the success of Airlie, which has integrated well into the group.”

Magellan shares dropped 4.8 per cent after the chief executive and chairman made their addresses to the AGM, which the market had expected to reveal big comeback plans.

It was only a few years ago that Magellan co-founder Hamish Douglass was revered in Australia with almost Warren Buffett-level enthusiasm, which kept Magellan funds awash with money.

That came to a shuddering halt with several bad investments in tech stocks and the controversial departure of Douglass and then-CEO Brett Cairns.

Magellan’s FUM has since halved, and many shareholders at the AGM voiced concerns over performance, but Mr George said he expected growth through existing products, opportunities in small caps and a new renewables product to invest in companies going through energy transition.

The CEO also said he was looking to snap up an equities and private markets team.

But time will tell as to whether Mr George has kicked an own goal, after this week announcing yet another set of changes to his revolving-door investment team.

His announcement this week that co-founder Chris Mackay was stepping back from an equities oversight role and taking on the chief investment officer role, along with other staff changes, triggered “on watch” reviews from all three ratings companies.

“That will be for others to judge,” Mr George said.

The affable executive will also have to prove he has the sales chutzpah to catch and retain clients in the competitive Australian market, having come from a role at the Future Fund with just one, guaranteed client: the government. “Magellan has a lot of clients and the Future Fund has one,” Mr George conceded. “But I’ve never made my career as a salesman … I want to be honest about what we can do and what we can improve on.”

Magellan was not considering cutting fees to attract greater FUM at this point, he said.

Morgan Stanley has an “underweight” rating on Magellan, citing downside risks on flows and fee risk associated with relatively high retail pricing.

“The strong balance sheet provides new management with options to invest in growth and add teams,” Morgan Stanley analyst Andrei Stadnik wrote in a note to clients. “But we think a turnaround and repairing the brand will take time, and with the stock trading on above peer multiples (~14.5x FY24E P/E on our estimates) we think it is too dear given these risks and little cost flexibility.”

Mr George said that although he was taking on the CIO role he would not be picking stocks. One of his first tasks will be to meet with clients, ratings companies and other stakeholders to explain why this week’s changes were necessary and positive.

“There are changes that happen to you, and there are changes that you decide on, and that’s what these changes are. It’s about making adjustments so we can develop better outcomes and … better performance.”

Changes announced this week included Gerald Stack, portfolio manager of the Magellan Infrastructure Fund, becoming deputy CIO. Magellan’s global equities strategy will be managed by Arvid Streimann and Nikki Thomas, while Elisa Di Marco was appointed portfolio manager of the Magellan Core International strategy, replacing Vihari Ross.

Morningstar, Lonsec and Zenith responded by moving funds such as the Magellan Global Fund to a “watch” position, citing yet another round of significant investment team staff changes.

Magellan’s performance in global equities would be a particular area of focus, having “not been at our normal high standard”, Mr George said.

“This is where I am taking action,” Mr George said.

“We will leverage Gerald Stack’s ability to manage and develop great investors.

“We are excited to bring his skill set to the global equities analyst team with a view to optimising analyst engagement, but also the engagement between the analysts and our portfolio managers.”

Magellan chairman Hamish McLennan said the performance in 2022 was not what shareholders would have expected.

“Throughout this period, the board has been extremely focused on restoring stability, confidence and value to Magellan’s clients and shareholders,” Mr McLennan said in his address to shareholders.

Mr McLennan was voted back in as a director of the Magellan Financial Group board.

The company also announced David Dixon as a non-executive director and deputy chairman of the board of Magellan Asset Management Ltd, and said it also intended on appointing him to the board of Magellan Financial Group.

In another other vote at the AGM, the remuneration report was approved with 94 per cent in favour.

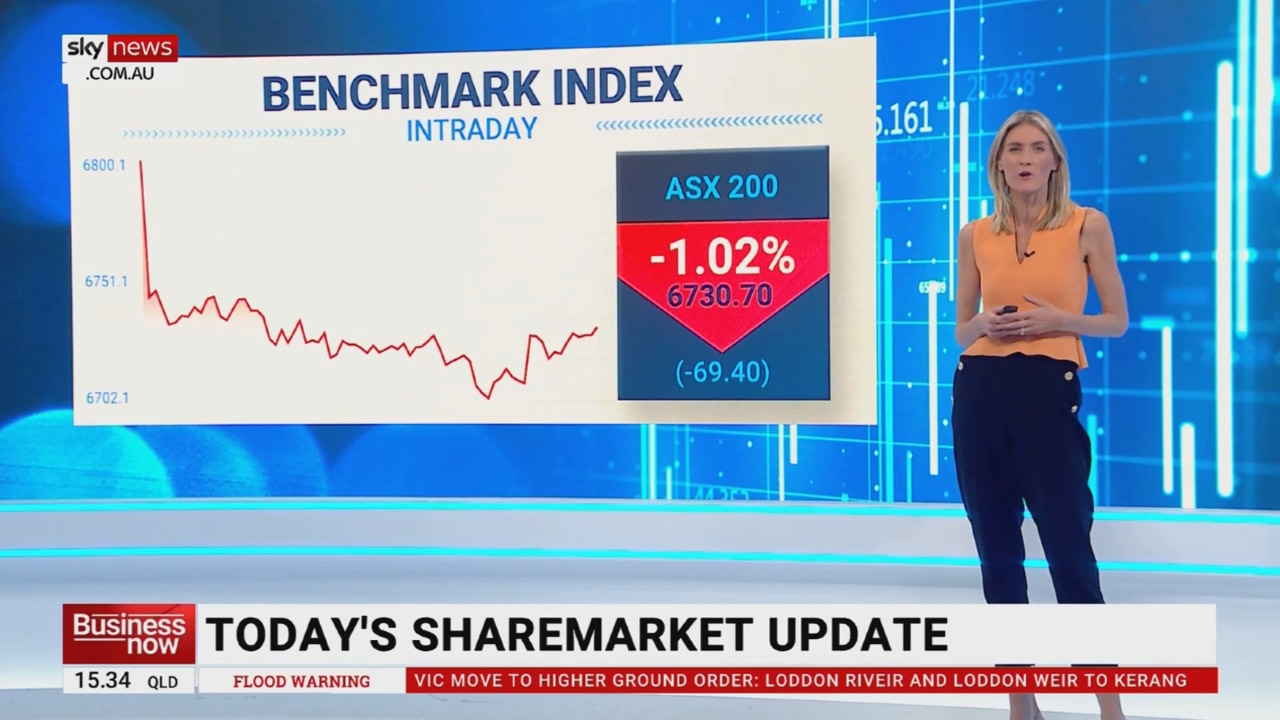

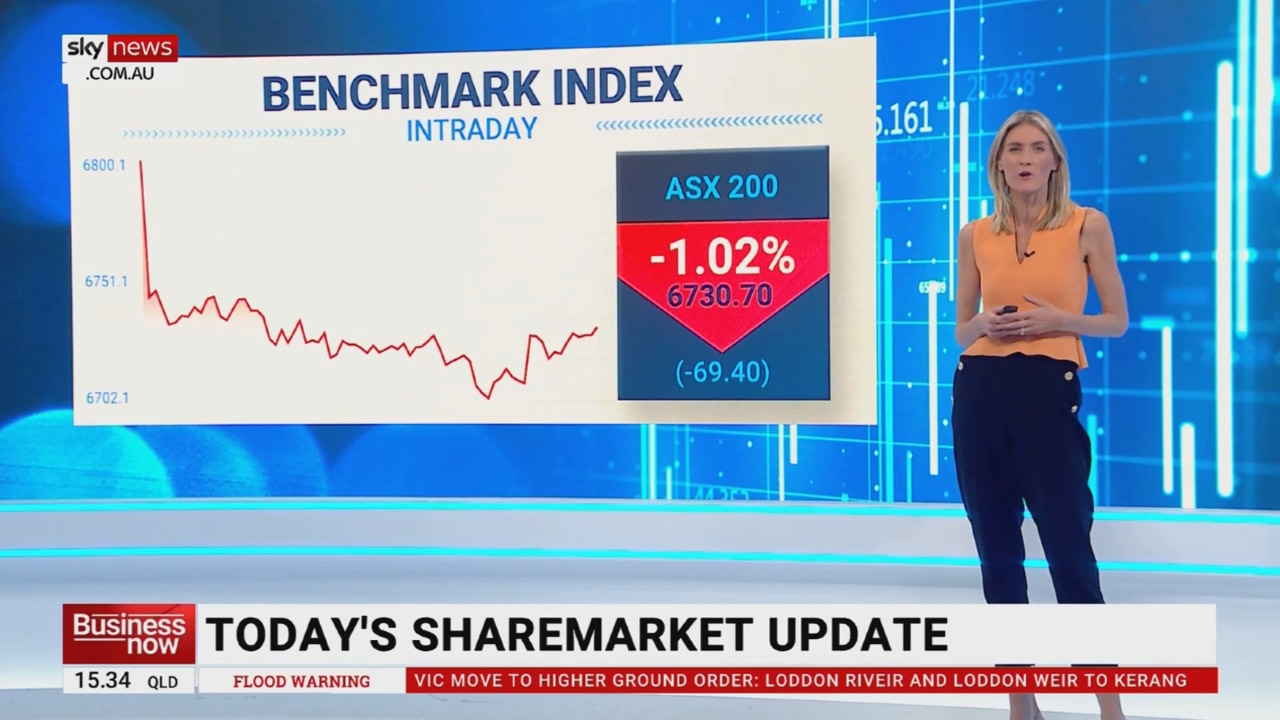

Magellan shares have been hit hard this year, with the stock down 4.8 per cent to close at $10.30 in a lower market on Thursday.

The stock has dropped 46 per cent this year.

More Coverage

Originally published as Magellan Financial CEO David George promises change after turmoil