Kit app: The serious fun behind giving kids their own bank

Kit, the banking app for kids, is ready to play. And it is teaching a new generation of digitally-savvy savers.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

It might be a game, but it’s serious stuff when it comes to teaching kids to be savvy around money to prepare them for a life of buy, selling and saving online.

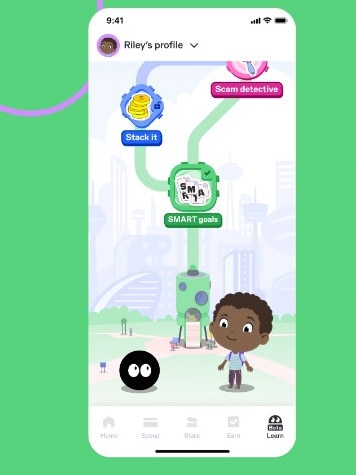

The homegrown app backed by the nation’s biggest bank just does that. And after more than a year of beta testing and its recent soft launch, Kit is ready to play.

Part game, part bank, but built entirely around teaching, Kit has started to take hold of the nation’s young families. Through the testing phase of the past year there was a cap of 5000 users, although it had a much longer waitlist of parents wanting to sign on. This came off at the start of October and Kit has now just signed up 36,000 young savers.

Yish Koh of the Commonwealth Bank-backed x15ventures arm, who has overseen the Kit project from inception to rapid build and testing, describes the app as giving kids their first experience with managing money. Through the games built into the app, kids can experience now how it can run out.

“When you were little with a piggy bank and counting how much money’s there. This is the digital version of that today,” Koh tells The Australian.

Koh will update investors at CBA’s tech showcase later this week on progress of the closely watched app. This will include Kit’s push into gamification with its “nudges” and explainers, all designed to educate about spending and saving money online. Designed for five to 13-year-olds, the app now links with any bank account operated by parents also has the option of its own-branded debit card to allow real-time payments. This step has heavy parental controls, including spending limits and the ability to block merchants. There are no loans or credit cards in the app.

Kit is also moving into new areas to teach kids about how to watch out for frauds and scams from a young age, and CBA is exploring linking Kit to one of its high-interest savings account to deliver bonus interest.

One of the drivers of Kit was the need to teach kids from a young age about money moving around online.

In the real world, the act of spending money involves physically handing something over in return for something. In the digital world, payments are invisible and take place at the click of a mouse, which makes spending and impulsive buying easier.

A string of studies show Australia continues to lag on financial literacy, with around a third of adults struggling when it comes to understanding the basic concepts around money and saving. The gap between men and women is one of the biggest among the G20 economies. One of the most comprehensive snapshots from the Household, Income and Labour Dynamics in Australia (HILDA) survey conducted by the Melbourne Institute shows that financial literacy has declined in the four years to 2016. Worryingly, the fall in literacy was faster among younger Australians.

Parents too can set chores for kids like the dishes, setting the table or cleaning and can transfer scheduled payments of real money on the completion. These can be tailored to help with the savings goal.

One of the unexpected findings from the money app was discovering that on average, the weekly pocket money payment is for Australian kids is $13. Another insight is that one of the most popular savings buckets is for charity — ahead of savings for toys.

Kit too is developing a quest preparing kids on how to spot a scam when it goes on with little clues, as well as providing a safe environment to make the wrong choice when it comes to falling for scams.

With a former teacher and gaming specialist now part of Koh’s x15 development team, the app draws on a gamified learning experience to improve financial capability.

Kit sits alongside learning apps like Mathletics, Reading Eggs and even Duolingo that time and time again show games work for teaching.

Since the introduction of gamification, Koh says the rate of savings by kids using the app has surged, according to Kit’s own internal measures. It means children too are starting more frequent conversations with parents about money – and this includes scams. Koh says that one parent got in touch after learning about an online scam from their child who had been using Kit.

“Just the act of giving the child ownership over their own money really gains their buy-in and motivation about money,” Koh says.

“We want to create an experience that’s really fun for kids. But fun and engaging translates into better education and better outcomes”.

Originally published as Kit app: The serious fun behind giving kids their own bank