JobKeeper lines corporate pockets — government handout a profit booster

More than half of the top 300 listed companies that received JobKeeper in the past six months reported a jump in profit.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

More than half of the top 300 listed companies that received JobKeeper in the past six months reported a jump in profit, with the government handout accounting for around 20 per cent of the windfall.

All up, close to 90 per cent of the listed businesses that received $1.38bn in JobKeeper payments were profitable over the December half, research from corporate governance firm Ownership Matters has found.

The payments — while going to employees stood down through the COVID pandemic — also represented a substantial lowering of the wages bill for companies taking part in the scheme.

For some, such as crash repair network AMA Group, the government subsidy made up the vast bulk of its earnings for the six-month period.

AMA posted pre-tax earnings of $46m for the six months through December, after putting its hand out for $31m in JobKeeper payments. In the prior corresponding period, it reported pre-tax earnings of $21.7m.

Likewise, more than half of Tyro Payments’ $8.5m in pre-tax earnings came from the $4.5m it received in JobKeeper.

While Tyro’s underlying earnings rose more than 400 per cent on the prior corresponding period, it made a statutory loss of $3.4m. This was an 82 per cent improvement on the first half of fiscal 2020.

For some, taking millions in JobKeeper handouts translated into a dividend bonanza.

Car retailing group Eagers Automotive posted profit before tax of $209.4m for the 2020 calendar year while receiving $130m in JobKeeper. Of that, $64m will flow straight into shareholders’ pockets when it pays out its final dividend next month.

Eagers was “a real standout” of the JobKeeper recipients, Mr Paatsch said.

“They improved their profit by about $100m and paid a $64m dividend. You can‘t deny the effect (of JobKeeper) on profitability, because it’s in their own numbers.

“They paid out that dividend. They’re not giving it back, they don’t have to.”

The car dealership has suggested the labour subsidy represented 14 per cent of its total wages bill for 6500 employees.

“However, notes to Eagers’ accounts reveal at least a $40m (profit and loss) benefit which is recognised as reduction in the portion of employee benefits expense that contributed to cost of sales,” the Ownership Matters report said.

For others, such as Harvey Norman, the government assistance accounted for only a small portion of pre-tax earnings.

The retailer received $3.8m in JobKeeper between July and December, while more than doubling its pre-tax profit to $610m. After tax, the retailer’s profit rose 116 per cent to $438m.

“When we did a comparison, I was staggered that 34 of the 66 entities had actually improved (earnings) from pre-pandemic levels,” Ownership Matters director Dean Paatsch said.

“So $284m, or 20 per cent of all JobKeeper that went to ASX 300 companies, went to businesses that weren’t just standing still, but had actually improved. And of the improvement — JobKeeper accounted for 20 per cent of it.

“If you’re an investor, that’s a one-off sugar hit, thanks to Josh Frydenberg. But you need to back it out of your numbers going forward.”

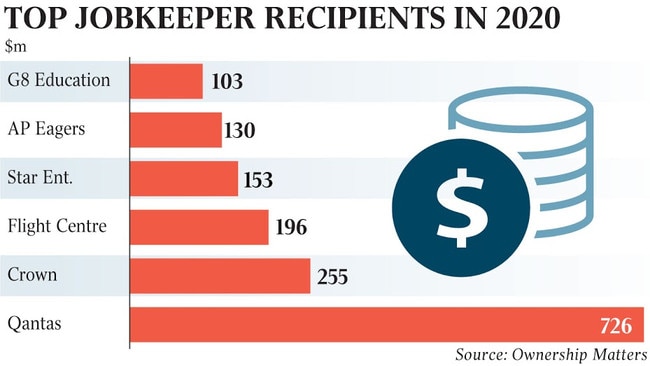

Eagers was among the six largest subsidy recipients over year, which were led by Qantas at $726m, followed by Crown at $254m, Flight Centre at $195m, Star Entertainment at $152m and G8 Education at $102m. In total, these six were handed more than 60 per cent of all JobKeeper payments.

Harvey Norman and Eagers are among the companies under pressure to return the handouts.

While Gerry Harvey recently said the payments went to the parts of the business that needed it most, Eagers CEO Martin Ward is adamant the company will not be repaying any of the JobKeeper payments.

From a governance perspective, the companies had no obligation to pay the money back, Mr Paatsch said.

“(They have a) duty to maximise profits for shareholders. And when there is a scheme as generous and as untesting as this one, you’d be mad not to take it.

“But that’s a separate issue to your duties as a corporate citizen to — in a time of crisis — do the right thing.”

In total, the top 300 listed companies were handed $3.78bn in government subsidies through the pandemic, with 95 companies, or just under a third, accepting government support.

The majority of the subsidies were from JobKeeper, which totalled $2.45bn: 75 of the 95 listed companies received JobKeeper, as well as other subsidies both at home and overseas, while the remaining 20 received $295m in subsidies outside of JobKeeper.

More Coverage

Originally published as JobKeeper lines corporate pockets — government handout a profit booster