Japanese nervous over government interventions in gas market: Mitsui Australia chief

One of Australia’s biggest resources players, Mitsui, has admitted a series of damaging policy interventions have made Japanese investors ‘nervous’.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

One of Australia’s biggest resources players, Mitsui, has admitted a series of damaging policy interventions have made Japanese investors “nervous”, as the company moved to diffuse tensions with the federal government amid the threat of gas export controls.

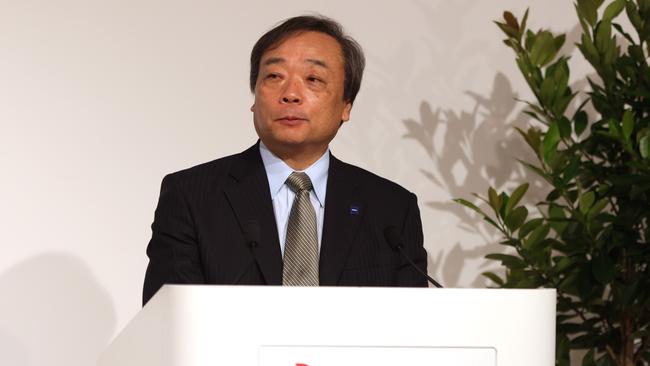

Mitsui Australia chief executive Masato Sugahara said: “While Australia has been a trustworthy energy supply country for the world, especially Asia, some Japanese companies are nervous about the stability of Australia’s energy supply.”

There were currently some “negative short-term discussions” about keeping some Australian gas bound for export for the domestic economy, but Mr Sugahara said he would “take a more optimistic position in the long term” about Australia-Japan relations.

Mr Sugahara’s comments, in an interview with The Australian, come after the former Japanese ambassador to Australia, Shingo Yamagami, warned in a departure interview last month that some Japanese companies were now concerned about the “sovereign risk” when investing in Australia.

The ambassador said comments like those made by Inpex chief executive Takayuki Ueda, who alleged that there was now a “quiet quitting” of the LNG business in Australia, reflected the “depth of concern shared by Japanese actors” about new energy policies in Australia.

Inpex owns the $60bn Ichthys project in Darwin.

In blunt words, Mr Ueda had criticised what he described as the deteriorating investment environment in the energy sector in Australia at a private function in Parliament House in Canberra in March.

He criticised what he said was the Labor government’s failure to back carbon capture and storage technology and urged the federal government to avoid triggering the domestic gas “security mechanism”, which could see some gas bound for export retained for the Australian market.

Separately on Monday, an EnergyQuest report warned that federal government gas market intervention did not address the industry’s fundamentals, and more intervention was likely.

“The government took control of the east coast domestic gas market in an effort to artificially lower prices and ensure ongoing supply. It can’t achieve both these goals over the long term and may end up achieving neither,” EnergyQuest chief executive Rick Wilkinson said.

“Price spikes and energy shortages during periods of peak demand are still possible. More government intervention, likely to the detriment of gas users, will be the result.”

But in his interview with The Australian, which comes ahead of this week’s Australian Petroleum Production and Exploration Association (APPEA) conference in Adelaide, Mr Sugahara, a veteran Mitsui executive who has headed its Australian operations for the past year, was keen to cool public tensions between Japanese investors and the federal government.

“I want to be an optimistic business person in terms of Australia-Japan relationships,” he said.

He described last week’s budget announcement of an increase in the petroleum resource rent tax (PRRT), which is expected to raise an extra $2.4bn over the next four years, as a “reasonable result after open discussions”.

While he said some Japanese investors in Australia were “nervous,” he was not one.

“I’m keeping good, necessary conversations with our partners, our customers and government people,” he said.

“Like the recent new (PRRT) tax. There were a lot of discussions before the official announcement, but, finally, it is a reasonable result.”

Mitsui has been a long-term minority investor in the North West Shelf gas project and has a stake in the proposed Browse project in Western Australia with Woodside.

Discussing the tensions between Japanese investors and the Australian government on its energy policies, Mr Sugahara said: “Both sides have their own perspective.

“From the Australian government’s point of view, they need to think about a certain level of protection for the domestic economy.

“However, in the long term, the two countries will be dependent on each other,” he said.

“As in past years, we want to keep good communications between top government officials and private companies.”

But he said it was a slightly different situation with the Queensland government’s sudden decision to increase the tax on coal.

He said concern had been expressed about that move by investors in the sector “because it was a very abrupt policy regulation”.

“Unfortunately, I understand there was very limited prior conversations between government and private companies,” he said.

“But I understand there is a continuous conversation on both sides about how to improve (communications).

“As Mitsui is one of the coal-producing companies (in Queensland), I’m closely watching the process.”

Mitsui, which traces its roots in Australia back to 1901, has extensive investments in Australia in fields including LNG, coal, iron ore, forestry, salt and woodchips.

Mr Sugahara said Mitsui was keen to step up its investments in Australia, with discussions under way on a range of areas including lithium, potentially expanding its ties with Wesfarmers where the two partners are backing a low-carbon ammonia project in Western Australia, and potential new investments in green hydrogen.

He said Mitsui had a strong belief in the future of the LNG industry which would play a key role in the transition to a cleaner energy environment.

“We think LNG will be a more significant source (of energy during the transition) than the world expects,” he said.

“It will play a longer and more important role in the energy industry. We are proud of being one of the LNG players in Australia.”

Mr Sugahara said Mitsui saw its role as being a source of “stable, competitive energy supply to Asia”.

“The North West Shelf is a very successful project in terms of stable energy supply to Japan and Asian countries,” he said.

“Mitsui’s mission is to keep a stable and competitive energy supply to Asia.

“That (LNG) is definitely a big enhancement of achieving energy transition.”

Mr Sugahara said that the investors in the Browse project in Western Australia were “working hard” and having discussions with state and federal government, largely around final permits.

“Browse is a very essential energy resource,” he said.

“We commit ourselves to promoting the Browse project in collaboration with other stakeholders, including governments.”

While he said there were still discussions with government over the project, they did not involve critical issues that could derail the project.

Mr Sugahara said Mitsui was closely watching Woodside’s proposed $16.5bn Scarborough gas project in WA.

“We are not involved in the project, but as one of the LNG players (in Australia) we are looking at the situation very carefully.”

He said Mitsui was still committed to the Australian coal industry, with no current plans to sell any more of its coal assets in Australia after the sale of its 20 per cent stake in Queensland-based coking coal miner Stanmore Resources last year, a deal worth some $US270m ($406m).

The first Japanese investor in the Australian coal industry, dating back to the 1960s, Mitsui still has a 49 per cent stake in the Dawson metallurgical coal project, a 30 per cent stake in the Capcoal project and a small stake in the Moranbah North project in Queensland’s Bowen Basin with Anglo American, as well as a 20 per cent stake in the Kestrel project near Emerald, in central Queensland.

Mr Sugahara described the sale of Mitsui’s stake in Stanmore as a “business decision” to recycle its investments.

But he said Mitsui wanted to be “a stable supplier of necessary natural resources including coal.”

“(Metallurgical) coal is still an important element for the steel industry in Japan and Asia.”

“As far as the economic demand is there, we want to continue to be a reliable, stable supplier (of coal),” he said. “While we need to work out the climate change issue and we try to minimise the environmental impact in terms of carbon emissions, the coal business is still an important factor in the global economy.”

He said Mitsui was always making decisions about whether to sell or buy different assets.

“We may think about new divestments or investments, but, as of today, we have no big critical decisions (about selling out of coal),” he said.

Mr Sugahara added that Mitsui was a strong supporter of the potential for the carbon capture and storage (CCS) business in Australia.

“CCS will be an important part of our energy transition strategies,” he said.

While he said there was work under way on the economics of CCS, he said Mitsui’s gas and exploration subsidiary was working with North West Shelf partners on a new carbon capture and storage project in Western Australia to “continue a stable supply of LNG by absorbing carbon”.

“We are a strong supporter to promote CCS,” he said. “There are discussions about the economic viability and practical solutions, but I think CCS has big business potential for Australia. ”

Mr Sugahara said Mitsui was also interested in the potential of the green hydrogen industry in Australia.

The company last year bought a 28 per cent stake in the Yuri renewable hydrogen project in the Pilbara region of Western Australia which is being operated by a subsidiary of French energy giant, Engie.

He said this was a “world-scale green hydrogen project to support a fertiliser company in Western Australia”.

“It’s a great trial to stabilise green hydrogen production,” he said. “It is being supported by both federal and state governments in terms of grant money.

“But we continue to try some more (green hydrogen) projects,” he said. “There are some new projects still under discussion.”

Mr Sugahara said Mitsui was also looking at potential investments in lithium and critical minerals in Australia.

But he said the market was very expensive at the moment.

“We are keeping our eyes on the market and having strategic discussions with a lot of traders,” he said.

Mr Sugahara says Mitsui is diversifying its operations in Australia into new areas, including the potential to produce beef with lower methane emissions.

It is also expanding into the carbon credit business with the purchase of a stake last year in Climate Friendly, which works with farmers to generate land sector carbon credits and increasing its investment in agricultural management company, New Forests, which it owns with Nomura.

He would not comment on the outlook for energy prices.

“The world economy is getting very volatile and uncertain,” he said.

“It’s our strategy that we should go along with any uncertain events in coming years.

“As of now, they say that commodity prices are getting more reasonable in coming years.

“But it is just a simple forecast. We always have to be flexible and prepared for any change.”

“Agility is more important, and we want to be as agile as possible in the coming years.”

More Coverage

Originally published as Japanese nervous over government interventions in gas market: Mitsui Australia chief