Hutchinson Builders boss Greg Quinn warns of more industry insolvencies ahead

MORE building companies are set to go broke in Queensland amid toughening conditions in the sector, according to the boss of the state’s largest construction company.

QLD Business

Don't miss out on the headlines from QLD Business. Followed categories will be added to My News.

MORE building companies are set to go broke in Queensland amid toughening conditions in the sector, according to the boss of the state’s largest construction company.

Hutchinson Builders managing director Greg Quinn said more builders were competing for a diminishing amount of work following the end of the housing boom.

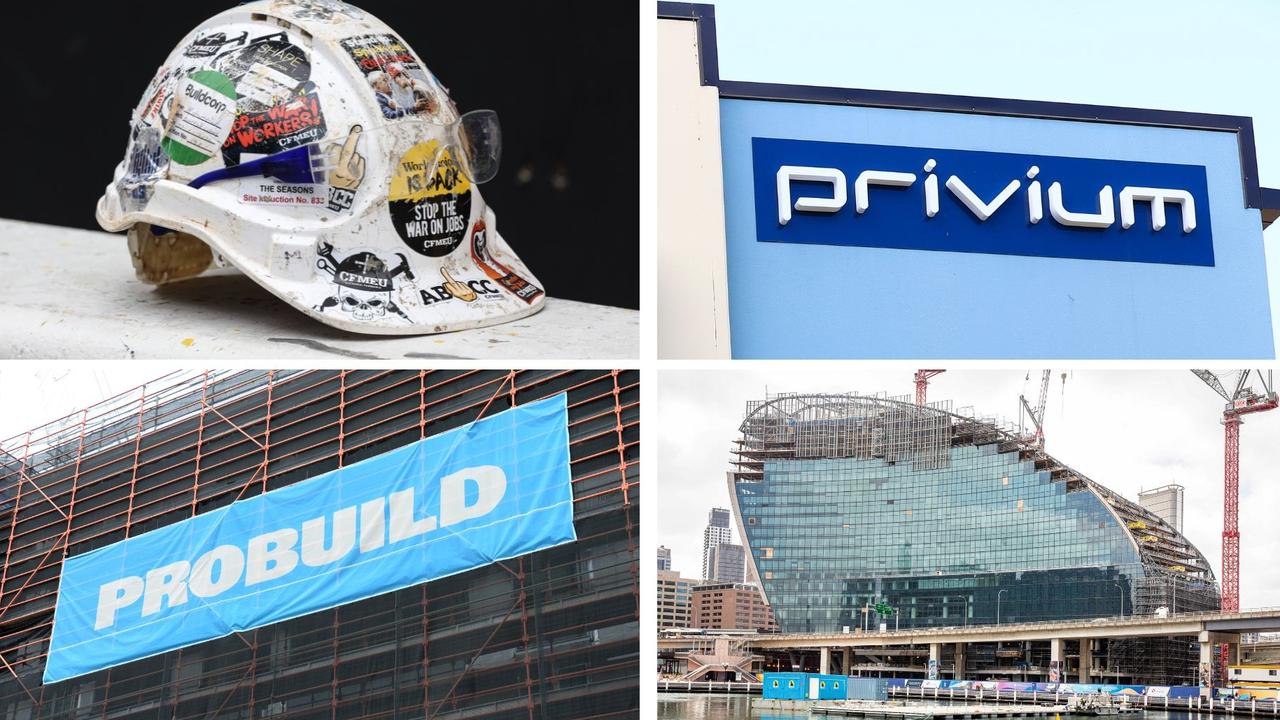

“We expect to see more insolvencies occurring in the next 12 months,” Mr Quinn said before speaking at the QUT Business Leaders’ Forum in Brisbane on Tuesday. “Just recently we have seen (the collapse) of companies like JM Kelly and Sommer & Staff.”

Queensland building company offers jobs to victims of collapse of builder JM Kelly

Queensland builder The Cleary Group collapses owing $3m

Queensland home construction company Metro Builders goes bust

More than 1400 companies in the state’s construction sector have entered administration in the past five years, with losses totalling an estimated $390 million.

The Queensland Building and Construction Commission said an increasing number of construction firms are getting in over their heads, taking on work they do not have the financial capacity to complete.

Mr Quinn said that the past couple of years had seen a “profitless boom” in the sector as building companies and subcontractors increased staff numbers to win more work.

“You have seen concreting firms that have gone from 250 to 500 workers, but the problem is that reduces productivity and eats into profit,” he said. “With the market coming off in the residential area it is now much more competitive and there is pressure on cash flow.”

He said Hutchinson, which has annual turnover of $2.7 billion and a 1600-strong workforce, was often well placed to pick up projects left uncompleted by collapsed building companies. For example, the company was looking at finishing a high-rise apartment block at West End left uncompleted by Sommer & Staff. The company’s flat management structure meant it was nimble enough to take on lots of jobs and adapt to a changing market.

“We made a profit of $37 million last year when I know five of our competitors lost money,” he said. “They may be doing only six to 10 jobs whereas we are doing 350 projects. That allows us to spread the risk.”

He said the State Government’s project bank account policy, which requires builders to put aside money in trust accounts to pay subbies, would deter some companies from tendering for projects. The policy already applies to government projects worth between $1 million and $10 million and from next year will be extended to private work.

Mr Quinn said project bank accounts were now the law, but he believed there was a better way to reduce insolvencies in the sector. That would include better education on financial management for smaller builders.