How to protect inheritances when divorce hits

Older Australians are not only wealthier – they are increasingly likely to divorce – here’s what to do.

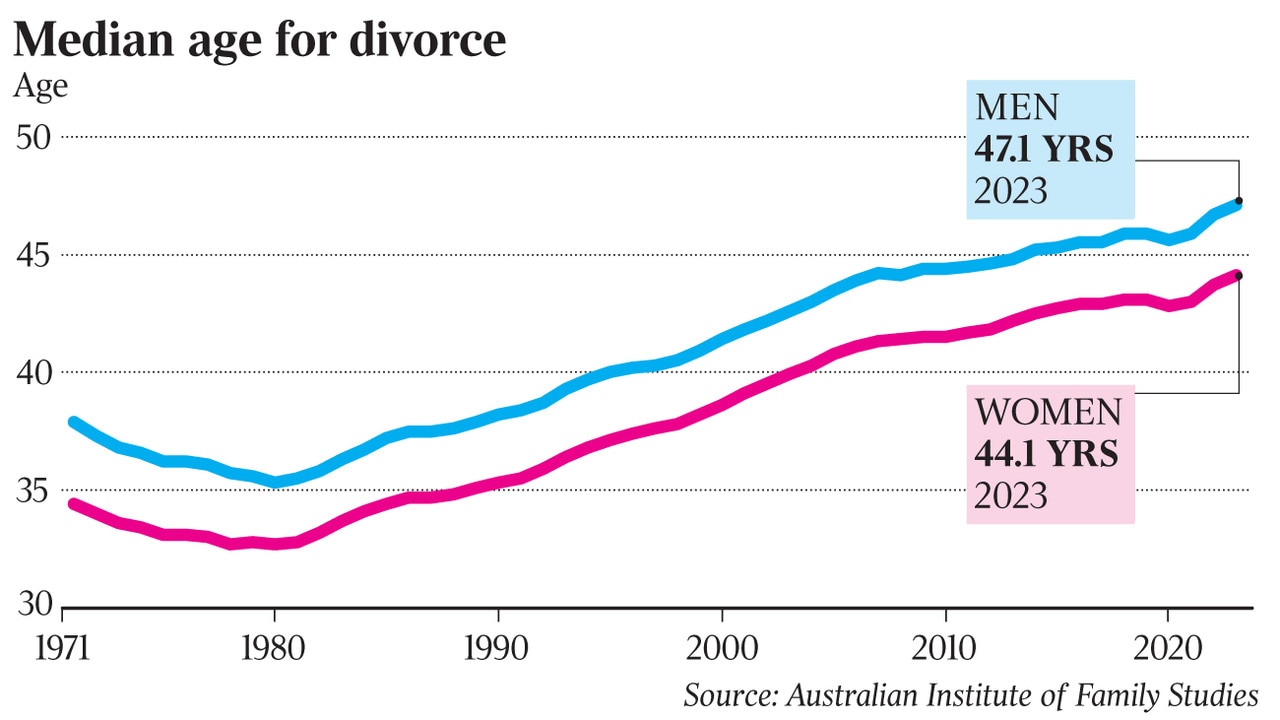

Australia’s rapid rise of “grey divorce” – couples splitting after the age of 50 – is causing havoc with inheritances and estate planning, as bigger asset stockpiles cause bigger family fights.

Statistics show divorce rates among over-50s have more than doubled in the past 30 years while overall divorce rates have fallen by one-third. At the same time, average wealth has boomed amid surging superannuation and property values.

Experts believe the grey divorce trend reflects longer life expectancies, changing social attitudes and empty nest syndrome, where parents wait for their children to move out of home before splitting. And they say there are ways to protect inheritances and family members.

Resolve Divorce managing director Chanel Martin says more people are divorcing later in life, making financial splits more complex and bringing inheritances into the mix.

“These situations can be complex, especially when inheritances were intended to benefit future generations,” Martin says.

“More families are turning to binding financial agreements, either to protect a child’s inheritance or to quarantine their own.”

Multiple losers

Martin says the children of divorcing couples could lose chunks of their inheritances as their divorcing parents use up assets previously intended for the kids.

“Often the division of assets, which can lead to the sale or redistribution of properties or investments, decreases the estate’s total value,” she says.

“Older Australians who decide to separate are also more likely to access their superannuation to satisfy a property settlement in circumstances where they are on the cusp of retirement age, leading to a further reduction of assets or an estate.”

Coote Family Lawyers partner Suzanne Jones says in some circumstances one or both partners may need to tap their nest egg earlier than anticipated.

“By dividing the assets, it may mean that one or both partners need to resort to the nest egg they once may have preserved to pass on to their children,” she says.

“Older Australians find it difficult to borrow and therefore their ability to regenerate their wealth is restricted when they reach their 50s.

“Divorcees may re-partner and their assets may be redirected to a new partner rather than their children. Decisions will need to be made as to how to divide their wealth on their death.”

Previous inheritances

Jones says whether someone inherited wealth during the relationship is another issue cropping up for divorce settlements.

Unless there is a binding agreement between the couple that quarantines inheritance, then the inheritance forms part of the asset pool on separation.

Australian Family Lawyers head of family law Bill Kordos says past cases show how the timing of an inheritance and the nature of a relationship could be treated by the court.

“An inheritance received early in the relationship will likely be treated differently than one received late or even post-separation, and could more likely be considered a financial resource or quarantined,” he says.

“Longer relationships may dilute the individual significance of an inheritance. For instance, an inheritance received early in the relationship may be given little weight.

“You are required to disclose financial resources, including expected inheritances, during family law property proceedings.”

Kordos says inheritances can affect spousal maintenance payments, also called alimony, and divorcing couples facing the possibility of an inheritance should consider this.

Recipients of maintenance payments may lose their entitlement if they received an inheritance.

“You might also become liable to pay spousal maintenance if your spouse has a need, and your inheritance is sufficient to meet that need,” he says.

Superannuation

Divorcing couples should check the beneficiaries in their superannuation and update where needed, even if they change their will. Super assets are not part of the estate distributed via a will, and instead depend on decisions by the fund or binding death benefit nominations.

Jones says people not seeking advice risk operating under false assumptions.

“For example, you might think that because you’re separated from your former spouse they’re automatically excluded from any benefit in your will or superannuation, but that’s not the case,” she says.

Martin says many people do not understand how assets are assessed.

“Super is often one of the biggest assets, but people forget to consider it or don’t realise it can be split,” she says.

Kordos says he has seen a rise in over-50s seeking advice about their superannuation and inheritances.

“With super balances being on average much higher than they were 10-15 years ago, and the rise in inheritances due to changes in the property market, there is a demand to preserve these resources,” he says.

Blended families

The rise of second and third marriages has muddied the waters and massively increased complexity around inheritances.

Tiyce & Lawyers Family Law Specialists principal Michael Tiyce says the most common issue is inadequate provision for adult children after a parent dies, “often because a subsequent spouse has been prioritised”.

“The court has been creative in establishing responses to such situations, such as guaranteeing the retirement security of a surviving spouse and securing assets for ultimate distribution to surviving children upon their death,” he says.

Tiyce says families should get specialist legal advice, have open conversations to contain expectations, and not rely on will kits to cater for complex family structures.

“Manage the process where able, and after taking tax advice, by giving potential beneficiaries gifts and future inheritances during their life,” he says.

De facto divorce

Many Australians are in long-term de facto relationships, and if they break up the law treats them like divorcing married couples when it comes to assets.

“The same laws for property settlement still apply to the settlement of their property disputes,” Tiyce says.

Legal specialists say second and third marriages tend to have higher divorce rates.

Originally published as How to protect inheritances when divorce hits