How this top investor defied the stockmarket shock

This fund manager delivered some of Australia’s highest share returns by sticking to some basic rules.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Investors should be very cautious about the recent bounce in tech stocks, while the real pain of higher interest rates is yet to come through corporate profits.

That’s the view of the fund manager who overtook the field to deliver the best returns among big investors in the face of one of the toughest years for Australian shares since the GFC. And heading into the August results season Aaron Binsted is still taking a defensive stand – particularly around tech.

The Lazard Asset Management portfolio manager and his team were one of the few to sidestep the tech wipe-out after he started to see the valuations of local players and buy now, pay later names start to take off from 2019. This quickly built into one the biggest equity bubbles since the dotcom crash of 2000, Binsted says.

“On our numbers, (the bubble) was actually larger” than the dot.com boom, he adds. This became a clear signal for many stocks to avoid.

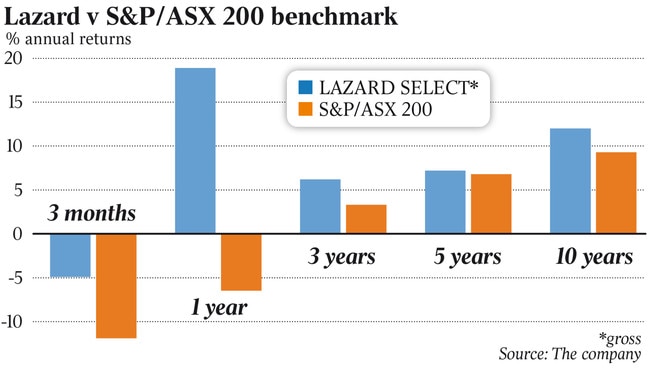

Binsted’s Lazard Select Australian Equity fund thrashed the field by posting a 19 per cent return in the year to end-June. The average performance of fund managers during the past year came in at nearly negative 4 per cent, according to figures compiled by Mercer.

To put some context around the Lazard performance, more than two-thirds of the 90 long-only Australian funds tracked by Mercer had some sort of negative return for the year, while the benchmark S&P/ASX300 index was negative 6.8 per cent. For Binsted it was the second year running making the top five of Australian funds.

“Every time there’s one of these valuation bubbles, it will crash. And when it does, it’s going to hurt a lot of people,” Binsted says.

Instead the fund went down a less glamorous path of buying up stable, secure companies with dependable cash flows and strong positions. Here Binsted was able to swoop on names like Coles, Metcash, Woodside and QBE, which were being ignored by the rest of the market while the tech party was on. After the crash of early 2022, cash flow became something the market cared deeply about again, which meant investors were scrambling to get in these names, further pushing up Lazard’s returns.

Still Binsted admits to feeling the pressure through 2020, when buy now, pay later names like Afterpay and Zip Co looked like they would keep defying gravity and his fund simply wasn’t there. Afterpay soared nearly 400 per cent in a year, while Zip was up more than 250 per cent. At one stage he found his returns were among the very bottom of the pack.

“We had a difficult period while the bubble was inflating. But at the end of the day, we don’t speculate,” he says. “We’re here to buy dependable cash flow companies that produce returns for the long run. We just won’t play that game. Our process will deliver alpha for clients in the long run and we’re not going to deviate from that just because the markets are doing something crazy.”

Lazard’s Select fund with $260m under management is focused on a concentrated portfolio of between 12 and 30 best ideas, designed to deliver large absolute returns over the long term.

Uncertain outlook

With the August reporting season just about to really take off from next week, Binsted expects that earnings for the period to end-June will still show corporate Australia in a good place. At the same time, several retailers including JB Hi-Fi and Myer have already flagged strong trading results. But he cautions Australia is about 12 months behind the US consumer, where successive rate rises have started to see shoppers shun household goods and skew towards groceries.

Cashflow Kings

Elsewhere, investors should be looking into outlook statements and whether businesses are able to pass on costs of inflation.

Cash flow remains king and the skew of his portfolio going into the August results season is defensive. As well as the cash flow kings, Binsted is also attracted to consumer names such as car parts supplier Bapcor and KFC franchise holder Collins Foods, two companies he believes have pricing power through inflation.

With the housing market slowing in the face of higher interest rates, Binsted is underweight banks and also some commodity cyclicals like BHP, where iron ore has started to pull back.

Energy-linked stocks including Woodside remain in favour while the broader theme of energy and the transition to renewables remains strong because of the catch-up investment needed.

Binsted’s fund has strong positions in companies he thinks will benefit from the build-out of renewables, extending to engineering and supplying the metals involved in the energy shift.

Despite the massive tech selldown since the end of last year, he remains downbeat on tech stocks, particularly Australian names. They still aren’t generating enough cash to justify even today’s reduced valuations.

“Most of the best tech businesses are not here,” he says.

“You’ve got the global data monopolies of Facebook and Google that are fantastic. They don’t really exist here.

“Even the stronger tech businesses such as listings sites Seek or Carsales.com are still trading at high valuations after the sharp selldown.

“You look at a long run basis – that (earnings) multiple normalisation is probably only a third of the way through.

“And then the other way these things play out in Australia is you get really low-quality businesses that were just given massive market caps. They’re the ones that have lost 80-90 per cent in the last six months. You just don’t want to go there. They’re low-quality speculative businesses.”

RBA’s long game

With the Reserve Bank strongly expected to issue its fourth consecutive interest rate hike on Tuesday, market watchers will be looking to the central bank’s revised forecasts on inflation and growth. Markets strongly expect another 50 basis point rate hike, taking the cash rate to 1.85 per cent. But in its statement on monetary policy, out on Friday, it will be telling to see just how different the RBA sees the glide path for the economy compared to Treasury.

It was Treasury’s revised forecasts that provided the basis for Treasurer Jim Chalmers’ gloomy economic statement to parliament last week, where he warned of another year of falling real wages as inflation nears 8 per cent.

Westpac’s closely watched chief economist Bill Evans in recent days increased his expected peak RBA cash rate in this cycle. He now sees it topping out at 3.35 per cent, up from his previous estimate of 2.6 per cent. It’s worth noting Evans has an even more downbeat medium-term outlook for the Australian economy than the Treasurer.

Chalmers is now tipping Australia to grow at 3 per cent in the current financial year and 2 per cent next year.

Westpac’s Evans expects growth of 4.5 per cent in 2022-23 and just 1.1 per cent a year later which will start pushing up unemployment from near record lows.

“In effect, we expect (calendar) 2022 to be much stronger than the Treasury while the slowdown in 2023 will be much more severe as the rate hikes bite,” Evans says. However he tips the slower growth is likely to pave the way for the RBA to start cutting again in 2024, which is likely to overlap with the next federal election.

johnstone@theaustralian.com.au

Originally published as How this top investor defied the stockmarket shock