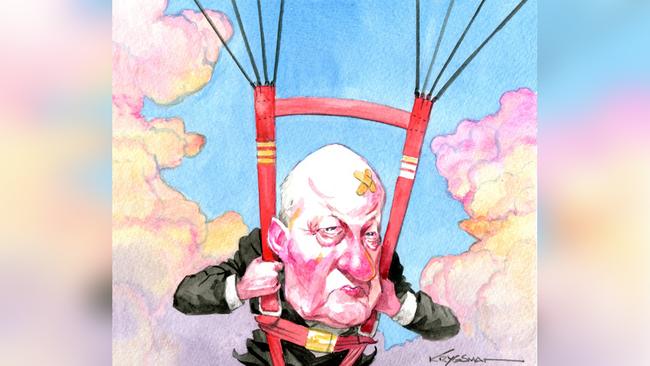

Goyder had no choice but to go as Qantas chair

The airline has been sent a powerful message from its investors - the reputational mess stops with the board.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Qantas chairman Richard Goyder has received the message from big investors the airline’s boardroom must take ownership of the reputational mess the airline finds itself in. That means he has to go.

After holding a series of meetings with investors over recent weeks Goyder has read the room and saw that his board was about to be hit with a massive protest vote. While the chairman could ride out the media storm, he simply couldn’t ignore the investor base who wanted significant changes.

Shareholders are clearly angry at the airline’s string of miscalculations that largely came down to former long-serving chief executive Alan Joyce being able to wield too much power with limited oversight.

After previously committing to dig in for the long term, Goyder will now step down at next year’s annual meeting. Two long serving directors – Jacqueline Hey and Maxine Brenner – will also step down in coming months, with plans to exit after the airline delivers its half year result in February.

Two Qantas directors – Todd Sampson and Belinda Hutchinson are up for re-election – and it remains to be seen if Goyder’s board overhaul will enough to head off a protest vote being aimed at them.

It was only last month Goyder told a Senate hearing he had full support of investors, but after wider soundings it became clear the proxy votes had moved against him and the entire board. Even with the proposed board shake-up is still likely Qantas will be hit with a shareholder “strike” at next month’s meeting.

There will be pressure too for Goyder to stand down earlier than the 12 months, but the message from Qantas is about undertaking an orderly transition in the boardroom. This will give Goyder – who is known for a painstakingly calculating approach in making top appointments at Woodside and the AFL – time to recruit and install a new chairman. He also feels its necessary to have continuity while a transition to new CEO is underway.

Goyder had been a vocal supporter of Joyce through his tenure as chair and this means the board has been too closely aligned to Qantas’ post-Covid-19 operational missteps. He too oversaw a boardroom that allowed Qantas’ governance issues to cascade into reputational problems. Several large shareholders told The Australian a new approach is needed.

Joyce had no choice by to move early on his retirement following the ACCC’s damaging legal action that alleged Qantas had been systemically selling tickets for “ghost flights” over a long period.

The claims remain allegations although Qantas faces the prospect of fines running in the hundreds of millions and top executives in the firing line if serious misconduct was found to have taken place.

Danger zone

The reputational danger zone that Qantas finds itself in means Goyder has little choice but to recruit the next chairman from outside the boardroom.

Qantas was forever seen as the trophy chairman role. That post has been tarnished and the new candidate faces an immense job keeping investors and customers onside.

Rather than aviation experience, the new chair will have to spend much of their time rebuild relations with both sides of government. The rise of union power will again become another big issue for the board in coming years. The addition of new directors in coming months will also help round out much needed technology and governance skills of the board.

Qantas shares are down 25 per cent from their recent July peak and while all global airlines have been sold down sharply in recent months there is an additional discount for Qantas for the ACCC court action and the cost that it will take for new chief executive Vanessa Hudson to win back customers.

Big investors have been demanding change in the boardroom, but Goyder’s compromise is not to add a crisis on top of a crisis by forcing the early exit of a chairman. This move would further weaken an already weak board at a time when power is shifting to a new CEO.

Unions too are flexing their muscle against Hudson following a damaging High Court ruling that upheld the airline had acted illegally by sacking ground staff who were stood down during the Covid pandemic.

Goyder has too belatedly acknowledged the airline’s governance has fallen short and has launched a board review taking into account the past 12 months. It is still being finalised who will lead this.

A big focus of the review will need to examine former boss Joyce’s stunning decision to dump most of his 2.5m Qantas shares four weeks before the airline signed-off on its full year accounts.

Goyder was given advance notice of the $16.9m sale that took place near the top of the market (and inside an open trading window). It is telling that the magnitude of Joyce’s share sale prompted some investors to reassess their view of Qantas and took it as a sign to dump some of their own holdings. The results of that review will be released in the June quarter and by then investors will have better visibility on a new chair.

BoQ’s slow grind

Bank of Queensland chief executive Patrick Allaway has his work cut out restoring momentum at the regional lender through a digital-first plan. The former bank chairman turned CEO reckons he is past the halfway mark doing what needs to be done. If the share reaction of a 7 per cent fall following the release of BoQ’s latest accounts, the market is not so sure.

It’s been 11 months since Allaway cut short the tenure of his star chief executive George Frazis amid growing concerns the $3.5bn regional bank was falling short on governance and this was an increasing worry for managing risk.

A former UBS investment banker, Allaway came out of executive retirement to run BoQ just as the lender was attempting to digest a costly $1.3bn acquisition of ME Bank. Allaway is picking up the pieces after Frazis’ short reign and the early numbers show the ME Bank deal would have been better left sitting on the table. It hasn’t delivered top line lending growth and the much promised boost to earnings per share never arrived.

However one area that Allaway is working with is Frazis’ strategy of building out a digitally-savvy bank. Allaway believes this is the path forward to lower costs and effectively compete against the big four banks and other lenders. Moving to a single core banking platform, including transferring ME Bank’s entire operation on the new platform will also help bring down costs.

But all the back end work, including the complex integration of ME Bank is taking place in a tough environment. The pace of top line lending is slowing; funding costs are rising as the fight for deposits are intensifying; and stressed loans are now rising – albeit slowly.

BoQ’s net profit collapsed 70 per cent to $124m in the year ended August. The bottom line was hit with $200m in non-cash charge to goodwill from a decade-old acquisition, while restructuring and other charges were packed into the result. Cash earnings were down by a more modest 8 per cent to $450m.

ME Bank which comes with a $25bn lending book remains a problem with expected integration costs of up to $140m with some provision for writedowns.

A 21 basis point crunch in the cash net interest margin during the second half was pressured by competition for slowing lending and higher funding costs which goes to the heart of the problem that regional lenders are facing. Indeed rising bond yields globally and falling Australian dollar will mean they will have to work even harder to lock in local deposits.

For his part Allaway says BoQ is past the halfway mark on its digital reset. All the major retail brands (BoQ, Virgin Money and ME Bank) are on a new cloud-based platform which is helping to bring down costs and the launch of fully digital mortgages is coming this financial year. The move to business and agribusiness customers to digital platforms in coming years will help to bring down costs.

“There’s no question that small banks have material disadvantages,” Allaway says in an interview. “We’ve got a much higher cost of funding for us; it’s greater because we have a smaller traditional transaction account base”.

He said Australia does need a strong, competitive banking landscape, which includes thriving mid-tier and small banks to provide customers with options.

“Our transformation plan is really about delivering a sustainable model, which has much lower cost to support customers and give them choice in their backing,” he says.

Allaway is betting the house that digital will be the solution but the market is taking a more cautious view.

johnstone@theaustralian.com.au

More Coverage

Originally published as Goyder had no choice but to go as Qantas chair