Gen Z worker on ‘average salary’ reveals budgeting hack that saved her from going broke

A 24-year-old retail worker has revealed the budgeting tactic that helps her pay cost of living expenses and save for holidays even on an “average salary”.

Budgeting

Don't miss out on the headlines from Budgeting. Followed categories will be added to My News.

Some of us are savings wizards with budgets down pat, but some of us are rather clueless.

Thankfully, though, the former are often all too keen to share their wisdom with the latter; like Hannah Koumakis, who has shared the budgeting hack that saved her from going broke.

Ms Koumakis took to social media to share exactly how she budgets her “average salary” – as an assistant buyer for hardware retailer Mitre 10 – each month.

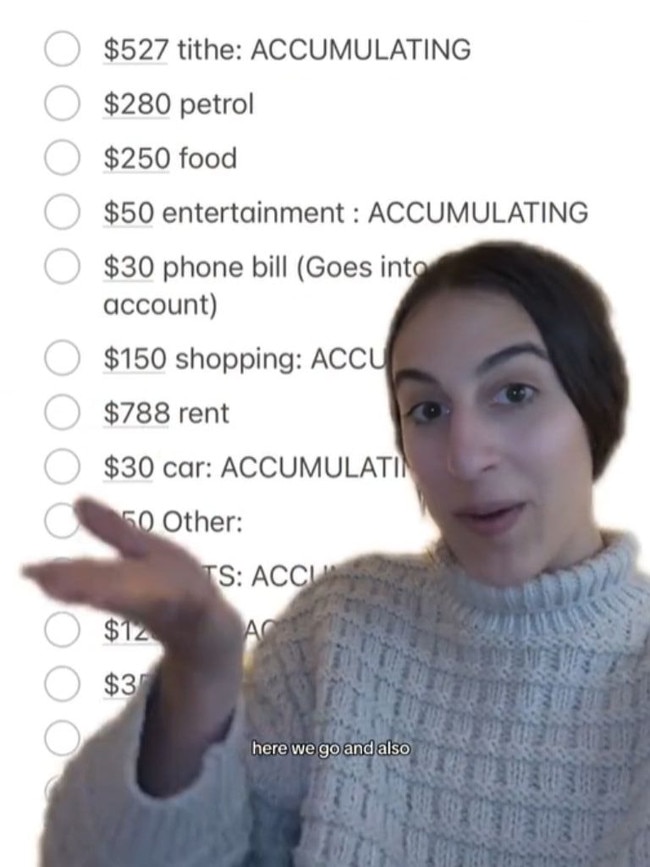

The 24-year-old from New Zealand revealed she splits her monthly pay into 16 different accounts for different purposes, including rent, entertainment, groceries, and travel costs. She even designates a portion to charitable contributions.

“I’m on a very average salary, like I kid you not, it is below the New Zealand average,” she says in a TikTok video that has racked more than 1.1 million views.

“But I still make it work and I still manage to save for so many different things.”

The average salary in New Zealand is about $NZ8200 ($A7580) a month or about $NZ97,300 ($A89,680) per year.

Ms Koumakis said she sets aside $NZ788 per month for “flat money”, which includes her rent, bills and groceries.

She also sets aside $NZ1100 to pay off the mortgage on her investment property – which she does not live in.

Her 16 accounts are either “accumulating” – meaning she adds a set amount each month to a growing total – or not.

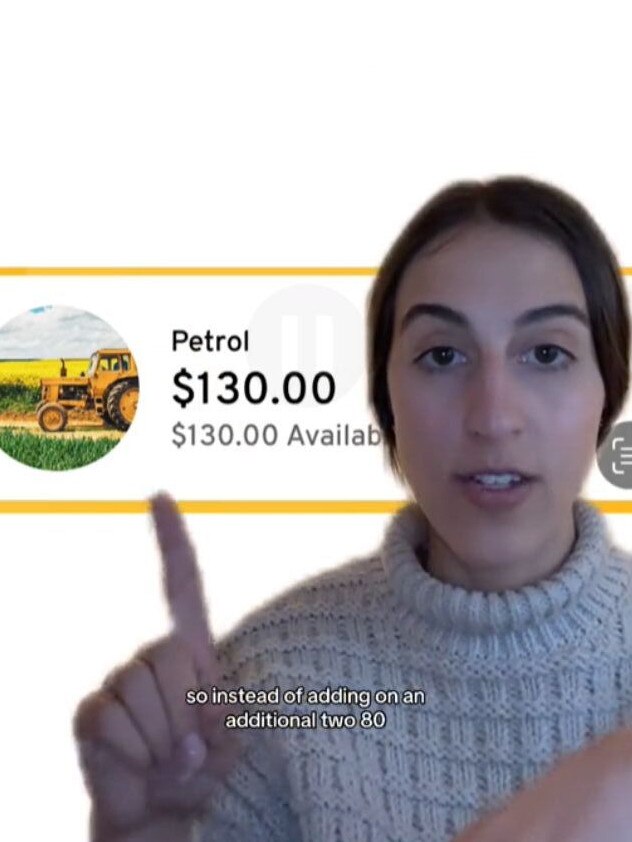

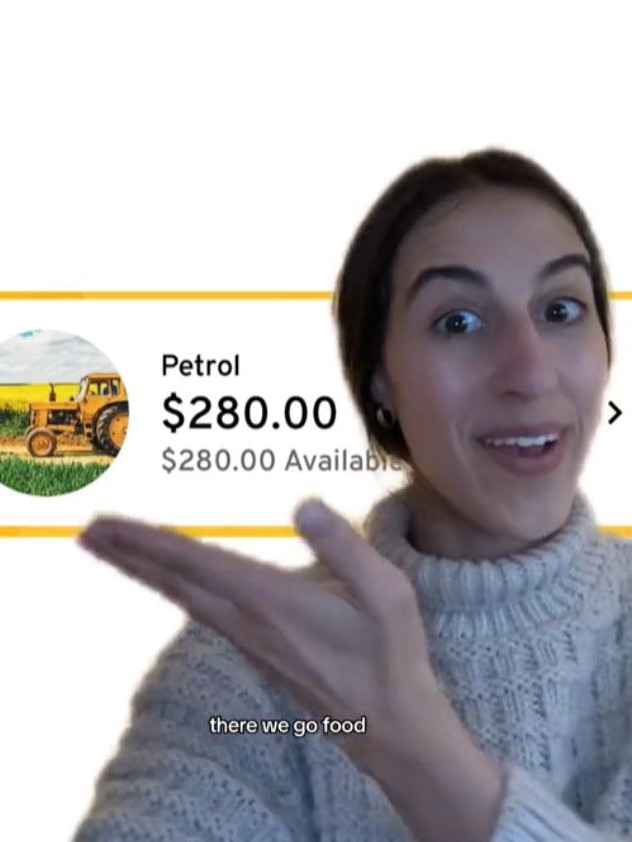

Those accounts, for petrol and food in Ms Koumakis’ case, are capped at a specific dollar amount that she tops up each month. For petrol, she designates $NZ280, while food is capped at $NZ250.

Her other accounts are accumulating: she puts $NZ50 into an account for ‘entertainment’, $NZ150 for ‘shopping’, $30 for her ‘car’, $NZ70 for ‘holidays’, $NZ95 for ‘insurance’, and $NZ80 for ‘other’ costs – including her phone bill or “anything else I haven’t budgeted for”.

She also puts away $NZ35 to save for a baby grand piano – “because I really want a baby grand piano … so I’m starting to save quite young,” she says – and $NZ125 for ‘short-term savings’.

“This is anything that I want to buy that is (a) depreciating asset,” Ms Koumakis said.

She also sets aside $NZ527 per month into a “tithe” account for her church, and an additional $NZ50 for a ‘Blessing’ account.

Anything left over goes into her EFTPOS account – which she caps at $NZ50 – and anything else after that is put into one of the other accounts, or a longer-term savings account.

“That is what I do when I get my money in every single month, and it’s just second nature and it’s so cool to be able to pay off the things that you need to,” she said.

The advice came as part of her “No Longer Broke” series in a bid to teach her followers how to be “better with money, better with finances, better with budgeting”.

Aside from her 9-5 with Mitre 10, Ms Koumakis also launched a number of businesses: including selling prompted journals, a podcast, a non-profit networking group, and a content creation and social media management agency.

Though she speaks from personal experience, her advice does follow that given by financial guru’s in the past.

Financial adviser Canna Campbell, who shares money advice on her YouTube channel SugarMamma TV and has written financial advice book Mindful Money, suggested a similar bucket method to manage savings.

She described the tactic as a “foolproof banking ritual” that helps savers prioritise financial goals and avoid debt by enabling control over savings and expenses without relying on credit cards for emergencies.

Originally published as Gen Z worker on ‘average salary’ reveals budgeting hack that saved her from going broke