Five ways to save on soaring car and petrol costs

Car costs have absolutely skyrocketed across the country. See how much more you’re paying — and what you can do to pay less.

The federal government’s temporary fuel excise cut has not restrained the ballooning costs of transport for Aussie families, with an average of $100 being spent every week just to fill up.

The latest Transport Affordability Index from the Australian Automobile Association (AAA) shows the average household in capital cities is spending $412.21 per week on their transport costs, inclusive of petrol, car insurance, maintenance and repairs, vehicle loan repayments and public transport fares.

The average weekly cost of fuel was $100.39 in the second quarter of 2022 – the first time it has hit the $100 mark since the index’s inception in 2016.

“Despite the temporary excise cut, fuel prices are rising and continue to be a significant contributor to cost of living pressures across both regional and metropolitan Australia,” AAA Managing Director Michael Bradley said.

The surge in weekly transport costs for the quarter was apparent in all capitals except for Perth – with Sydney and Hobart both up $16 year on year, Melbourne up $21, Brisbane up $19, Adelaide and Darwin both up $27, and Canberra up $14.

The cost of filling up soared dramatically between the first and second quarters of 2022, the index revealed. Motorists in Sydney paid an average of $23 a week more, while in Melbourne, Brisbane and Perth it was $24, in Adelaide it was $26, in Hobart it was $28 and in Darwin it was $29.

In the regions, average weekly fuel costs went up even higher, as much as $34 in Geelong.

The spike in petrol costs has been attributed to Russia’s invasion of Ukraine, and a rise in international wholesale prices for refined petrol and diesel.

A typical Australian metropolitan household now spends $21,435 a year on their transport costs, a more than $600 annual increase in Sydney, Melbourne, Adelaide and Canberra, while in Darwin costs have skyrocketed $890.

National transport costs are eating up 15.2 per cent of the average household income, but in Hobart this figure is 18.2 per cent, in Brisbane it’s 17.4 per cent and in Melbourne it’s 16.4 per cent.

It’s not just fuel that’s going up, either: car loan payments, tolls, insurance, servicing and registration costs have all increased since the beginning of the year. The cost of roadside assistance has declined very slightly while public transports costs are stable, the AAA found.

Separate research undertaken by financial broking service Savvy found the rising cost of fuel was now the number one cost of living concern for most Australians.

In a nationwide survey of 1003 adults, the price of fuel was named as a serious concern by 64 per cent of respondents, even more than the cost of food (62 per cent) and utility bills (45 per cent).

Just over half the respondents (51 per cent) said they would look to drive less frequently if prices stayed high, while one in four (26 per cent) said they would catch more public transport, and seven per cent said they would look to buy an electric vehicle to stop the pain at the pump.

COSTS SURGES ACROSS ALL STATES

NRMA spokesperson Peter Khoury said the impact of rising costs was “demonstrably and painfully clear”.

“Record high petrol prices, coupled with inflationary pressures across every aspect of transport, has resulted in this considerable jump. In recent weeks we have finally started to see oil prices begin to fall and this has led to lower prices at the pump. We want to see these falls increase and relief especially passed on across regional areas,” he said.

RACV spokesperson Elizabeth Kim said the increases would have prompted some Victorians “to reconsider their choices when it comes to transport”.

“It is not uncommon for retailers close by to be selling fuel at different rates, so it’s important to keep an eye on the Fuel Tracker and include independent retailers in your searches, who can often have some price flexibility,” Ms Kim said.

RAA fuel expert Mark Borlace said the surge in fuel costs “highlights the importance of using real-time fuel pricing apps, such as the myRAA app, to find the cheapest prices in your neighbourhood or along your journey,” he said.

RACT Chief Advocacy Officer Garry Bailey said Tasmanians were “paying more in transport costs as a percentage of income than any other state or territory”.

“That hit on the family budget is not just about rising fuel prices. It’s about Tasmania having, on average, lower household incomes than people in other states. It’s about Tasmania having an older vehicle fleet with the average of 13 years compared to 10 nationally.

“That means we have more less fuel-efficient vehicles on our roads, higher running costs as vehicles age, and less capacity for many households to upgrade to more fuel-efficient transport.”

Mr Bailey said many on lower incomes lived away from city centres, and alternatives like public transport or car sharing were not really an option.

SEVEN TIPS FOR SAVING ON CAR COSTS

Surging global oil prices have pushed fuel costs towards $2.50 a litre, and prices will automatically rise by 22.1c a litre in September when the temporary cut to government fuel excise ends.

Saving a few bucks here and there may feel pointless when you’re paying twice as much for fuel as you were a couple of years ago, but every dollar counts – especially when household budgets are under pressure from soaring inflation elsewhere.

Consider these seven strategies to save on the cost of running your car.

1. Follow the fuel price cycle, which still exists in most capital cities and can fluctuate more than 30c per litre over a month. The accc.gov.au website has information about petrol price cycles, and graphs showing where in the cycle your city currently sits. Use free fuel price apps from motoring groups, governments and private businesses to compare costs in your area.

2. Use discount schemes operated by retailers and other businesses that can deliver savings on each litre purchased. A simple 4c a litre can be earned using supermarket dockets, but these can multiply if you buy items instore or combine them with other business’s discount offers. But beware – you don’t want to chase a discount by buying an overpriced bag of chips at the petrol station if it negates all the savings you make on fuel.

3. Drive more economically to reduce fuel consumption. That means avoiding harsh braking and accelerating, keeping the car well-tuned, inflating tyres correctly, going easy on the airconditioner where possible and driving within the speed limit.

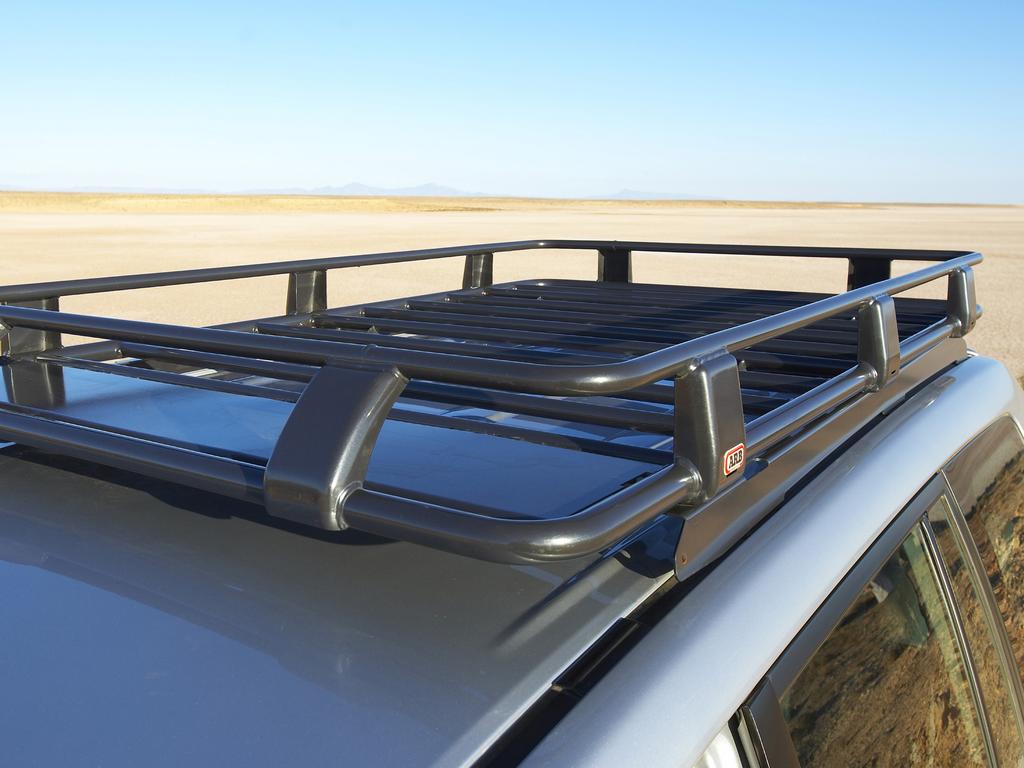

4. Remove excess items from the vehicle to reduce the overall weight, and take off roof racks, which will reduce the air resistance. Keeping the windows closed while driving also reduces drag.

5. Avoid short trips: cold engines can consume 20 per cent more fuel.

6. Car insurance can cost much more than it needs to if you don’t shop around and compare policies and premiums. The potential saving, for what is essentially the same cover, can be hundreds of dollars a year. Consider paying annually rather than monthly as that also can reduce the overall cost.

7. Don’t feel bound to use your new car dealer’s service department. Warranty services and repairs can be done by most mechanics, so check prices before booking.