First home buyers cop it over bank regulators’ crisis-era footing

It’s a big call by the bank regulator to use its boom time instrument to keep highly-restrictive settings on housing lending where no crisis exists.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The nation’s bank regulator is refusing to budge by keeping in place an unusually high hurdle for borrowers to get a loan, and this means its first home buyers who will once again, be left worse off.

Three years ago, bank regulator APRA hiked the so-called “serviceability buffer” to make it harder for borrowers to qualify for a loan as mortgage lending was running hot coming out of Covid.

Sadly, the bank regulator thinks the same conditions when rates were near zero should apply today, even as the economy has moved down several gears and the cash rate is at its highest level in more than a decade.

It’s a big call by the regulator to use the boom-time trigger to keep its highly restrictive settings on housing lending at this point of the cycle, given interest rates have plateaued, inflation is cooling and the pace of lending remains subdued.

At the same, the RBA is keeping a watch for a breakout of inflation, although the economy is clearly feeling the pinch of interest rates holding tight. What APRA is doing after its latest review of the buffer is keeping crisis settings in place where no crisis exists.

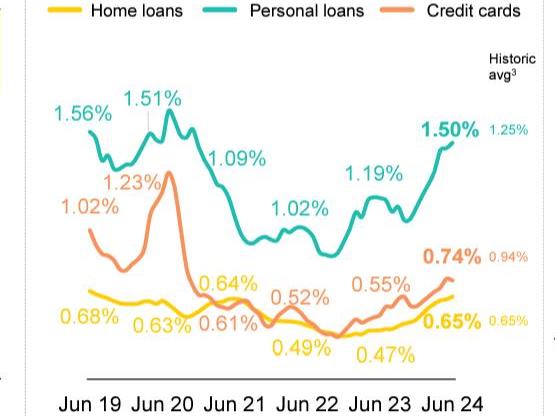

The serviceability buffer requires banks add 3 per cent on top headline mortgage rates to stress test the borrower if interest rates rise to that level.

Current headline standard variable mortgage rates are around 6.5 per cent. A new borrower would be tested if bank interest rates moved to 9.5 per cent. It was late in 2021 when APRA hiked the buffer from 2.5 per cent.

It’s the regulator’s way of keeping banks safe and, based on the extraordinarily low lending losses as interest rates were surging in recent years, some bank executives have privately argued the settings were too safe.

Commonwealth Bank's latest accounts show mortgage lending losses are still running lower than pre-Covid. Souce: CBA

Even the much warned “mortgage cliff” was barely a blip, as borrowers rolled off from ultra-low Covid-era fixed mortgages onto higher variable rates.

Nothing happens in isolation in banking and by moving lending losses away from shareholders, this means potential borrowers miss out in access to credit.

It’s the first home buyers who hurt the most from a high mortgage buffer, giving banks can look to the long-term track record of existing borrowers.

APRA chair John Lonsdale on Monday said while the “risk of higher interest rates has receded somewhat” the regulator is concerned around high household debt, rising prices, a weakening jobs market and higher geopolitical risks.

It could be argued these are all “business as usual” risks and the big banks have billions of dollars of collective provisions sitting on their balance sheets, designed to protect against these very broad risks.

The heat has moved out of the housing market. Melbourne was first and now other east coast states are following.

National auction clearance rates — one indicator — have been below 70 per cent for nearly three months. Sydney’s clearance rate last week fell to just 58 per cent.

The big banks have been split around, pulling the buffer back down to normal settings. Matt Comyn at Commonwealth Bank has said he was comfortable with the buffer at 3 per cent, while ANZ and National Australia Bank have urged a rethink.

ANZ’s Shayne Elliott has previously warned while regulators have good intentions, there are serious implications on the decisions.

“If you can’t get a home loan, or can’t start your business, because the laws makes it really hard for banks to lend to you, that means the economy is less dynamic,” Elliott previously said.

More recently, outgoing Westpac boss Peter King said while it’s appropriate to have some form of buffer there has to be some wriggle room given the nation is moving into a period where it faces a serious problem around housing.

“What we actually need is incentives for more houses to be built. I think there’s probably a more targeted way that we can be safe from a prudential perspective but what the country needs which is more houses,” King said this month.

Like the clarity the market has around the Reserve Bank’s interest target, APRA needs to start setting out the threshold when it will start to pull back on the mortgage buffer. And then it needs to stick to it.

eric.johnston@news.com.au

Originally published as First home buyers cop it over bank regulators’ crisis-era footing