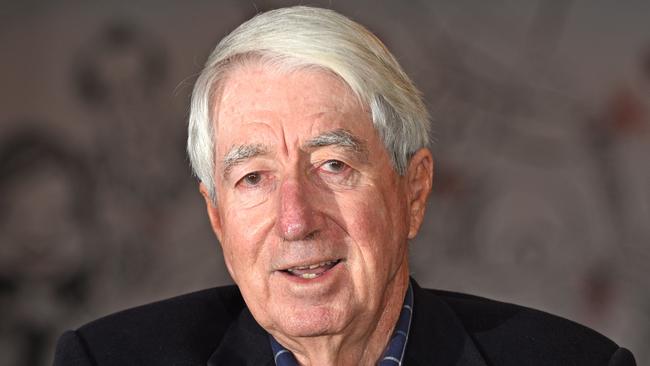

Noel Whittaker loses private banker at St George as part of a wider cull

His financial planning advice has made him a household name, but that wasn’t enough to stop him getting the chop from one high-profile bank after 20 years.

QLD Business

Don't miss out on the headlines from QLD Business. Followed categories will be added to My News.

GETTING DUMPED

Arguably one of Australia’s most prominent financial planning guru has been unceremoniously dumped by one of his banks.

Yes, Noel Whittaker tells City Beat that St George gave him the chop after 20 years in what appears to be part of an internal cost-cutting exercise.

“Last week my private banker at St George rang me to tell me I was to be sacked as a private client as I did not have $2 million of assets in St George products,’’ Whittaker said.

“I responded ‘Who would be that stupid?!’ He then said my affairs would be handled by a branch, to which I responded ‘You don’t have many’.’’

Whittaker is not alone either.

It turns out one of his friends, who happens to be a former senior executive at the bank, just got the same treatment.

In a letter to this gent, his private banker said that “given your activity with us, we have identified that you would be best serviced by your local St George branch’’.

Ouch!

What’s behind the shake-up?

The well-documented woes of St George parent company Westpac, and its record $1.3bn fine stemming from the Austrac debacle, just might have something to do with it.

BUST OR NOT?

A Sunshine Coast security firm has gone bust. Or has it?

Entrepreneur Matt Lewis tipped his solely-owned company QSEC Pty Ltd into liquidation this week after six year years of trading.

He tapped Jarvis Archer, from Revive Financial, to handle the wind up chores.

But an outfit associated with Lewis is continuing to trade under the QSEC name. How can that be?

Lewis told us on Tuesday that the now-failed business had been trading well and carried no debts.

Yet he said he was forced to pull the plug because he could no longer source public liability insurance, which is mandatory and most recently cost him about $100,000 a year.

Even though he had made no claims over the past 12 months, Lewis said his existing insurer refused to renew a current policy and a broker could not source any other parties willing to write a new one.

In a bid to manoeuvre around the industry-wide problem, Lewis said he acquired another security firm and bought the rights to the QSEC name to keep trading under that banner. He stressed that he was not acting as a director.

But Jarvis revealed that he’ll be reviewing that deal as part of his investigation.

“I am aware that the QSEC business name was sold to a related entity prior to my appointment,’’ he said.

“Any sale of a company’s assets that occurs prior to liquidation requires close scrutiny by the appointed liquidator, in particular where the purchaser is a related party.”

GOOD DEED

Someone in town needs to pay this forward.

We hear that three Brisbane legal eagles from Herbert Smith Freehills found a lost wallet on Adelaide Street last week.

A quick scan of the contents revealed the owner’s name.

After learning his employment details courtesy of LinkedIn, the trio then spent the next 10 minutes walking to the opposite end of Ann Street to find this bloke’s office and rocked up to the front counter to see him.

Amazingly, the grateful recipient had not yet even realised his wallet had gone missing.