Fastest growth in new investor home lending in 18 years, says ABS

Speculators are plunging into the hot property market, as a 13pc jump in new lending to investors drove record monthly loan commitments.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

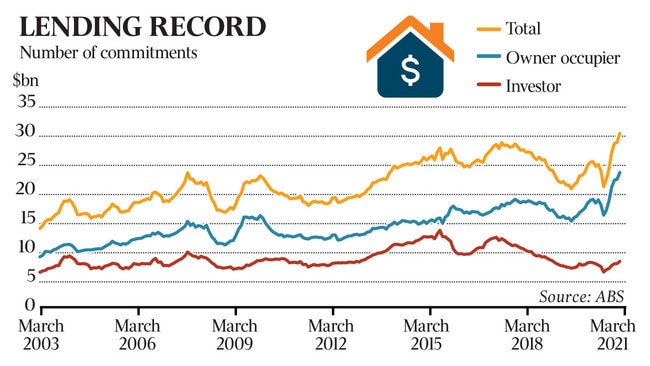

Speculators are plunging into the nation’s hot property market, as a 13 per cent jump in new lending to investors in March — the sharpest increase in nearly 18 years — drove monthly loan commitments to a record $30.2bn.

A dramatic drop in borrowing costs through 2020 and a much better than anticipated recovery from the COVID-19 recession has triggered a surge in new mortgages alongside booming house prices.

After a pause in February, the Australian Bureau of Statistics showed total new home lending unexpectedly climbed by 5.5 per cent in the month to be up 55 per cent on a year earlier.

Prospective landlords committed to $7.8bn in loans in March — accounting for half of the monthly rise — up 54 per cent versus 12 months before. Owner-occupier new lending lifted a further 3.3 per cent to $22.4bn, a record high.

The data suggests new money going into the property market is increasingly driven by speculators and landlords keen to capitalise on the continuing rise in home values.

CoreLogic data released on Tuesday showed a moderating but still powerful upward trend in prices, which nationally climbed by 1.8 per cent in April — shy of the 2.8 per cent rise recorded a month before, but still the third-largest hike since 1988.

ANZ economist Adelaide Timbrell said “while owner-occupiers led the recent housing lending boom, it is now clear that low interest rates, the rapid labour market recovery and perhaps hopes for an eventual recovery in population growth are bringing investors back”.

Investors accounted for a quarter of new lending, a nine-month high, Ms Timbrell said.

“This is occurring despite persistently high rental vacancy rates, particularly in Melbourne.”

The increasing prevalence of investors in the market amplified the risks of regulatory intervention to curb any perceived deterioration in lending standards, although there was no evidence Reserve Bank governor Philip Lowe was becoming more concerned that this was the case.

“Given the environment of rising housing prices and low interest rates, the bank will be monitoring trends in housing borrowing carefully and it is important that lending standards are maintained,” Dr Lowe said in a statement accompanying a board decision to keep rates pinned at 0.1 per cent.

Still, Ms Timbrell said “strong investor lending may eventually pique the attention of regulators, along with recent up-ticks in higher debt-to-income loans and more low-deposit loans”.

In March, the biggest lift in overall new home lending was in NSW, up 9.6 per cent, followed by Queensland (5.5 per cent) and Victoria (4.4 per cent), with growth across all other states and territories.

CBA senior economist Kristina Clifton noted that monthly lending to owner-occupiers was almost double the previous peaks, while lending to investors was still below levels seen in 2014 to 2017.

Economists tip prices could jump by 15-20 per cent this year, before growth moderates in 2021.

Affordability is increasingly an issue, analysts say. The ABS data showed new lending to first-home buyers fell by 0.9 per cent to $6.8bn but was still up 61 per cent on an annual basis.

Originally published as Fastest growth in new investor home lending in 18 years, says ABS