‘Failing’: Banks hit out at Meta over scams

Banks and social media giants are locked in a battle over how to protect Australian consumers from scams.

Costs

Don't miss out on the headlines from Costs. Followed categories will be added to My News.

The Australian Banking Association has hit out at the likes of Meta for its failure to stop scams in a crisis that is costing the country $2.7 billion in a year.

The banking lobby that represents 20 Australian banks has claimed their experience to date shows that the digital platform sector has not matched their investments or ambition of the Australian banking sector when it comes to preventing scams.

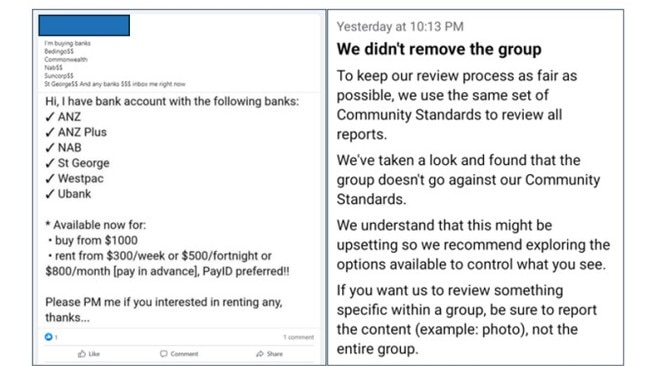

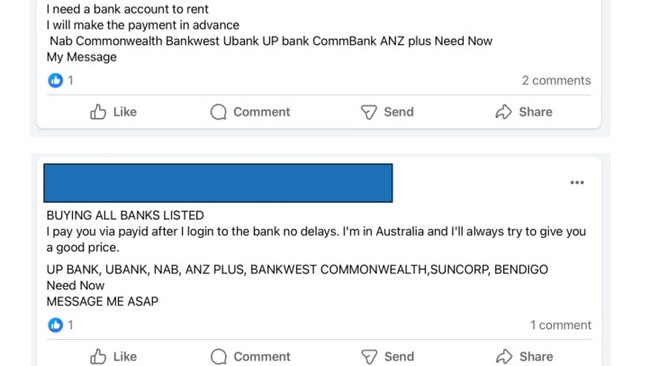

The Association said it had found multiple examples of scams being advertised on the site with just a short search, including mule accounts – which are used by criminals to launder stolen funds.

“Facilitating the sale of legitimately established Australian bank accounts undermines attempts by banks to combat mule accounts and is an example of burden shifting by digital platforms that are failing to meet reasonable community expectations to help keep Australians safe from scams,” the ABA said in a submission to the Senate about the government’s proposed Scam Prevention Framework.

“When this was drawn to the attention of the platform, they declined to remove the ad as it did not “go against our Community Standards”.”

The Association shared screenshots from Facebook which it said were taken following a short, 10 minute search of the platform using the term “rent bank account”.

“These examples were openly visible on the platform and the ease at which they were identified raises serious questions about the platform’s commitment to fighting scams,” the ABA wrote in its submission.

“Identifying a mule account via other measures becomes much more complex if an account is validly opened by a genuine customer and later rented or sold to a scam syndicate.”

Banks have an essential role in detecting scams, warning customers of potential scam risks, and attempting to recover funds, the ABA added.

“However, this role is necessarily a last line of defence and must be complemented by efforts to stop scams at source before they reach Australians in the first place,” they said.

In early December 2024, ASIC warnings to consumers about suspect investment scams being advertised on digital platforms and a review of cryptocurrency advertisements by the ACCC indicated that 58 per cent of the advertisements reviewed “violated Meta’s Advertising Policies or, potentially, involved scams”, the ABA said.

Consumer Action Law Centre CEO Stephanie Tonkin said Meta is a pipeline for many of the scams our clients have been fallen victim to.

“Meta has the data, the algorithms, the control of information and most importantly the resources. Any solution to this scams crisis must involve Meta, it has to be an ecosystem approach otherwise it’s not going to work,” she said.

“It’s really disappointing to see businesses like Meta, and also the telcos, and banks all pointing the finger of blame at other sectors, attempting to shift responsibility for solving this scams crisis to others, and in particular, to the victims who have already suffered enough.”

Meanwhile, Choice CEO Ashley de Silva called out Meta in its annual Shonky Awards last year.

He said in 2023 scam losses from social media reached $95 million, an almost 250 per cent increase from 2020.

“Accordingly, you’d think a huge company like Meta would be taking adequate action to protect people from scams. Unfortunately, despite scams on the Meta platforms Facebook, Instagram and WhatsApp accounting for 76 per cent of all reported social media scam losses last year, Meta hasn’t stepped up,” he said.

“When Choice reported three suspicious Facebook ads as scams to Meta, one remained live for at least four days. The other two were taken down within 24 hours, but one of these accounts was allowed to quickly re-post an almost identical ad and continue to promote other suspicious ads.”

The ABA added that banks accept that liability should apply to all relevant sectors on a proportional basis where entities would have failed to meet their obligations under the proposed Scams Prevention Framework.

But Digi managing director Sunita Bose, an organisation that represents the digital industry, said scammers are usually organised criminals overseas who need to be stopped with a sophisticated scams policy that stops crime and prevents Australians from becoming victims.

“We need a multi-pronged approach of prosecuting offshore criminals to close down scam call centres along with mandatory codes that have properly targeted legal obligations for different industries,” Ms Bose said.

“Instead, we have a scams law that is focused on getting companies to inundate the regulator with information on every possible scam, without a clear mechanism for the regulator to remove scams or share that information with the Australian public to help them better spot scams.”

Members of the Digital Industry Group include Meta, eBay, TikTok and X.

In it’s own submission to the Senate inquiry into the Scam Prevention Framework, Digi said focusing on anti-scam interventions on banks – including liability – would be simpler, easier for consumers to understand, and more effective.

“Given the central role that banks play in the life of every Australian, consumers should be able to trust in the integrity and safety of their accounts,” the submission said.

“In 2023, bank transfer was the most reported payment method with $212 million in reported losses, and there have been regulatory and legal decisions that indicate banks are able to take greater steps to protect consumers.”

If the government wishes to provide consumers with timely redress and reimbursements, then Digi supports the original recommendation made to the government by Treasury to focus on banks, they group argued.

However, it also argued that the framework should focus on prevention or external dispute resolution should be included at a later time.

Originally published as ‘Failing’: Banks hit out at Meta over scams