The Reserve Bank is acting cool on housing. Is it faking?

THE key people who control the Aussie economy seem relaxed about falling property prices, but are they ignoring the danger?

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

THE Reserve Bank of Australia is not worried about the housing market; not one bit. That is the message hidden in the RBA governor’s decision to keep interest rates on hold this week. The central bank call is not about to step in to stop prices falling — not yet, anyway.

“Ease” is the word they’re using to describe what the housing market is doing. Not crash, or tumble, or even slip. “Conditions … have continued to ease,” the RBA said on Tuesday, as it announced it would leave official interest rates on hold.

Easing sounds nice. You certainly don’t need to panic when things are easing. In fact, if things are easing it implies they were too hard before. The RBA wants us to believe this house price fall (we will use the neutral word “fall” because prices were higher before and they are lower now) is totally fine.

Whey are they still so relaxed when so many other people have begun to consider worst-case scenarios? Do we all need to chill?

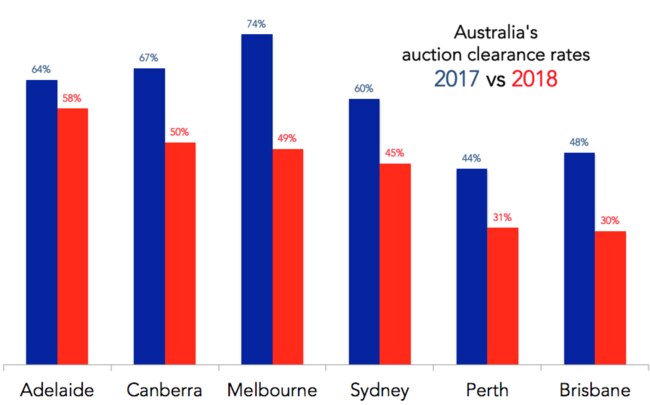

The RBA uses the word “easing” to refer to Australia’s two biggest housing markets, Sydney and Melbourne, where prices are going backwards faster every month, and auction clearance rates have fallen well below 50 per cent.

As this next chart shows, auction clearance rates this time of year are below last year, even in cities such as Adelaide where prices are holding up.

Louis Christopher of residential property analysis firm SQM research is not relaxed about these kind of clearance rates. He thinks they could get us to housing crash territory.

Auction clearance rates this low in Sydney and Melbourne effectively translate into price falls of between 1.5% to 3% PER QUARTER. That is crash territory for housing if this state of affairs persist.

— Louis Christopher (@LouiChristopher) November 3, 2018

HOW DO WE HANDLE THINGS IF THERE IS A CRASH?

So the RBA is acting cool. But what could it actually do even if it was panicking? Would it really cut interest rates from where they are now — at a record low of 1.5 per cent? And even if they did, would the banks pass those interest rate cuts on to borrowers?

My personal view is that if the property market starts to fall fast enough to imperil the economy, the RBA will cut. What else can they do? Their job is to keep the economy ticking and inflation in the 2 per cent to 3 per cent range. If house prices were truly in free-fall, that job would be very hard.

So if property price falls accelerate, a rate cut would be their best move. But then they face the risk that banks would not pass it on.

Australia’s big banks have had rising costs recently and they might decide to pocket part of any cut to restore their profit margins. That means if the RBA acted it would have to be decisively.

Given that the RBA wouldn’t bother cutting unless it was really necessary, a super-sized rate cut of 0.5 percentage points might be more likely than a simple cut of 0.25 percentage points.

Would such a big cut add to the sense of panic? This is part of the dilemma the RBA could face if property price keep falling. They definitely don’t want to cause panic.

WHY IT MATTERS

While the RBA was acting all nonchalant on the housing market, it did let a new note of concern creep in when it was talking about consumer spending.

Here’s what it said: “One continuing source of uncertainty is the outlook for household consumption. Growth in household income remains low, debt levels are high and some asset prices have declined.”

Those asset prices they’re talking about? Well, the share market has fallen recently. But Aussies have way more money wrapped up in housing. If housing falls, we feel less rich and we spend less.

Australian retail is suffering and our wages growth is absolutely pitiful. The last thing our economy needs is even more things weighing down consumer spending.

The housing market is not insulated from Australia’s economy. This is the problem with the cohort of people who hope for a really big housing crash. OK, prices might get a lot lower but there’s a risk too — you might not have a job to get a mortgage.

But even a modest fall in house prices could hurt employment in construction. Our building boom means the share of Aussies working in construction is approaching 10 per cent, the highest on record, as this next graph shows.

That building boom is largely about building apartments in Melbourne, Brisbane and Sydney, because property prices made that a profitable business. As dwelling prices fall, the chance of profit falls and the building boom could cool.

We are already seeing some big residential projects get cancelled. A Singaporean developer walked away from a huge apartment tower development on Collins St, Melbourne, recently and sold off the site. That project would have given jobs to many people. If other planned developments are cancelled, construction employment could suffer.

If the share of Australians working in construction falls back to levels of the 1990s that would be a lot of people looking for jobs in other industries.

This is why we should all hope the RBA has everything figured out and there really is no reason to panic on housing prices. Because the alternative will be too horrible to contemplate.

Originally published as The Reserve Bank is acting cool on housing. Is it faking?