Reserve Bank’s ‘stark warning’ about house prices

One of Australia’s top economic figures has made stark comments about property prices. But it’s the last-minute change to his speech should ring alarm bells.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

The Reserve Bank has delivered a shocking warning on the consequences of interest rate cuts, even as it is slashing them to record lows.

“We can be confident that lower interest rates will push up asset prices, and I think that later on we will have problems because of that,” said RBA governor Philip Lowe this week.

It was a small, but signficant last-minute change to his speech.

This stark warning of problems “later on” is a far cry from the confidence the RBA has exuded more recently.

“Today’s decision to lower the cash rate will help make further inroads into the spare capacity in the economy,” Dr Lowe said in July when the RBA cut Australia’s official interest rate to a record low of 1 per cent.

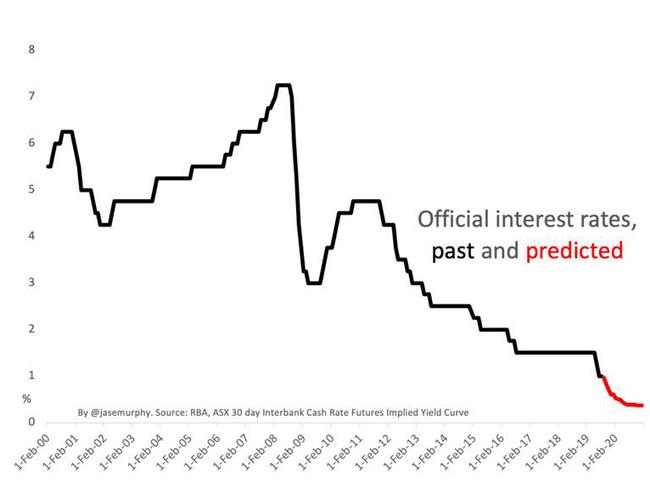

More interest rate cuts — and more record lows — are expected, as the next graph shows.

MORE MONEY, MORE PROBLEMS

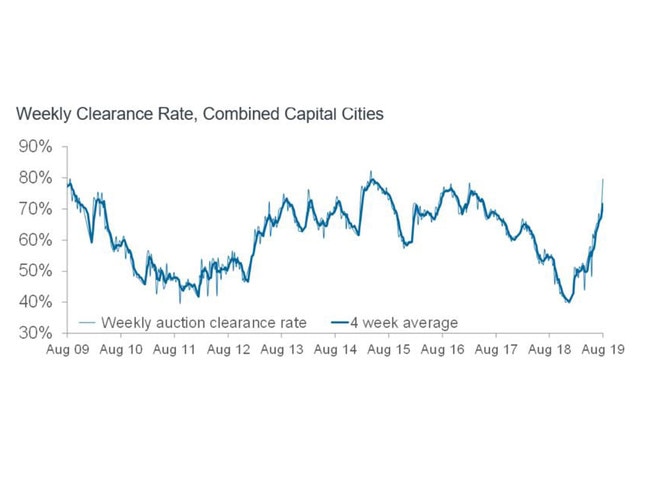

We are already seeing the results of interest rate cuts in the Australian housing market. The auction clearance rate has reversed last year’s fall.

The uptick in clearance rates predates the first RBA rate cut in June, in part because that rate cut was expected in advance. Since June, and the second rate cut in July, clearance rates have shot up even higher.

House prices have begun to rise, up 0.75 per cent in the last three months according to Corelogic data covering the five largest capital cities. We have not yet returned to the massive price growth of the past few years. But if the veiled warnings of the RBA governor come true, his interest rate cuts could contribute to another boom and bust cycle.

WHAT SORT OF PROBLEMS?

The obvious implication of Dr Lowe’s statement is he is worried about asset price bubbles blowing up then bursting. Australian housing is just one class of assets that has shot up in price. Housing in Canada, Sweden and many other markets around the world has also exploded.

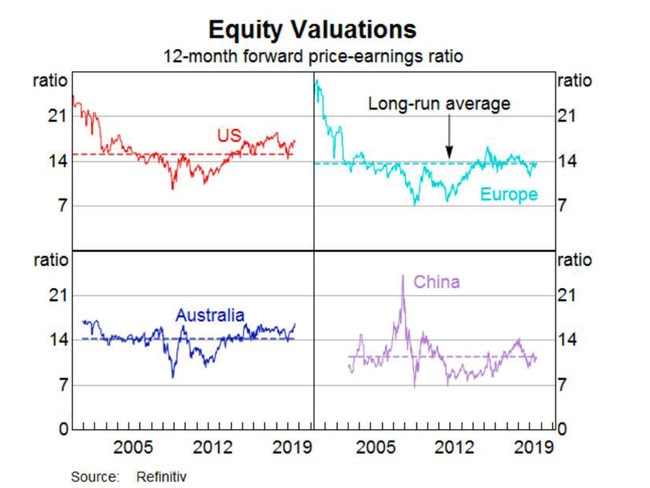

Major stock market valuations around the world have also risen in recent years as we entered a world of low interest rates. As the next graph shows, several markets, including the US and Australia, are now at valuations above their long-run average.

So how can low interest rates cause asset price bubbles? Low rates make it easier to borrow to buy a house, of course, but there’s a bigger picture too.

When interest rates are low, it reduces the return on putting money in the bank and other low-risk investments like buying government bonds. Investors who want returns are forced to choose other places to invest — higher risk investments.

Trillions of dollars of investor money goes out hunting for other things to buy, like stocks, corporate bonds, private companies and real estate. And when that money bids to buy them, the price of those assets goes up.

Low interest rates are part of why technology stocks like Facebook are so highly valued at the moment, for example. They explain why US President Donald Trump gets to crow about record high stock prices even though US companies aren’t doing particularly well.

Of course, higher asset prices are not the reason central banks cut interest rates. They’re not usually trying to boost asset prices. The central banks hope that by cutting rates, they will make business borrow to invest and give people with a mortgage more spare money to spend at the shops.

Those two activities would boost the economy. But recently when interest rates were cut we tended to get more of a response in asset prices than the real economy.

THE TRANSCRIPT

When the RBA governor speaks, the RBA releases a copy of the speech on their website. This time they released the audio too and I listened to it.

There were intriguing differences between the written speech and what he actually said. When he stood up to speak, the governor decided to ditch some of the cautious language and speak more forcefully about the risks.

“Easier monetary conditions will push up asset prices, which brings its own set of risks,” read the written speech. But, “We can be confident that lower interest rates will push up asset prices, and I think that later on we will have problems because of that,” said the governor.

In the highly controlled world of central bank communications, this deviation is meaningful. The governor obviously felt this was no time to beat around the bush.

A HERO STEPS UP

With the RBA worried that interest rate cuts will boost asset prices and give us big problems, the Australian economy needs a hero.

This week, into the void, stepped Treasurer Josh Frydenberg — the man who controls the $500 billion dollar government budget and could single-handedly boost the Australian economy with a big pulse of spending.

The Treasurer took this golden opportunity … and used it to pass the buck. Australian companies were not doing enough, he said.

“Back yourself to grow,” he said, asking business to spend big now to create a better future, while he himself hoards tax revenues in order to create a surplus.

It’s clear the Treasurer is eager to be the man who returned the Budget to balance. And yes, he has said he is willing to do what’s “necessary” to boost the economy. But perhaps that refers to responding after there is an emergency, rather than acting now to prevent an emergency from developing.

WE ARE STUCK

So, for now, we are stuck with more interest rate cuts. And the consequences? Those problems the RBA governor warned about? We will have to deal with them “later on”.

Jason Murphy is an economist. He is the author of the new book Incentivology. Continue the conversation @jasemurphy

Originally published as Reserve Bank’s ‘stark warning’ about house prices