RBA to hike until something breaks

As the RBA keeps hiking rates, the rising probability outcome is that the bank is forced to go so hard that something breaks in the economy.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

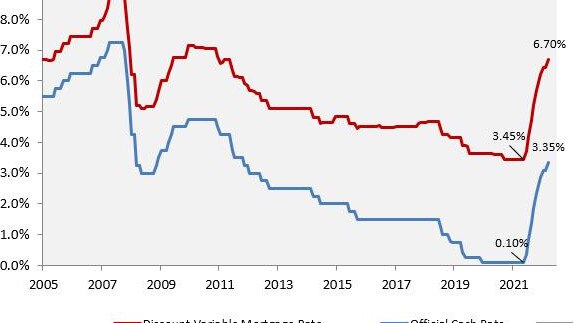

As the Reserve Bank of Australia lifted its cash rate another 25 basis points to 3.35% today it stated that “the Board is seeking to return inflation to the 2–3% range while keeping the economy on an even keel, but the path to achieving a soft landing remains a narrow one”.

Ain’t that the truth!

Central banks like to couch their language in terms of probabilities. As the RBA keeps hiking into broadening inflationary pressures, the rising probability outcome is that the bank is forced to go so hard that something breaks in the economy. That’s no “soft landing”.

What is the most likely thing to crack? There are three main candidates.

Businesses

Thanks to huge pandemic stimulus, and inflation but weak wage growth, business profits, and balance sheets are in rude health.

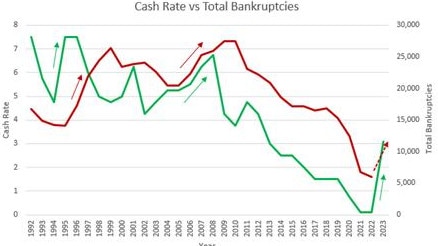

Indeed, Australian bankruptcies are at a decades-long low. They are certain to rise, and probably quite a lot, in part because in the decade leading up to 2020, it was easy to leverage up. That said, overall corporate leverage is well contained:

Businesses will suffer in a recession, and profit margins especially will collapse as inflation disappears, but they will not start it.

Banks

The second candidate is banks. Collateral for mortgages in the form of houses is devaluing fast.

Eventually, this upsets bankers’ calculus for the amount of capital that they hold against mortgages as insurance against loan losses. Markets can get spooked as this develops and funding pressures develop. Both can force banks to restrict lending.

But no such problem appears close for the major banks. They are repricing their mortgage books successfully and market funding costs are well within historical averages:

The banks, too, will run in trouble if the economy busts but they are not going to trigger it.

Households

This brings us to candidate three: households. Here the story is more alarming.

Aussie households are the second most indebted in the world. The RBA cash rate is still very low but, in terms of servicing costs, it is fast moving towards record territory:

Moreover, not even half of this tightening has actually hit mortgages yet owing to technical bank delays and the notorious fixed-rate mortgage reset, which doesn’t move into full swing until Q2.

This is where we must look for what is going to break first. And within the household sector, there is one group in particular that is at risk: marginal borrowers.

These are those households that took on high leverage during the pandemic. Lured in by the RBA’s 2% three-year fixed-rate mortgages. They have not built a war chest of savings from the pandemic fiscal measures.

This 20-25% of borrowers are going to see their discretionary incomes crash, some below zero, and their spending restraint will be harsh. In turn, this demand deficit will land on consumption, especially in areas of discretionary retail.

As these borrowers break, property prices will also keep falling while distressed properties hit the market and banks will be forced to tighten lending standards and provision for losses.

That is how the margin impacts the centre and, although other households still have good levels of savings, caution will eventually prevail as asset prices break down.

As the RBA is forced to overshoot monetary tightening by pandemic distortions, it is very likely to end in a per-capita recession.

Indeed, as the RBA itself admits, is increasingly likely to end in a sudden stop for the economy.

Originally published as RBA to hike until something breaks