Deficit slashed as surging tax take bolsters government coffers, boosting chance of second surplus

Swelling government tax revenues from soaring commodity prices and low unemployment has pushed down the budget deficit to a razor-thin margin.

Fed Budget

Don't miss out on the headlines from Fed Budget. Followed categories will be added to My News.

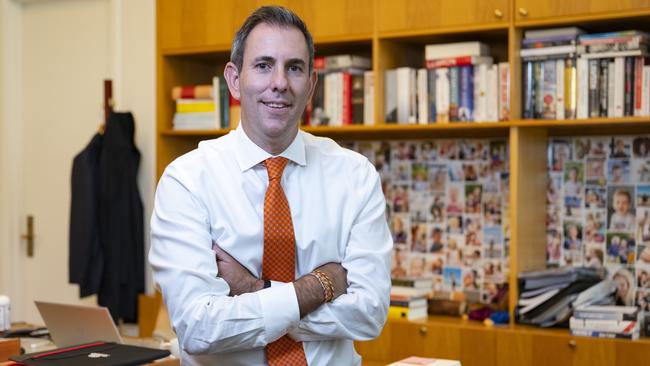

The federal budget deficit forecast for this financial year has been slashed to just $1.1bn, all but guaranteeing Jim Chalmers will deliver back-to-back surpluses.

In a move designed to ease inflationary pressures, the Mid-Year Economic and Fiscal Outlook (MYEFO), released on Wednesday, shows revenue windfalls of $65bn since May will be largely banked rather than spent so that additional demand is not added to the economy.

With government revenue pouring in and showing few signs of slowing, it’s highly likely that a surplus will be recorded at what could be a pre-election budget in 2024 and provide the government with the opportunity to provide more substantial cost of living relief.

But while Dr Chalmers is confident he is within “striking distance” of handing down a second surplus next May, he declined to lock it in.

“We have given ourselves a chance but we are not there yet and we have been deliberately cautious and deliberately conservative,” he told reporters in Canberra.

“We have been determined to take a different approach to this, cautious and conservative when it comes to revenue upgrades, because of the uncertainty and volatility in the global economy and in our own domestic economy.”

The mid-year update revealed a staggering $12.8bn improvement to the 2023-24 budget with soaring commodity prices and low unemployment fuelling bumper tax receipts.

In May, Dr Chalmers forecast a deficit of $13.9bn for the current financial year.

Over the next four years, the budget bottom line is forecast to record a combined deficit of the $74.5bn, down from $114.1bn expected in the May budget.

Pressure set to grow for cost-of-living support

But the razor-thin deficit is likely to heap more pressure on Dr Chalmers to deliver additional cost-of-living relief in the next budget, scheduled for May 2023.

In recent weeks, the Treasurer has fielded demands from aggrieved government backbenchers over increased support for households which are being crunched by high inflation and soaring interest rates.

Dr Chalmers said that he understood Australians were “doing it tough” but the priority was to focus on bringing down inflation.

“Our strategy over the past 18 months has delivered a historic turnaround in the budget position but we know there is still much more work to do,” Dr Chalmers said.

“And you’re seeing less debt and smaller deficits over the four years of the forward estimates, as well, and because of our efforts, we have less debt, and its major advanced economy.”

Government tax collections soar

Total revenue receipts were $17.1bn higher than expected in the May budget, outstripping an increase in government spending which was up by $4.3bn.

The personal income tax take has been revised up by almost $9bn this financial year to reach above $360bn as a combination of low unemployment and wages growth, which pushes workers into higher tax brackets, adds to government revenues.

Meanwhile, corporate tax receipts swelled by an additional $9.2bn since May due to surging prices for key commodities including iron ore, coal and gas.

Treasury has pushed out its forecasts for iron ore to reach $US60 a tonne to the September quarter 2024. In the May budget, officials had anticipated prices for the commodity would fall to this level by March next year.

However, iron ore prices have increased in recent months to hover at $US135 a tonne – more than double the forecasts – calling into question whether revised the updated forecasts will be accurate.

Tax revenue as a share of the economy will reach 23.7 per cent this financial year, according to the budget update, the highest since 2008.

Debt growth slows but interest bill climbs

Despite the bumper revenue windfalls, budget deficits are forecast to continue over the forward estimates, peaking at $35.1bn in 2025-26 before falling to $19.5bn in 2026-27.

Estimates of gross debt have been cut to $909bn for 2023-24, down from $923bn forecast in May. Gross debt is expected to rise past $1 trillion by 2025-26.

Higher long-term bond yields mean the servicing of government debt is expected to blow out by an extra $80bn over the next decade, overtaking the NDIS to become the fastest growing area of government spending.

The cost of paying interest on government debt will grow on average by 11.7 per cent per year for the next decade. In May, the cost of debt servicing was expected to grow by 8.8 per cent a year over the same period.

The mid-year update also states 92 per cent of the revenue upgrades will be banked over the four-year forward estimates period.

However, this estimate by the Treasury does not account for the $13.2bn spent on the 15 per cent wage increase awarded to aged care workers and other off-budget funds worth almost $50bn.

Inflation jumps on oil price spike

According to the mid-year update, inflation is expected to remain higher in the near term but will still fall below the Reserve Bank’s target of 2 to 3 per cent by the 2024-25 financial year.

Inflation will now be 3.75 by June quarter 2024, half a percentage point higher than expected during the budget.

“The primary driver of this upgrade is the recent rise in global oil prices,” the outlook reads.

“While oil prices have subsequently retreated, movements in oil prices and the exchange rate this year have added to near-term petrol prices and inflationary pressures.”

Despite the increase, the government is still on track to deliver real wages growth from the current financial year as workers’ pay packets outstrip inflation.

Labor committed to stage 3 tax cuts

Dr Chalmers spruiked the result as a result of the government’s responsible economic management.

When asked if keeping the expensive stage 3 tax cuts (which will cost $20bn in the first year and $313bn over 10 years) was in line with that mandate, Dr Chalmers held the line.

“Our position hasn’t changed for all of the reasons we have been through in this room and elsewhere over recent months. Our priorities, when it comes to tax reform are elsewhere, in this document,” he said.

Originally published as Deficit slashed as surging tax take bolsters government coffers, boosting chance of second surplus