Devastating impact of Evergrande’s $532 billion collapse

Australia’s economic future is in the balance as the $532 billion collapse of mega developer Evergrande takes hold.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

ANALYSIS

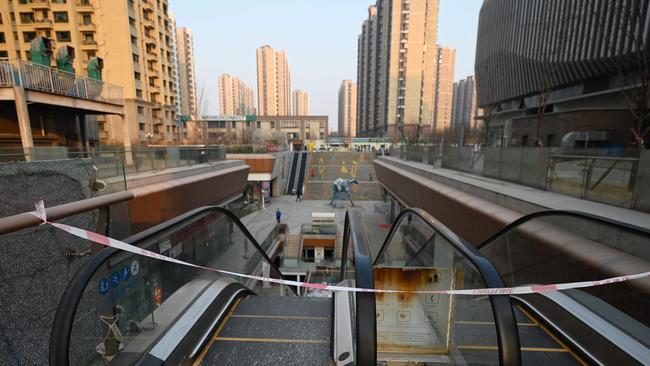

Chinese mega developer Evergrande has been ordered into liquidation owing almost $350 billion US ($532 billion AUD) to its creditors. This is more debt than some entire nations- Thailand, Israel and Portugal – and concerns are high that its liquidation could have some disastrous knock-on effects.

In a recent press conference Treasurer Jim Chalmer’s noted that the Albanese government was “monitoring these developments closely” and that the woes of the Chinese property sector was “one of the reasons why the global economic outlook is uncertain”.

There are worries that Evergrande’s liquidation could spill over into the Chinese financial system and the broader economy. Given the size of Evergrande’s holdings and debts, under the wrong set of circumstances its liquidation could prompt some challenging side effects.

There are also differences between how land holdings function in China compared with what we are accustomed to in Australia and much of the rest of the world. Every year Chinese local government sells hundreds of millions of square metres of land to state owned and private developers. In the year to August 2023, 300 cities across China sold a total of 220 million square metres of land to residential property developers, worth 2.71 trillion Yuan ($580 billion AUD).

To put Evergrande’s holdings into perspective, their land reserves came in at 230 million square metres in June 2022. With Evergrande holding such a sizeable amount of land, if a traditional fire sale of assets was to occur as part of the company’s liquidation, it would risk hitting land prices hard and also the hundreds of billions of dollars a year in revenue local government derives from land sales.

For this reason, if Evergrande’s mainland China land assets are to be liquidated on to the market, its likely they would be drip fed over time to not upset the balance of the economy.

But Australia’s interests run deeper than just Evergrande and carry what some consider to be even greater risks than the liquidation of Evergrande and even larger Chinese mega developers.

Beijing has problems

From financial markets to the reports of China analysts, there has long been the relatively widespread idea that a huge wave of government stimulus would wash over the property sector and the broader Chinese economy refiring growth. If we did see a rerun of the GFC era-type stimulus in China that helped drag the Australian economy out of the doldrums at that time, it would be a huge boon to the economy.

But there are several issues with that theory. Chief among them the fact that annual debt issuance by local government has already more doubled since 2019 and rose by 25.3 per cent compared with 2022.

Beijing also has other pressing issues, from youth unemployment recently sitting at record highs until the Chinese governments National Bureau of Statistics changed the methodology that measures it, to elements of the Chinese stock market crashing.

Overall Chinese and Hong Kong stock markets have lost $7 trillion US worth of value since peaking in 2001. The story for smaller listed Chinese company’s is even worse, with the benchmark Shanghai CSI 1000 index has lost up to 72.3 per cent of its value since peaking in June 2015. Since the turn of the new calendar year, the index lost as much as 29.1 per cent of its value.

A problem for Australia

While other nations from Russia to Brazil each have a stake impacted by the fate of the Chinese property sector, Australia is uniquely tied to its fortunes. Australia exports more iron ore than the rest of the world combined, accounting for 53.6 per cent of all global exports. On the other side of the coin, China imports more iron ore than the rest of the world combined, accounting for 70.1 per cent of all global imports.

If Chinese demand for steel falls significantly, there is no one who can swiftly rise to take its place. While India is undergoing a rapid industrialisation, the Indian government is pressing hard to fuel it as much as possible with domestic mined minerals, which has seen India as a net exporter of iron ore multiple times in recent years.

For now, the falling usage of steel in Chinese property construction has been made up largely by significant increased consumption on infrastructure construction projects, with part of the shortfall made by manufacturing and increased car production.

But as the chart below illustrates, the drawdown in Chinese property construction activity is only a fraction of the way down the path to its final destination.

Chart 2/5 pic.twitter.com/7xH10mMVyI

— Boris Kovacevic (@MacroKova) January 17, 2024

According to data from the partially state owned China International Capital Corporation, the proportion of Chinese steel consumption stemming from property and infrastructure construction has fallen from 60 per cent in 2020 to an estimated 58 per cent in 2023.

The outlook

While the Chinese government may end up containing the implosion of Evergrande and other even larger developers, making up for the decline in activity within the broader property sector may prove to be a far greater long-term challenge.

A study authored by Harvard Economics Professor Kenneth Rogoff found that in 2018, 80 per cent of all new homes were purchased by buyers who already had at least one home.

Where the fundamental underlying level of demand lays for Chinese residential housing remains a hotly contested debate. But what is clear, is that we are a long way from the bottom in property sector activity and there is a finite amount of resources Beijing can direct toward infrastructure construction to support demand for steel.

Ultimately, the fate of Australia’s economy in many ways remains where it has been for well over a decade, in Beijing. If the Chinese government can contain the collapses of Evergrande and its peers, while simultaneously providing enough capital to the infrastructure sector to maintain steel demand, Australia remains in a pretty decent place.

But if the Chinese government fails to contain the fallout from the collapsed mega developers and finds it has insufficient resources to keep rapidly growing infrastructure construction, then Australia faces a much more challenging economic future.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator

Originally published as Devastating impact of Evergrande’s $532 billion collapse