China Evergrande: Australia’s iron ore producers should worry

The potential collapse of a Chinese property development giant could have severe consequences for iron ore prices and the Aussie economy.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

One of the biggest Chinese property developers China Evergrande faces potential collapse as it buckles under a mountain of debt, and it could have serious consequences not only for Australia’s iron ore prices but the economy too, an expert has warned.

There are fears that should China Evergrande, the country’s second-biggest property developer, collapse, it would make raising debt more difficult for other property developers, which in turn would impact China’s construction industry and reduce the demand for iron ore used to make steel.

Australia has already taken a hit with iron ore prices dropping 30 per cent since May.

Michael Shoebridge, director of defence, strategy and national security at the Australian Strategic Policy Institute, said the Evergrande issue is just part of bigger picture of China’s economy as a whole.

“A huge part of China’s economic program continues to be stimulus of the domestic economy through the construction and development sector and it’s been great for Australia as it sucked in huge amounts of iron ore and also coal – until they decided to cease trade,” he told news.com.au.

RELATED: China will go to war with the world in next six years

However, now Evergrande faces a whopping $408 billion in debt. This is a “big problem” for the Chinese government, Mr Shoebridge said, as it has a huge reliance on construction for stimulus, having failed to move its economy into technology and services.

“Evergrande is the second-biggest property developer so its future really matters to the future of China’s economy,” he said.

He believes the Chinese government would have no choice but to step in and save the company if it was on the brink of collapse.

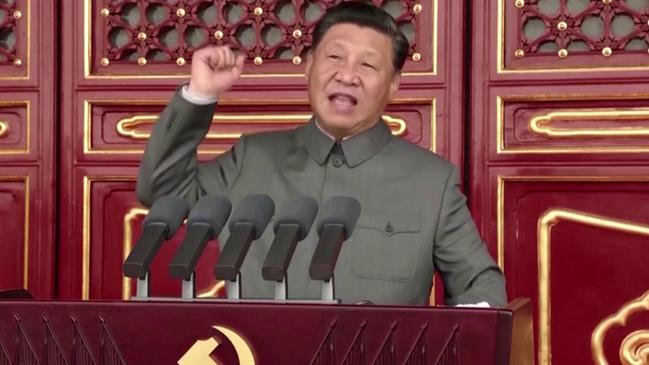

It could also form part of President Xi Jinping’s government’s recent moves to exert more control over billionaires in the country.

“Right now the Chinese president has brought other billionaire company owners to heel and imposed the party’s will and direction on them and you can see that happening with big tech companies like Alibaba, Tencent and Didi,” he said.

“Those companies are experiencing these recentring of power in the party and by the hordes of different Chinese regulators that are trawling over their business and there is this movement of power from CEOs to the broader Chinese Communist Party.

“The Evergrande situation looks ripe for recentring of the party authority in that huge company because it’s very unlikely that it will just allow the billionaire owner to do whatever he wants, particularly if they end up bailing out the company. It fits the direction that the Chinese government is taking to stop them going and creating wealth and making big companies work to the party’s direction. So it’s even more than likely that a corporate disaster for Evergrande can be an opportunity for the party.”

RELATED: Australia rejects claims it is ‘anti-China’

RELATED: Panic buying in Wuhan as new virus outbreak hits

Evergrande’s Hong Kong-listed shares have slumped 63 per cent this year, amid reports it is also facing creditor lawsuits applying for assets to be frozen.

S&P Global Ratings has warned that Evergrande’s non-payment risk is escalating with around $50 billion in bills for just the next 12 months alone.

Evergrande has been selling off assets to cover the debt with $US8 billion ($A10.8 billion) accumulated so far and another $US420 million ($A570 million) from its stake in a Netflix-style streaming service.

But other assets, like its 65 per cent stake in an electric vehicle manufacturer which hasn’t yet sold a car and “vanity projects” like Ocean Flower Island, a man-made archipelago with hotels, theme parks and an opera house, would not be enough to bail it out, according to Mr Shoebridge.

“The electric vehicle exposure shows the developer has really got itself into a lot of financial leverage trouble and that’s the kind of asset that might look attractive to sell but when making it as a fire sale of assets the prospects of future growth from an electric vehicle firm doesn’t look as attractive when it’s a distressed sale and it’s about hypothetical profits rather than sales now,” he said.

But if he was wrong and the Communist Party let Evergrande go under, it would mean the Chinese economy would experience a much “darker outlook”, which would also be bad news for Australia and the world, Mr Shoebridge warned.

“I think this shows the growing stresses in the Chinese economy and is also demonstrating the Chinese government hasn’t got effective ways of dealing with stresses in the longer term with highly leveraged markets,” he said.

“A lot of people will make a lot of money until the music stops and the time when the music stops is very hard to predict, so it’s not just the Australian economic impact but if there is a financial crisis in the Chinese economy there will be a global impact … that would mean widespread economic recession, corporate restructuring and unemployment.”

The collapse would also drive down further demand for Aussie iron ore, with China’s construction industry accounting for more than half the steel made from Australia’s largest source of export revenue.

New Covid outbreaks in 17 Chinese provinces have also prompted concerns over iron ore demand as construction is disrupted by tighter restrictions.

The Chinese government has also called for curbs on steel outputs to drive down its reliance on iron ore and there was a drop last month with production in China 3.5 per cent lower than in June.

Meanwhile, stockpiles of steel have increased by 3 per cent also easing the need for the Aussie commodity.

With a trade war already under way between China and Australia, Mr Shoebridge said this latest issue with Evergrande was a clear warning for those reliant on the country.

“Australian companies can be a little bit ahead of the game and can diversify away from the Chinese economy and be more insulated from growing financial and other market risks,” he said.

Originally published as China Evergrande: Australia’s iron ore producers should worry