Economic outlook for 2025 is a mixed bag, do you want the good news, or the bad news?

Experts have offered their outlooks for the economy in 2025, and while there’s some good news, there will be continued pain to come for many.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

It was a rough 2024 for many Australians, with the cost-of-living and housing crises combining to put pressure household budgets.

As if that wasn’t enough, uncertainty in the local and global economy and concerns about the impacts on living standards, have cast a long shadow.

But experts say there are a few reasons to be optimistic about the year ahead – in some ways, in any case.

While housing markets are cooling, interest rates are set to stay higher for longer, making it harder to secure a loan and pay it back.

And similarly, lower inflation and the flow of tax cuts is putting more money in people’s pockets, but wages growth is tipped to slow and there’s a risk of rising unemployment.

This is the mixed bag scenario likely to play out over the coming year.

Housing markets set to soften

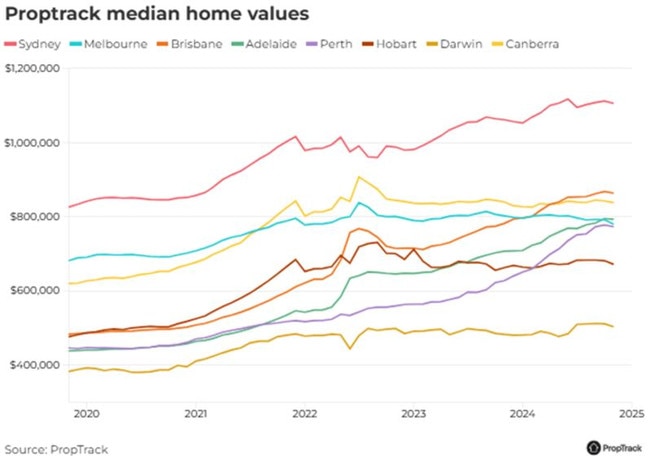

Against many expectations, property prices rose strongly over the course of 2024 in many parts of the country, despite affordability constraints and high interest rates.

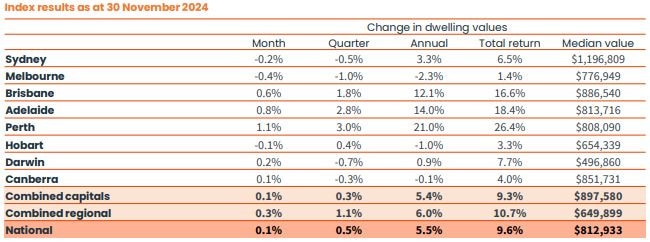

At a national level, home values grew by 5.5 per cent in the 12 months to November, with more than 528,000 dwellings sold, representing a lift of six per cent on the five-year average.

Across the combined capitals, prices rose by 5.4 per cent year-on-year but movements in individual cities were volatile, ranging from Perth’s whopping 21 per cent lift to Melbourne’s 2.3 per cent decline.

But broadly speaking, it was a good year for homeowners and investors, with most major markets seeing growth. Brisbane was up 12.1 per cent, Adelaide rose by 14 per cent, and Sydney saw a modest 3.3 per cent bump.

But that strong growth has moderated in recent months, CoreLogic research director Tim Lawless said, and is likely to continue to do so.

“Home purchasing is winding down, total listing numbers rising, the clearance rate is falling and homes are taking longer to sell,” Mr Lawless said.

“CoreLogic’s national Home Value Index virtually flatlined in November with a 0.1 per cent rise, while four of the eight capitals recorded a negative quarterly change in values.”

Analysis of housing affordability by ANZ bank and CoreLogic found a record high portion of income is currently required to service the mortgage of a median income household, at a staggering 50.6 per cent.

“Affordability may increasingly see buyers drop out of the market amid high interest rate settings. With less demand and more available supply, some heat is leaving the housing market.”

Valuation expert Mike Mortlock, managing director of MCG Quantity Surveyors, also expects housing markets to soften in 2025.

“In 2024, we saw three standout markets – Perth, Adelaide and Brisbane – outperforming the national trend, while others experienced softening or declines,” Mr Mortlock said.

“In 2025, Perth and Brisbane are expected to continue outperforming national averages, although an anticipated increase in listing volumes may temper the feverish buyer activity observed recently.

“This adjustment could bring more balance to these markets.”

A big factor driving housing market movements is interest rates, Kevin Brogan, national director of risk and compliance at valuation firm Herron Todd White, said.

“Traditionally, a change in the interest rate will take some time to stimulate a response,” Mr Brogan said.

“A lag response seems likely because, although inflation is declining, cost of living pressures remain a significant issue for many households.

“As the year progresses, I expect the effect of a resilient employment market, the benefit of Stage 3 tax cuts, and the much-awaited interest rate cut could combine to awaken market activity.”

When will rates fall?

This time last year, the broad expectation was that Australians could see the first long-awaited cut to the Reserve Bank’s official cash rate by mid-2024.

That never eventuated. It’s now clear the RBA board is in no rush to move.

Minutes from its last meeting revealed it wants to see two quarters of low inflation before it considers a reduction.

Until then, barring any major increase in inflationary pressure, the cash rate will remain on hold at 4.35 per cent.

Among the big four banks, the CBA has the most optimistic expectations, tipping the first rate cut to occur in February, while Westpac, ANZ and NAB expect a reduction in May.

For his part, Mr Brogan pointed out that forecasts have been pushed “further and further back” in recent months.

“The current consensus is we may have to wait until the second half of the year.”

The painful war on inflation that’s raged for years now has yielded good results, but the RBA remains nervous.

Underlying inflation currently sits at 3.5 per cent – one percentage point above where the RBA board wants it to be – and headline inflation is at 2.8 per cent.

In its latest Statement on Monetary Policy, the RBA said forecasts indicated inflation would not return sustainably to the midpoint of its two to three per cent target range until 2026.

“The board is gaining some confidence that inflationary pressures are declining in line with these recent forecasts, but risks remain,” the statement read.

Some relief for renters

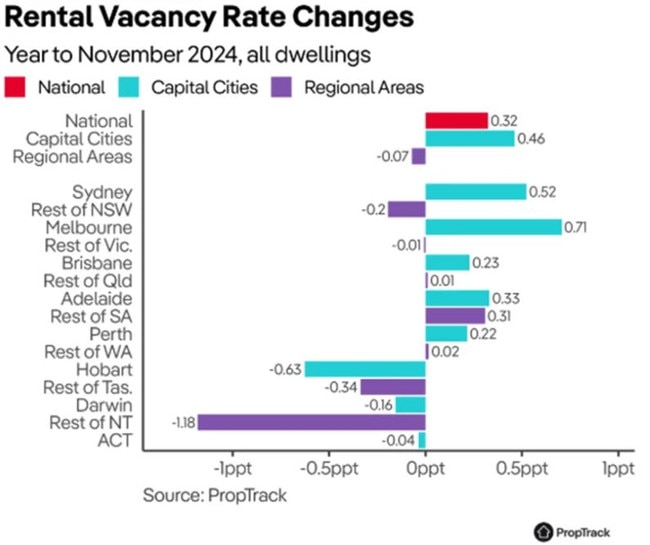

Australians who rent the home they live in remain under significant pressure, following years of hefty price growth across virtually the entire country.

Eliza Owen, CoreLogic’s head of research, said values remained high throughout 2024 but were showing signs of cooling.

Annual growth in rent values slowed to 5.3 per cent in the year to November, down from 8.1 per cent in the year prior and a high of 9.6 per cent in the year to September 2022.

Ms Owen expects the slowdown to continue into 2025.

Eleanor Creagh, senior economist at PropTrack, said there are signs that ultra-tight rental vacancy rates are also beginning to improve.

“The lift in investor activity seen through 2024 has supported a rise in rental listings, which has which has led to more available rental properties and helped ease tough conditions,” Ms Creagh said.

“Rental affordability constraints, larger household sizes among renters and slowing net migration and student arrivals have also helped ease demand pressures.

“This tapering in demand, coupled with a boost in rental supply has contributed to more stable conditions in the rental market and the slowing in rental price growth.”

However, markets are still tight and many renters will remain “extremely challenged” for some time to come, she said.

Interesting times for Aussie economy

Some experts are concerned that the Australian economy is in a precarious state, not helped by the RBA’s dogged view on when to cut interest rates.

“In my view, the risks to the Australian economy in 2025 are now skewed to the downside,” independent economist Nicki Hutley told The Guardian.

“Monetary policy takes time to work so a February rate cut is both justifiable and warranted, as long as public sector spending growth is brought to heel.”

Mr Lawless agreed, saying growth has stalled and is now tracking lower on a per capita basis over the past seven quarters.

“Outside of the pandemic period, the annual change in GDP hasn’t been this weak since 1991 as the economy was emerging from recession,” Mr Lawless said.

The RBA expects a recovery in GDP growth to commence from August, which is later than previously expected.

Household spending is expected to increase on the back of a run of wages growth and tax cuts putting more money in people’s pockets, the RBA said.

A mixed bag globally

An area of concern for the RBA is “uncertainty about the outlook abroad” going into 2025, its latest Statement on Monetary Policy reads.

“Most central banks have eased monetary policy as they become more confident that inflation is moving sustainably back towards their respective targets,” the board said.

“They note, however, that they are removing only some restrictiveness and remain alert to risks in both directions, namely weaker labour markets and stronger inflation. Geopolitical uncertainties remain pronounced.”

Investment firm Morgan Stanley said growth trends vary across regions, but overall, the global economy is softening.

“Morgan Stanley forecasts global growth to remain near three per cent for the next couple of years,” it said in a December analysis note

“In the US, however, we anticipate a slowdown in 2025 driven by the waning impact of fiscal policy, the delayed effects of ongoing restrictive monetary policy, and the introduction of new tariffs and immigration restrictions.

“Additionally, we foresee weaker growth in China next year due to insufficient consumption stimulus and the potential for higher US tariffs.”

Unsteady path ahead for workers

Labour Force data released in mid-December showed unexpectedly robust conditions, with employing rising 35,600 in November, well above the 25,000 market estimate.

Unemployment also dipped by 0.2 percentage points to 3.9 per cent, which was also against expectations.

But Creditor Watch chief economist Ivan Colhoun said the expectation was for unemployment to rise.

“SEEK job ads have dropped in the past two months, which suggests a rising trend in the unemployment rate should emerge,” Mr Colhoun said.

“But only a slow rise could be expected given the current slow rate of reduction in job advertising.”

That’s also the view of the RBA, which noted in its latest statement that tight conditions are set to ease.

“The unemployment rate is expected to rise over the coming year as overall labour demand and supply comes roughly back into balance.”

It also expects wages growth to continue to slow over the coming year.

Business nervous about the New Year

Australia’s business community is looking to 2025 with nervous uncertainty, it seems.

NAB releases a monthly report measuring various aspects of the business landscape, from major industry performance to operating costs and demand.

Its latest survey, released in mid-December, revealed “noticeable declines” in most industries, with manufacturing and retail among the weakest.

All three measures of business conditions across the board are now “at or below average”, the survey revealed.

And business confidence collapsed by a whopping eight points, hitting minus three and wiping out promising gains recorded in October, NAB chief economist Alan Oster said.

“Confidence fell sharply in November and is now back below average,” Mr Oster said.

“While we were optimistic last month, it appears the trend of well below-average confidence remains intact.”

At the same time, CreditorWatch’s latest Business Risk Index indicates “an extremely challenging start to 2025 for businesses – particularly small businesses”.

The credit reporting bureau noted that business insolvencies are running at record highs – up 57 per cent year-on-year in November – while average business failure and closure rates are at the steepest levels in more than four years.

Patrick Coghlan, CreditorWatch chief executive, said the data shows businesses are under increasing stress “on multiple levels”.

“We expect those exposed to discretionary spending such as hospitality, retail, and arts and recreation, will continue to find it particularly difficult,” Mr Coghlan said.

Any relief will be unlikely until interest rates begin to fall, allowing consumers to increase their spending again, he said.

Consumers also uncertain about 2025

Meanwhile, Westpac recently released its latest Consumer Sentiment Index for December, which showed a slight dip of two per cent month-on-month.

Although one top economist believes the bulk of increased anxiety is about factors far from home.

“Deterioration in questions about the outlook for the economy over the coming year and five years likely reflects uncertainty about re-elected President Trump’s widely reported proposed significant tariff and immigration policy changes,” Mr Colhoun said.

“In fact, family finance reports continued to improve, and consumers were more favourably disposed to buy a major household item, excluding a house.

Originally published as Economic outlook for 2025 is a mixed bag, do you want the good news, or the bad news?