Zip reports losses while Apple Pay Later reveals no plans to launch in Australia

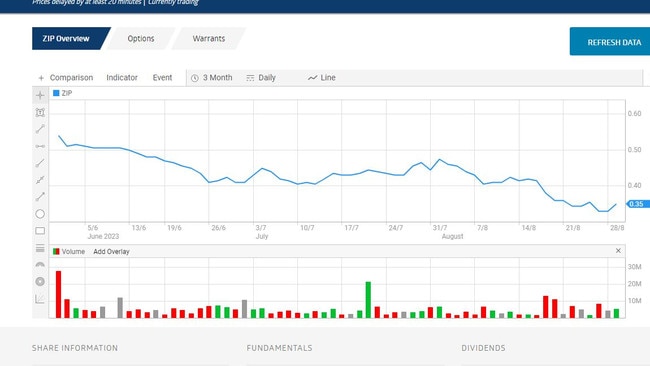

Buy now pay later provider Zip has revealed a staggering $413 million loss as regulation weighs heavy on sector.

Companies

Don't miss out on the headlines from Companies. Followed categories will be added to My News.

Buy now pay later (BNPL) provider Zip Co has cut its statutory net loss to $413 million for the year to June 30, down from an eye-watering $1.1 billion last year.

In June, Zip hit monthly profitability in Australia, the US and NZ for the first time, amid a cost of living crisis that is seeing consumers cut back on spending.

This comes as tech giant Apple confirmed it has no immediate plans to launch its Apple Pay Later BNPL offering in Australia.

Kyle Andeer, Apple vice president of products and regulatory law, spoke at an inquiry into promoting economic dynamism, competition and business formation in Australia on Tuesday. He said while the company was “really excited” about the BNPL service it launched in the US in March, the “challenging regulatory structure” in Australia meant a local launch was not in the works.

Tighter regulation of the BNPL sector, which may see the sector brought under the Credit Act, is in the works.

The upcoming regulation is not a deterrent to Zip, which said it already exercises “responsible lending practices and full ID, credit and affordability checks on its customers”.

But it has already forced one player out of the market, with LatitudePay pulling out of Australia in April.

Announcing the decision it said: “We have decided to stop offering LatitudePay services in Australia as a consequence of the uncertainty surrounding the future regulatory environment for the BNPL (by now, pay later) sector.”

LatitudePay is not the only BNPL casualty this year; in February ASX-listed OpenPay went into receivership.

Buy now pay later services have fallen out of favour as consumers tighten their belts.

The Sydney Morning Herald revealed that fellow BNPL operator Afterpay has opted not to renew its naming rights sponsorship of Australian Fashion Week.

The decision was reflective of Afterpay’s desire to somewhat divest from being a “fashion brand”, as consumer spending patterns changed in a tighter economy, an insider told the publication.

The latest results for Zip come after payments consulting firm McLean Roche’s chief executive Grant Halverson described the company as being in a “cycle of death”.

Earlier this year, he said the company would need to make profits as soon as possible given the company had not been profitable since 2013.

“They need to cut credit losses, which means stopping customers’ spending, which means they leave or get cancelled by Zip – but they have plenty of other options,” he told the Australian Financial Review.

“PayPal is saying they are No 1. You can see this in ANZ where spending was already slow – now it’s in decline.”

Despite this, Zip co-founder and CEO Larry Diamond said the company was accelerating its path toward profitability with a “strategy to increase revenue margins and reduce credit losses”.

“In an environment of rising interest rates and high inflation our results demonstrate the increasing relevance of our products to customers and merchants. In Australia, the strength of our brand and product offering continues to resonate and is attracting new merchants such as eBay AU, Qantas, Jetstar and Uber which all launched during the period,” he said.

“The expected consolidation of our sector has begun and there are significant opportunities for Zip as this dynamic continues to play out. We have already experienced an increase in inbound merchant inquiries following recent developments in the market.”

In February this year, Australian company OpenPay became the first BNPL service to collapse, announcing to the Australian Securities Exchange (ASX) that it had gone into receivership.

It followed OpenPay pausing trading a few days prior in a sign that the company was on its last legs.

The appointed receivers, Barry Kogan, Jonathan Henry and Robert Smith of insolvency firm McGrathNicol put a stop to the business but said customers would still have to keep paying off their debts in instalments.

There were fears the collapse could potentially leave dozens of Australian retailers out of pocket as receivers have not confirmed if the stores where it offered its services will be getting their money back. OpenPay had a number of different retailers including Bunnings, Bupa Dental, Glue Store, and Kogan.com.

OpenPay had been struggling for some time, with ASIC documents showing it had not turned a single profit since its debut on the Australian stock market in 2019.

Its latest quarterly report showed that the company had racked up $18.2 million in operating losses.

Originally published as Zip reports losses while Apple Pay Later reveals no plans to launch in Australia