“We love to pay taxes”: Airbnb planning long-term stay, says founder

IT’S hated on by some for turning apartments into hotels and blamed for high rents and housing affordability, but short-term rental site Airbnb is here to stay.

Travel

Don't miss out on the headlines from Travel. Followed categories will be added to My News.

THE way Airbnb co-founder Joe Gebbia tells it, Airbnb is the perfect business guest in Australia.

It “loves to pay taxes”, it’s helped save mortgage-stressed people’s homes, it welcomes regulations and wants to keep the neighbours happy, promote tourism, work with local governments and be part of the community.

And as for those who accuse Airbnb of driving up rents, making housing affordability worse and leaving cities short of residential properties as owners and landlords capitalise on tourist accommodation?

They were “misinformed”, said Mr Gebbia, who is in Australia for the first time since he co-founded the company in 2008, as most Airbnb owners lived in the properties they rented out.

“There’s this misconception globally that the platform is about property groups and big property owners renting out entire buildings full-time,” he said.

“When we go city by city, country by country, the majority of our hosts, our owners are simply renting out their spare bedroom.”

Airbnb’s Australia and New Zealand country manager Sam McDonagh said: “In Australia, more than two-thirds of the listings that we have on the platform are sharing the home that they live in.”

There is no national regulation requiring Airbnb hosts to pay additional tax if they live in a frequently-visited area, that task falls to local councils and some State Governments.

Strata disputes and arguments about noisy Airbnb strangers fouling up common areas and presenting safety concerns?

They just need to talk, Mr Gebbia said, and — if necessary — regulate in a “fair and balanced” way which didn’t impinge on peoples’ right to make a buck out of renting their home to tourists.

“GENIE IS OUT OF THE BOTTLE”

Mr Gebbia’s visit to Sydney comes as the NSW Government continues its drawn-out process of coming up with laws to govern Airbnb and other short stay rentals, a process stretching towards the two-year mark.

Earlier this year, a NSW parliamentary inquiry into the short-term holiday letting sector concluded the current arrangements were “fragmented and confusing”.

Reforms canvassed in a subsequent options paper included possible fines for owners of out-of-control “party houses”. Submissions are currently being considered.

South Australia and Tasmania have recently passed laws governing Airbnb.

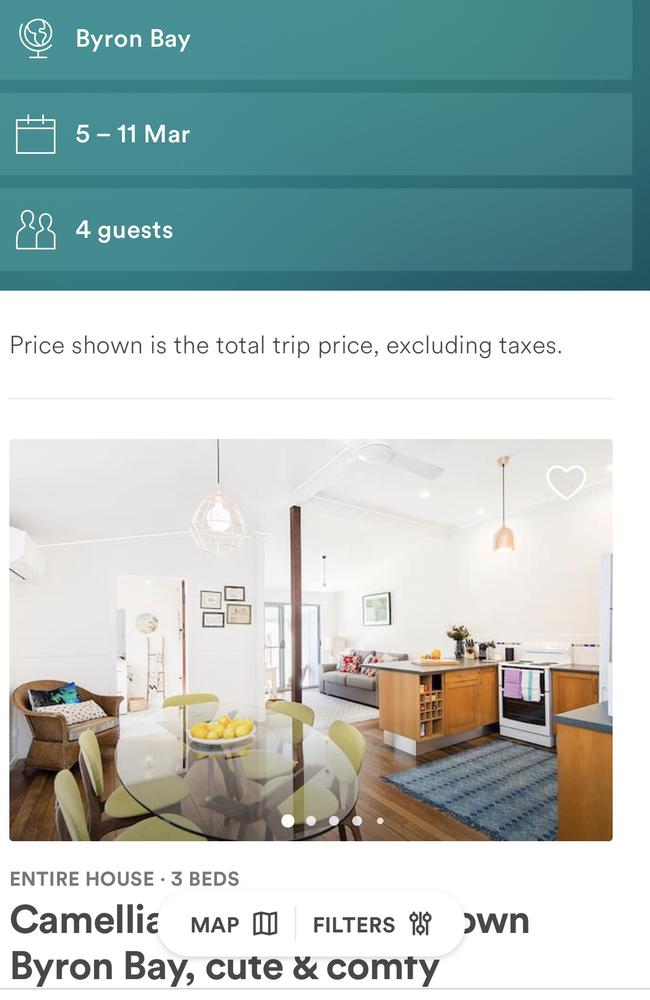

New South Wales has 40,000 Airbnb listings — 25,000 of them in Sydney — and while opponents would love that not to be the case, Mr Gebbia said the company wasn’t going anywhere. In fact, Australia is its greatest success story.

There have been 4.6 million arrivals in Airbnb properties in Australia over the past year. Australia has the largest number of Airbnb registered users per capita of any country — one in five Australians has an Airbnb account.

“There are 4.8 million Airbnb users in Australia and 122,500 active listings — an increase of 40 per cent over last year,” Mr Gebbia said in Sydney on Monday.

“The genie is out of the bottle and it’s not going back in.

“A lot of people say to us, ‘Oh, Airbnb isn’t paying tax to our city’, and to that I say, ‘We love paying taxes’, which is why we’ve worked with 340 cities to do that.”

He’s talking about Airbnb’s “partnerships” in 340 cities across the world, where regulations include contributing to taxes collected by hosts to put towards the facilities guests use.

OVERSEAS OPPOSITION

But that hasn’t happened in cities including New York where New York Governor Andrew Cuomo struck a blow to Airbnb by signing a law making it illegal to rent out apartments for fewer than 30 days unless the host was present.

Other areas in the United States have moved to make short-term rentals illegal or similarly restricted, and internationally, Iceland has ruled that apartments rented out for short-term rentals for more than 90 days a year will need a special licence.

In Amsterdam, the limit is 60 days a year.

Vancouver in Canada has also moved to limit short-term rentals to address its severe housing shortage, the New York Times reports.

The city’s new regulations stop businesses from offering short-term rentals through Airbnb and similar services; individuals will be allowed to rent only their principal residences.

Vancouver is struggling with both high housing prices and unusually low vacancy rates for apartments and houses.

Paris, one of Airbnb’s biggest markets, has also slapped limits on the short-term rental of apartments and rooms as they compete with hotels, encourage property speculation and reduce the housing available to residents.

THE STORY IN SYDNEY

The NSW government is considering regulations including taxing Airbnb hosts, forcing strata owners which list on Airbnb to contribute extra money to strata sinking funds and giving strata committees the right to ban Airbnb listings in their building altogether.

Despite Airbnb’s initiatives such as friendly building programs, many locals remain unconvinced Airbnb rentals are the right fit for their communities, especially in the inner city. Apartment dwellers fed up with their homes being turned into hotels are being urged to take advantage of strata laws to combat the practice, rather than wait for the NSW government to clarify regulations.

Author and apartment living expert Jimmy Thomson, founder of the website Flat Chat, has called for owners’ corporations to fine landlords who don’t register tenants using a “widely ignored” law. which could result in fines of $550.

But Airbnb’s head of public policy Brent Thomas said the rules for home sharing in NSW were “broken, outdated and need to be fixed”.

“People should not be forced to get lawyers to defend their rights or navigate arcane rules that were written well before the internet even existed,” he said. “The longer this regulatory uncertainty continues the worse it is for everyone in the community, with some trying to exploit the confusion.”

HOW BIG ARE THE BUCKS?

Mr Gebbia said Airbnb opponents refused to see the financial benefits to hosts, many of who he says are small operators making a bit of extra cash.

The typical Australian listing is booked for 31 nights a year and the average length of stay per guest is 3.4 nights

But some hosts are definitely making big bucks. Even an Ikea sofa bed picked up $7276 for its hosts in Sydney last year.

Mr Gebbia said concerns that landlords buy multiple properties and set them aside as Airbnb listings rather than to long-term tenants weren’t backed up by Airbnb data.

The average income for an Australian Airbnb hosts was $5000 a year. The biggest “host” demographic was women over the age of 45, who on average made $5600 a year renting out their spare room or holiday home.

Mr Gebbia said detractors also ignored the social and community value Airbnb offered, as well as new ways of helping locals share their communities and skills for cash.

For the past year Airbnb has offered a service where locals can offer experiences to visitors, such as walking tours or home-cooked meals. He said one woman overseas had made $15,000 in a matter of months, and that some who offered visitor experiences had become involved because they did not have accommodation to rent on the platform.

Originally published as “We love to pay taxes”: Airbnb planning long-term stay, says founder