Texts reveal trouble before $11m collapse

Employees tipped off government departments about problems before the company’s demise but they have still been left owing thousands.

Companies

Don't miss out on the headlines from Companies. Followed categories will be added to My News.

An Australian company has collapsed after amassing a debt of $11 million as employees chase more than a million owed in superannuation.

The 10-year-old business called Boosted Fire Pty Ltd specialised in providing fire safety equipment and sprinkler services in the commercial sector but in recent years had moved into residential.

Boosted Fire owed employees $1.26 million in superannuation while unsecured creditors had outstanding debts of $4.5 million, a report filed with ASIC found.

The ATO was owed $2.5 million and the company had just $8000 in the bank, administrators found.

Anna* was an employee of Boosted Fire who has missed out on almost $1500 worth of superannuation.

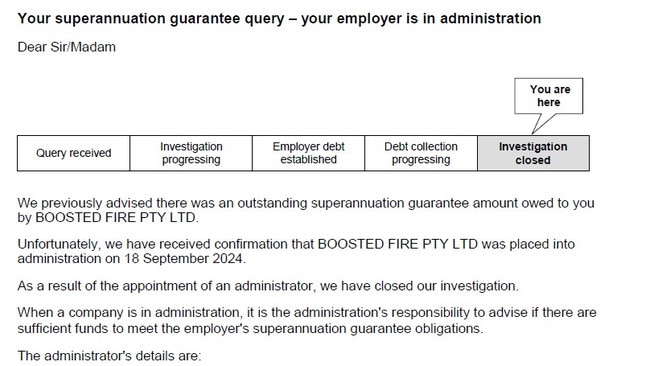

The mum-of-three is bitterly disappointed that she alerted the Australian Taxation Office (ATO) about her super being unpaid back in October last year and claims nothing meaningful was done to recover it.

She received a letter from the ATO on Wednesday saying the matter was closed due to Boosted Fire being in administration.

“Nice to know they did jack and now just wipe their hands clean,” she told news.com.au.

“The company owed millions. It’s pretty disgusting.”

To add to her distress, her husband and her also worked with a related company where they are owed thousands in unpaid super, although this business is still operating. Her husband has more than $55,000 outstanding and she is chasing $5500.

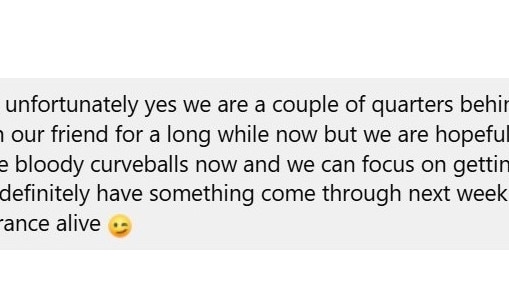

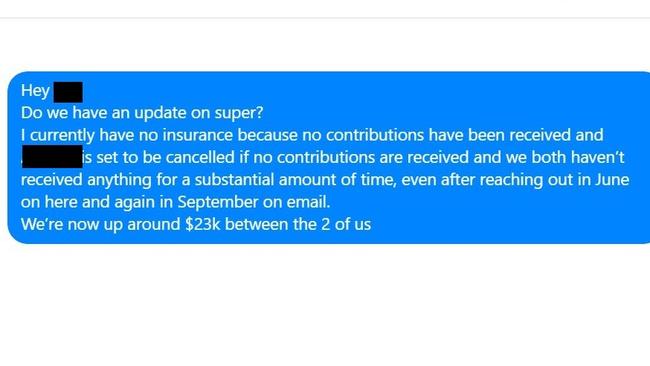

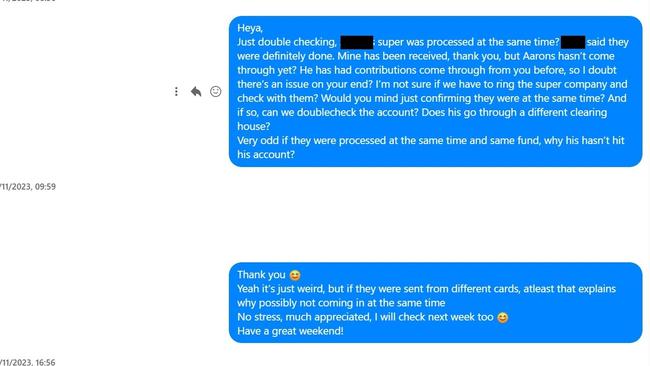

Messages from Anna show her begging for an update on the couple’s unpaid super multiple times.

She is told the company is a “couple of quarters behind”.

“Cashflow has not been our friend for a long while now but we are hopeful we are at the end of all these bloody curveballs now and we can focus on getting everything back on track,” the message from June last year reads.

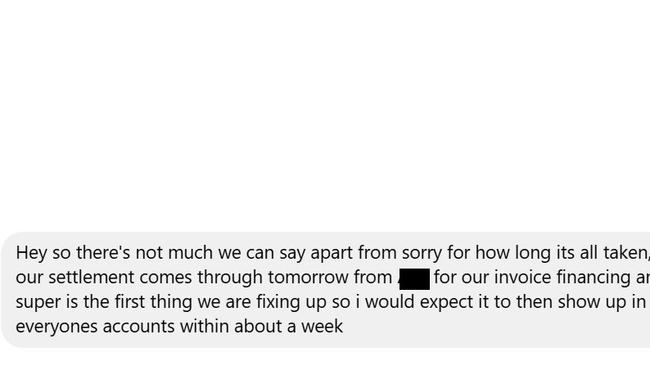

Another message in November last year said “sorry for how long its taken” and super would be the first thing to be fixed up.

‘Haven’t been held accountable’

Anna said employees of Boosted Fire believed the company was experiencing issues when suppliers would call up chasing payments last year but from there the situation got “worse and worse”.

The 41-year-old said her super balance sits at just $60,000.

“I have always worked part time with the kids, so super has taken a huge hit for that,” he said.

“It's one thing to not pay your creditors but to have employees come to work every single day and literally steal money off them — that is pretty low.”

Anna said the family have been “failed” by the ATO.

“Not only have they not recovered funds but they have been allowed to continue it despite a number of complaints about the company in regards to super … and it’s even to the point where they still haven’t made them accountable,” she said.

“The company has gone into voluntary administration and it’s at a point where it was protected.”

$55,000 in super

Anna said her husband only realised his super hadn’t been paid for almost 12 months when he got a letter from his fund warning his insurance would lapse due to the lack of contributions.

“From there we took a heavier approach and said you have to pay something and reported it to the ATO,” she said.

“Prior to that we were told we will get something in, we are a little late, we are a couple of quarters behind and you get swallowed up in the story, you are a little bit hopeful.”

By November, the couple knew they had to find new jobs. It was also the second time Anna’s husband had missed out on super after another employer failed to pay him.

An ATO spokesperson said it cannot comment on the tax affairs of any individual or entity due to its obligations of confidentiality and privacy under the law.

What went wrong

Boosted Fire was placed into voluntary administration in September but the company’s assets had been licensed to a related entity called Boosted Services four days prior to the administrators appointment, a report for creditors filed with ASIC revealed.

Employees were provided with letters of offer to continue their employment under Boosted Services with all accrued entitlements – except outstanding superannuation would not be included.

However no documentation had been provided to the administrators “substantiating the transfer of employment”, insolvency firm Cor Cordis which has been appointed to deal with the company’s demise noted in its report.

Booster Fire’s director blamed “insufficient cashflow” for the company’s difficulties as a result of losses incurred on materials used in fixed-price contracts following significant price increases after the Covid pandemic and delays with practical completion of projects.

It also blamed the breakdown of a relationship with another company Fire Point, which issued a statutory demand for payment of debt totalling $2.3 million.

But the administrators said there were other factors including the Queensland business entering into unprofitable contracts and work during and prior to the 2022 financial year resulting in substantial losses being incurred totalling $4.5 million.

“These losses appear to have been funded predominantly from non-payment of trade creditors, superannuation and statutory creditors as well as through refinances and increases in borrowings,” the report noted.

It also revealed that the company “appears to have been insolvent in or around 30 June 2023” until their appointment on 18 September.

There may be a claim for insolvent trading against the director for in “excess of $4.2m” based on preliminary investigations, but this is likely to increase, the report noted. Further investigations were necessary, the report added.

Anna said she had also reported her concerns to ASIC.

Potential other claims

Cor Cordis identified potential unfair preference claims in the range of $400,000 to $600,000 which may result in money, property or other benefits being recovered for creditors.

The creditor’s report also identified potential claims against the director and related entities for

unreasonable director-related transactions and potentially uncommercial transactions, totalling $580,000 although further investigations were necessary.

Boosted Fire has also faced two winding-up proceedings including from Fire Point Pty Ltd.

On 16 September, the company’s QBCC licence was also cancelled – which was crucial to it being able to operate, the report noted.

Cor Cordis noted that the licence agreement has been varied following the administrators’ appointment to provide various protections, reduce exposure to potential liabilities and provide a better outcome to the company as a result of the continued operations.

News.com.au contacted Boosted Fire for comment.

*Name changed

sarah.sharples@news.com.au

Originally published as Texts reveal trouble before $11m collapse