Clothing giant Mosaic Brands in voluntary administration, owing $250m

A huge Australian clothing conglomerate is in voluntary administration, owing nearly $250m.

Retail

Don't miss out on the headlines from Retail. Followed categories will be added to My News.

Australian clothing giant Mosaic Brands has gone bust owing almost $250m.

The company went into voluntary administration on October 28, and a newly released report from the external administrators shows a long list of creditors.

KPMG has been appointed as receivers and managers and is looking to sell the business.

More than 300 employees are owed an undisclosed amount.

Mosaic owes 23 Bangladeshi garment factories more than $30m. Workers earning a few hundred dollars a month told the ABC they were worried about feeding their families.

Before going into administration, Mosaic announced it would shut down its entities Autograph, BeMe, Crossroads, Rockmans and W.Lane.

Those closures were supposed to open the way for more investment in its other brands Katies, Millers, Noni B and Rivers. In total, Mosaic Brands had more than 700 stores and 10 online shops.

But an announcement to the ASX in October shows the restructure was unsuccessful.

“Following recent attempts by the company to informally restructure its operations, the board of Mosaic has determined that voluntary administration is now the most appropriate way to restructure the Group.”

A “significant majority” of secured lenders, suppliers, service providers, landlords and the Australian Competition and Consumer Commission supported a restructure, but “a small number” declined the restructure proposal and Mosaic could not reach a “commercially acceptable resolution” with the consumer watchdog, the ASX announcement reads.

The Mosaic group will continue trading, work on a wider restructure plan and focus on the “key Christmas and holiday trading period”.

“The board wishes to reiterate its belief to those who supported the restructure, to Mosaic’s customers, and most importantly, to Mosaic’s dedicated team across Australia, that the business has a long-term future,” the announcement continued.

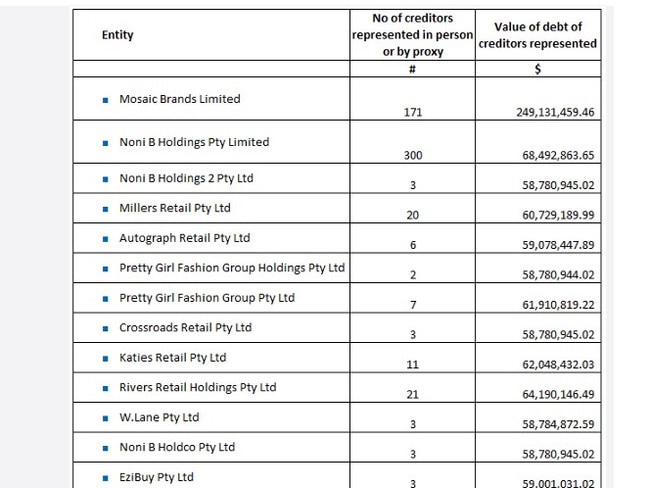

Mosaic Brands Limited owes about $249m to 171 creditors, though this number could change as administrators comb through the books.

The administrators report says KPMG has more than 12 interested buyers for the business. Administrators are confident some staff can be redeployed and “expect to be able to satisfy employee entitlements in full”.

The Bangladesh Garment Manufacturers and Exporters Association told the ABC that Mosaic’s conduct set a bad precedent for the industry.

An association spokesperson told the ABC they wrote to Australia’s High Commission about Mosaic’s non-payment, and the association was told to seek independent legal advice.

Oxfam Australia said the business collapse highlighted systemic inequalities.

“These workers are already paid poverty wages at around $6 per day for the minimum wage,” Oxfam Australia advocacy lead Sarah Rogan told the ABC.

“For Mosaic not to pay for orders already fulfilled means they have essentially worked for free.”

Originally published as Clothing giant Mosaic Brands in voluntary administration, owing $250m