Multiple companies linked to convicted fraudster collapse owing $5m

One company had just $3 left in its bank account when it went under, while a business providing services was forced to sack staff after its bill went unpaid.

A series of companies founded by a convicted fraudster that all collapsed earlier this year had racked up combined debts totalling almost $5 million.

The four companies were created by John Issa, who was sentenced to three years imprisonment after pleading guilty to five charges including dishonestly obtain financial advantage by deception and recklessly deal with proceeds of crime. In 2020, he served out his sentence through a community corrections order.

One of the companies called Sports Foyer was ordered into court liquidation in May after the Australian Taxation Office (ATO) launched winding up proceedings over an almost $1.3 million debt.

Meanwhile, one business that completed work for two of the companies told news.com.au that it was forced to sack staff after its $655,000 bill went unpaid.

Liquidators McGrath Nicol recently released a series of reports into the group of liquidated companies referred to as the Go Big Media Group.

These included Go Big Tech, Go Check ID, Seeky IP and Sports Foyer. However, Issa has previously said the majority of these companies had never traded.

The liquidator’s report, filed with ASIC, revealed that employees from Go Big Tech were collectively owed $416,000 in entitlements, while there were also 15 unsecured trade creditors with debts totalling $773,00 and the ATO had an outstanding bill of $254,000.

Issa had previously denied that such a large sum was owed to employees and told news.com.au in July that a couple of week’s wages were owed “at most”, which he intended to pay back.

Go Big Tech employed various staff and contracted software engineers to build different software platforms and apps for the other entities in the group, the liquidator’s report noted.

These included a digital identity verification platform for Go Check ID, an AI driven shopping platform for Seeky IP and a centralised children’s sporting commitments platform for Sports Foyer.

Claim 1000s of hours of work unpaid

The collapse of the companies had a devastating impact on software development company Ant Colony.

Its CEO Ismir H, who did not want his full surname used, said his company entered into a contract to develop products for Go Check ID and Sports Foyer, with work starting in January 2023.

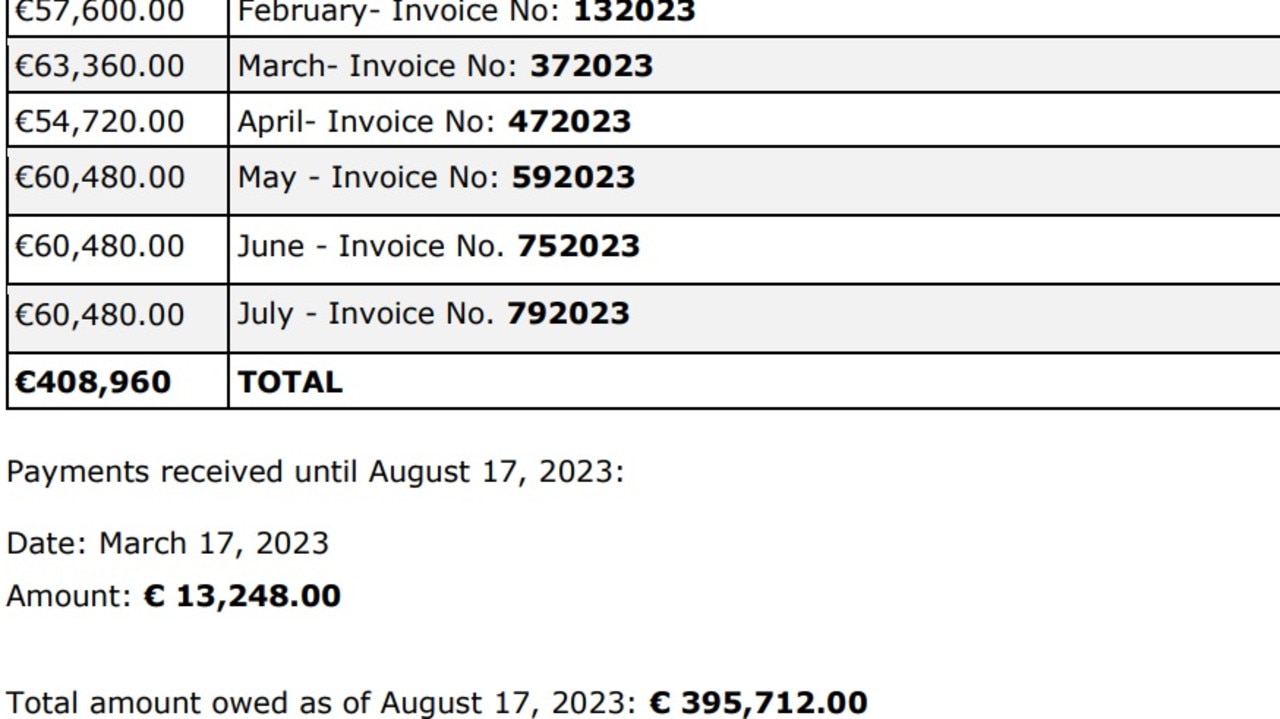

Monthly, they were doing 1000 hours of work, he claimed, but out of the many invoices sent, the company via Issa only paid one partial invoice.

“He paid only 20 per cent of the first invoice. He did not pay six or seven other invoices that followed,” he told news.com.au.

“When he could not pay he was asking us for patience, offering to pay everything as soon as he lands the investment, or once the ATO releases his money and all sorts of stuff. (He was) telling us how he has many important people involved and we would have a lot of future business with him if we can just hold on, thanking us for patience and how he will make it worth our while.”

A receipt provided by Ant Colony showed a payment of $21,700 being made by Go Big Tech in March last year.

Do you have a story? Contact sarah.sharples@news.com.au

‘It’s a lot of money’

Ant Colony’s CEO has recounted to news.com.au the desperate lengths he went to last year to try and get their invoices paid.

He claims despite promises the money would be paid within one or two weeks “that never happened”.

Finally, Ant Colony suspended their services on August 17 last year, sent a formal letter of demand and a deadline for payment.

He said Issa acknowledged the debt and asked about the option for a repayment plan, but although Ant Colony submitted a proposal it was never signed. Then there were further promises to pay in a few days.

Ismir said he was then forced to get lawyers involved with a demand notice issued in September last year.

Yet, 395,700 euros ($A655,500) has still never been paid.

“It is a lot of money. Monthly we were doing like 1000 hours. The monthly invoice was like 60,000 euros ($A98,000),” he said.

“We did it for like seven months and got caught up in his promises and lies he told us.

“Once I demanded money and the debt collector reached out to him, he then claimed we have scammed him. I’m not sure how that is possible since we did the unpaid work.

“The impact is that we had to restructure our business and unfortunately had to scale down business for a while. People lost jobs, until we managed to overcome the difficulties.”

McGrath Nicol confirmed Ant Colony had lodged a creditor’s claim.

News.com.au approached Issa for a comment but he did not respond.

Just $3.93 in a bank account

The liquidator’s report also revealed that Go Check ID had just $3.93 in the bank at the time of its collapse.

It owed $308,000 to the ATO and there were four unsecured trade creditors with debts totalling $121,000, which included the Department of Home Affairs that had a bill of $6000.

Meanwhile, the AI driven shopping platform Seeky IP owed $1.16 million to the ATO, according to the liquidator’s report.

Then there was Sports Foyer, which had a debt of $1.28 million outstanding to the ATO and a bill of $686,000 owed to law firm Corrs Chamber Westgarth, the liquidator’s report revealed.

What might have gone wrong

A series of disputes with Sports Foyer and other entities within the Go Big Media Group in relation to GST credits and Research & Development grants, which were reversed, left the group with a tax liability, the liquidator’s report noted.

Sports Foyer IP, Go Check ID and Seeky IP were wholly owned by Inotap Limited, while Go Big Tech was wholly owned by Mr Issa, the report noted.

Issa was the founder and managing director of Inotap Corp and the associated companies, according to its now deleted website.

The liquidators noted no report on company activities and property had been received from Issa, who was “in the office for the majority of the trading period”.

“Sports Foyer IP and the other Go Big Media Group entities all had significant taxation liabilities at the date of our appointment.”, the liquidators noted.

Issa told them the ATO cancelled the business numbers of each of the Go Big Media Group entities in 2022 and issued demands for repayment of tax credits to the Go Big Media Group. Meanwhile the business registrations were later reactivated, but the tax liability remained.

“Financial records indicate that the only cash inflows were from loans by a related party of Mr John Issa and the ATO, which ceased on 20 July 2022 and 26 September 2022 respectively. Accordingly, there were insufficient cash flows to continue operating from September 2022,” the report noted.

Issa previously told news.com.au that that the Sports Foyer debt was incurred due to government research and development grants that had to be returned – something he said he fought for two years.

The liquidator’s report noted loans to the companies from Issa, a business associate and investment loans topped $792,000.

The father-of-three Issa previously told news.com.au that he had used his own money to fund the businesses.

“I’ve sold everything for this business and over the last five years we have had nothing, and I’ve lost my house over it,” he said.

Issa added the company collapse had forced him into bankruptcy.

The reports, which were filed with ASIC, found there may be further actions that could be taken including a potential insolvent trading claim, acting as a director while disqualified and failing to maintain adequate books and records that could be pursued.

However, the liquidators noted they had no funding to conduct further investigations.

McGrathNicol have lodged the statutory report to creditors for each company and are preparing a report to ASIC regarding company affairs and the director’s conduct, Kathy Sozou from McGrath Nicol told news.com.au.

“Beyond that, there are no other substantive updates, as we remain unfunded and have limited capacity to pursue further actions based on the information available,” she said.

sarah.sharples@news.com.au

More Coverage

Originally published as Multiple companies linked to convicted fraudster collapse owing $5m