Company collapses surpass pre-Covid levels, building industry hit hardest

With the UK now officially in recession, a terrifying graph has revealed what’s in store for Australia.

Companies

Don't miss out on the headlines from Companies. Followed categories will be added to My News.

The number of company collapses has surged by 44 per cent as the bloodbath continues with construction industry insolvencies leading the way.

New data from credit agency Equifax released to news.com.au this week painted a sobering picture of the reality of Australia’s flailing business landscape.

Equifax’s Quarterly Commercial Insights found that business insolvencies have risen to a five-year high, long surpassing pre-Covid volumes.

And in a concerning discovery, in December, insolvencies jumped by 44 per cent compared to the same period the year before, according to the analysis.

“Total insolvencies in 2023 consistently surpassed pre-Covid volumes, due to challenging market conditions seen throughout 2023,” Equifax’s General Manager of Commercial and Property Services, Scott Mason, said.

“This trend continued through to the end of the year, with December having the highest monthly insolvency volumes in the past five years.”

In a surprise to no-one, the construction industry received the title that nobody wants — the worst hit industry.

Australia’s embattled building sector recorded a “record high” level of insolvency, up 28 per cent in the last three months of 2023 as opposed to the like period the previous 12 months.

The same data found that overall business credit applications reduced by 0.9 per cent, while business loan applications decreased by 4.1 per cent, in a sign of a weakening economy.

Average days beyond terms for payment across the market increased to 6.5 days in the most recent quarter.

That’s up 44 per cent, or two days, compared to the same quarter in 2022.

“The construction industry continues to outpace the market, paying their dues on average 10 days beyond terms,” the analysis also noted.

It comes as news.com.au previously reported that 8471 businesses went bust in 2023.

Of that, a staggering 2349 construction firms collapsed in the past year — with fears more may fall soon.

Mass collapses of construction companies are usually the first signs of a struggling economy caught in the throes of inflation, as they run on tight margins and rely on supply chain prices staying the same.

Last year, news.com.au has reported on dozens of major builders that have collapsed including one week in July where a new builder went into external administration every day.

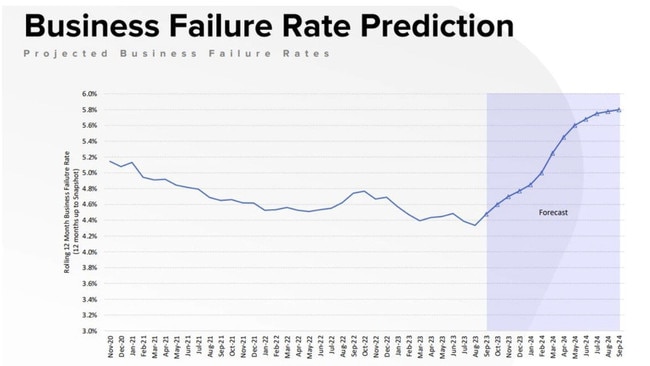

CreditorWatch previously warned that business failures are likely to continue to rise over the next 12 months, from the current rate of 4.5 per cent to 5.8 per cent.

Liquidator Nicholas Crouch, from insolvency firm Crouch Amirbeaggi, previously told news.com.au that he was “not surprised” that insolvencies in the construction sector had leapt over the past two years.

He said the hundreds of billions in Covid-19 stimulus pumped into the economy by the Australian government helped prop up struggling businesses and resulted in long delays between an insolvent event and liquidators being called in, as business owners tried to hang on.

The previous Morrison government’s HomeBuilder grant, which was introduced in June 2020 and handed out $2.52bn to owner-occupiers who wanted to build or substantially renovate a home, turbocharged the sector.

More than 130,000 customers signed on for the program, with many tradies agreeing to the work under fixed-price contracts that soon became unsustainable as prices began to soar.

Shamefully, in 96 per cent of cases where small and medium sized businesses go under, only between zero and 11 cents is recovered for every dollar owed to out-of-pocket creditors.

Originally published as Company collapses surpass pre-Covid levels, building industry hit hardest