Australians want microchip debit cards despite lure of spending

More Australians are in support of getting a debit card microchipped under their skin despite not being as good at managing money as they think, new research shows.

Banking

Don't miss out on the headlines from Banking. Followed categories will be added to My News.

Exclusive: Almost one in three Australians are in support of having a microchip debit card implanted under their skin to make tap and go payments easier and one in five would use it to completely replace their physical card.

But almost half of us think we spend more as a result of tap and go technology and a third think it enables frivolous spending.

New research shows Australians are not as good at managing money as we think and are living beyond our means.

A total of 73 per cent of us never look at our monthly bank statement and have “no clear idea of what I have spent”.

And more than half (52.2 per cent) say Afterpay and Zip pay have made them spend more.

Saving is not a priority for many Australians with 64 per cent of respondents only saving 10 per cent or less of their income per month.

MORE MONEY NEWS:

The great home loan rate gouge

What to do about Labor’s tax hit on investors

Why my mortgage rose by $1000 a month

This is despite parents believing their kids should be saving 45 per cent of their pocket money and donating 7 per cent to charity.

One in four Australians don’t trust financial institutions and of those a quarter say their distrust has been shaped by the findings of the Banking Royal Commission.

The research was done by major research house The Online Research Unit of 1000 respondents on behalf of Credit Union Australia.

Matthew Warren, deputy director of the Centre for Cyber Research at Deakin University, said implantable microchip debit or credit cards came with a myriad of risks and were not all they were cracked up to be.

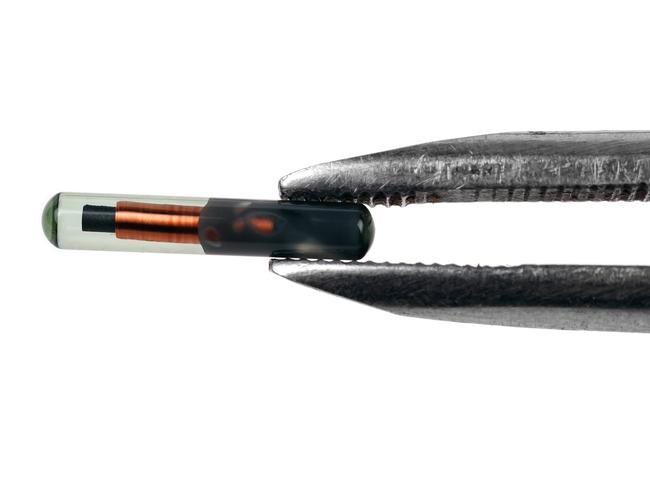

“These are definitely being used in Australia now and the microchips are usually implanted in between the fingers on the hand as that’s where there are fewer nerve endings,” Professor Warren said.

“Right now though these chips are not equipped to allow for an update once card details change or you have multiple cards so it means replacing them each time details change.”

Professor Warren said many microchips contained heavy metals so posed serious health risks.

Chief executive of the Consumer Action Law Centre, Gerard Brody said buy now pay later schemes were “dangerous” for many Australians.

“The lure of spending what you may otherwise not be able to afford can be dangerous for many,” Mr Brody said.

“Our lawyers and financial counsellors regularly assist people on low incomes or facing other disadvantage who are unable to achieve a fair outcome when things go pear-shaped.”

Bianca Hartge-Hazelman, founder of Financy/Women’s Index and a financial well-being spokesperson for CUA, said Australians could be costing themselves extra fees and interest by failing to be good with money.

“As technology gives us new, easier ways to pay for purchases, it is more important than ever for consumers to be financially savvy and monitor their spending,” Ms Hartge-Hazelman said.

“It’s interesting to see there is a rise in consumer demand for even greater payment convenience with technology such as RFID implants with Australia following the lead from other markets such as Japan and Sweden.

“Australians should do their homework when it comes to assessing the pros and cons of using these technologies to be more empowered around their finances.”

Economist Mark Crosby from the Monash Business School said more needed to be done to teach Australians about financial management.

“Australians are not as aware of their personal finances as they should be and this is a serious gap in the regulation.”