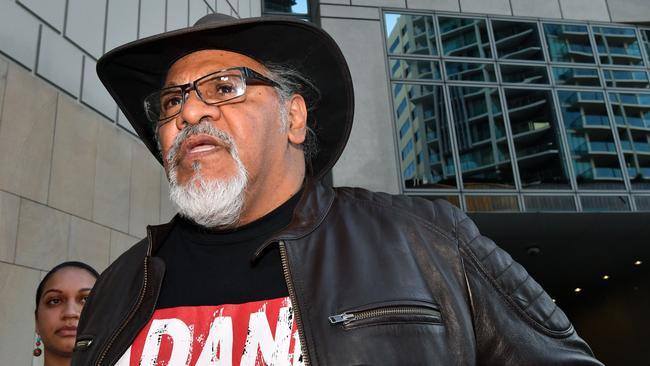

Adani tries to bankrupt Wangan and Jagalingou man, Adrian Burragubba

It’s the multi-billion dollar mega-mine set for Queensland. But one man is trying to stop it going ahead. And he isn’t going away.

Mining

Don't miss out on the headlines from Mining. Followed categories will be added to My News.

Adrian Burragubba has been a thorn in Adani’s side for years and now the mining giant has had enough.

Last month Adani filed an order seeking to bankrupt the Wangan and Jagalingou man by demanding payment of more than $600,000 in legal costs.

The extreme action follows numerous failed court actions that Mr Burragubba has been party to since 2015 to stop Adani’s coal mine in Queensland’s Galilee Basin from going ahead.

Mr Burragubba is part of the W&J People, who have a native title claim over about 30,000sq km of land in central Queensland, west of Rockhampton, including the townships of Clermont, Alpha, Rubyvale and Capella.

He’s a vocal member of the W&J Family Council disputing the validity of the indigenous land use agreement (ILUA) which Adani has secured from the traditional owners of the land.

The W&J had been negotiating with Adani since 2011 but were unable to reach an agreement so the company applied to the National Native Title Tribunal to grant them two mining leases.

The tribunal can order that mining leases be granted even if an agreement with traditional owners has not been reached.

In October 2013, the Queensland Government gave notice it intended to grant the leases and a six-month negotiation process started between the mining company and native title holders.

Australia’s first Indigenous silk Tony McAvoy has previously criticised the native title system because the tribunal rarely rejects applications for mining leases.

Mr McAvoy is a W&J traditional owner and he said Aboriginal people were being coerced into agreements with mining companies because if an agreement was not reached, they lost their opportunity to negotiate compensation or royalties.

“If we don’t agree, the native title tribunal will let it go through, and we will lose our land and won’t be compensated either. That’s the position we’re in,” Mr McAvoy told The Guardian.

In its arguments to the tribunal, Adani spruiked the economic benefits of the mine, including the capital investment of $21.5 billion, which would generate an estimated $78.2 million per year in direct and indirect benefits to the Mackay region.

On April 8, 2015, the tribunal agreed the leases should be granted because the mine would have a positive economic impact and was in the public interest.

The W&J later appealed this decision in the Federal Court, saying Adani had overstated the economic benefits of the mine, after evidence emerged in a separate case that Adani’s job numbers in particular had been inflated.

But on April 3, 2016, the Queensland Minister for National Resources and Mines Dr Anthony Lynham approved three mining leases.

The W&J People did approve a land use agreement with Adani on April 16, 2016 but only after the minister approved the leases.

At the meeting, which Mr Burragubba has claimed is not valid, there were 294 votes to approve the agreement and only one against.

But Mr Burragubba said the company failed to explain that once native title is relinquished it cannot be reclaimed.

“Our position has always been the same — that there has never been any free or informed consent with any agreement with Adani,” Mr Burragubba said in August.

However, legal action challenging the registration of the land use agreement was dismissed on August 17, 2018.

The decision was delivered after the Federal Government passed legislation to override a separate Federal Court ruling that all members of a native title group had to approve of an agreement for it to be valid.

The law change was important for Adani because its agreement did not get approval from all 12 families represented.

At that point, state and federal governments had already granted Adani all necessary state and federal approvals, although it still needs to submit groundwater and other plans.

But Mr Burragubba has refused to give up.

Another appeal was filed on September 7 and is due to be heard in May.

Adani tried to stop the most recent action, which was originally scheduled for February, by asking the court to force W&J representatives to pay $160,000 in security costs or have their appeal dismissed.

Adani’s lawyers said it had tried to recoup payment of $637,000 in legal fees from previous cases and had been unsuccessful. While the court agreed to the payment, it reduced the amount to $50,000 that must be paid by the end of January.

The decision was a blow to Adani, partly because its move also saw the court case delayed further and it will be heard in May instead.

After weathering years of legal actions from the W&J Family Council and other environmental activist groups, Adani appears to have had enough and is playing hardball.

It is now specifically targeting Mr Burragubba, one of the most vocal voices against Adani’s mine, for $600,000 in legal costs.

Adani filed a petition in the Federal Court in December seeking an order to bankrupt Mr Burragubba.

“Activists should be held to account. They are not above the law,” the company said in a statement.

Adani has vowed to donate to charity any funds from Mr Burragubba.

“Mr Burragubba refuses to accept the voice of his own people,” the company said. “The courts have repeatedly said he has no case.

“It should be noted that Mr Burragubba has been urged on by environmental groups who now seem to have abandoned him.”

The Australian Conservation Foundation (ACF) backed his opposition given Adani’s “appalling” environmental record.

“The Wangan and Jagalingou people have every right to defend themselves from Adani,” ACF campaign director Paul Sinclair said.

“Adani’s mine threatens the ancestral lands, water and culture of Indigenous people in the region,” he said.

The W&J Family Council has described the bankruptcy proceedings as “corporate bullying”.

“Our people will stand with Mr Burragubba at this trying time. He is a courageous leader who has put our people, country and cultural heritage before his own and his family’s personal needs,” council chairperson Linda Bobongie said.

“He speaks for many of the rightful traditional owners of Wangan and Jagalingou Country and we will not be frightened by Adani’s latest abuse of power.”

The W&J Family Council have also taken their fight to the United Nations, calling on it to condemn Australian authorities for wiping out their native title rights.

Adani announced in November it would be self-funding a scaled-back version of its Carmichael mine and the ongoing legal challenges with the W&J are one of the remaining barriers to it starting work.

With a start date so tantalisingly close, Adani’s heavy-handed approach may backfire.

The AFR’s Matthew Stevens said trying to bankrupt the activist was a confronting strategy to take when Adani was only months away from finalising the appeal and moving on with the project.

“Surely, with the real progress so tantalisingly close at hand, the timing and the optics of the move to bankrupt Burragubba could hardly be worse,” he wrote.

— with AAP

Originally published as Adani tries to bankrupt Wangan and Jagalingou man, Adrian Burragubba