ACCC to investigate airlines and phone companies plus take car companies to court

COMPANIES suspected of denying customers their legal rights will be investigated and possibly taken to court in a major crackdown by the consumer watchdog.

Companies

Don't miss out on the headlines from Companies. Followed categories will be added to My News.

EXCLUSIVE

COMPANIES suspected of denying customers their legal rights will be investigated and possibly taken to court in a major crackdown by the consumer watchdog.

Car manufacturers, airlines and telcos are top of the list for the Australian Competition and Consumer Commission, which believes many major businesses still impose policies that sell customers short — even almost six years after “consumer guarantees” were written into law.

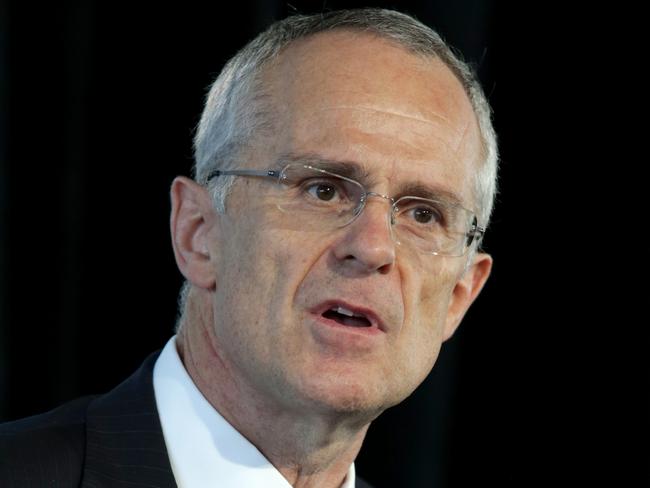

While the move is an admission the ACCC hasn’t done enough to pull recalcitrant businesses into line, its chairman Rod Sims said the “guidance phase” was over and the “enforcement phase” was about to begin.

PETROL WAR: Consumers fight back at the bowser

CLASS ACTION: Volkswagen accused of more ‘dirty tricks’

Mr Sims said he plans to make an example of automakers and caryards, having lost patience with their failure to refund and replace lemons.

“It’s going to take some court cases,” he said.

“There comes a time when that’s the only way to get the message across. This is becoming a big issue.”

Mr Sims said it was not acceptable, under consumer law, to repair a car over and over without fixing the problem, nor was it reasonable to make a “goodwill offer” whereby the customer had to fork out more money to switch to a properly functioning vehicle.

The ACCC would likely bring “two or three cases” against car companies in the Federal Court this year, part of an offensive he vowed would “pleasantly surprise” consumers.

Mr Sims has also tasked a team with probing “no refund” policies on cheap flights and instances when passengers have been left empty-handed after cancellations which were within the airline’s control.

If the “proactive investigation” found evidence of unreasonable behaviour then airlines would have to change their practices or face court action, Mr Sims said.

Telecommunications companies will also feel the heat over their treatment of customers amid concerns they have not done enough to make good for repeated network outages.

“The airlines and the telcos won’t like it but consumer guarantees are now in law — one of the most powerful changes we’ve had in recent years,” Mr Sims said.

The ACCC’s airline clampdown comes after consumer group Choice called for action.

“An investigation by the regulator can’t come soon enough,” Choice campaigns director Matt Levey said.

Choice has also been critical of car companies for gagging customers.

“We’d like to see an end to the practice of businesses hiding behind non-disclosure agreements for simply giving people their basic consumer rights,” Mr Levey said.

And the penalties for dudding customers needed to be increased, he said.

“While we welcome any action by the regulator against companies that breach the Australian Consumer Law, increasing penalties will give the regulator bigger teeth to put the bite on those who seek to rip off everyday Australians,” Mr Levey said.

The current maximum for each breach of consumer law is $1.1 million, compared with $10 million for flouting the related Consumer and Competition Act. The ACCC wants the maximum fine raised to $10 million.

Consumer law is currently under review by Consumer Affairs Australia and New Zealand, with a final report due to be delivered to federal and state Consumer Affairs Ministers next month. The final report is likely to recommend raising the maximum penalty to $10 million per breach.

Mr Sims said “rightly or wrongly”, consumer guarantees was an area the ACCC hadn’t looked at enough.

“While we welcome any action by the regulator against companies that breach the Australian Consumer Law, increasing penalties will give the regulator bigger teeth to put the bite on those who seek to rip off everyday Australians,” Mr Levey said.

The current maximum for each breach of the ACL is $1.1 million, compared to $10 million for flouting the related Consumer and Competition Act. The ACCC wants the maximum ACL fine raised to $10 million.

The ACL is currently under review by Consumer Affairs Australia and New Zealand, with a final report due to be delivered to federal and state Consumer Affairs Ministers next month. The final report is likely to recommend raising the maximum ACL penalty to $10 million per breach.

Mr Sims said “rightly or wrongly”, consumer guarantees was an area the ACCC hadn’t looked at enough.

Follow this reporter’s work on Facebook via this link and on Twitter here

Originally published as ACCC to investigate airlines and phone companies plus take car companies to court