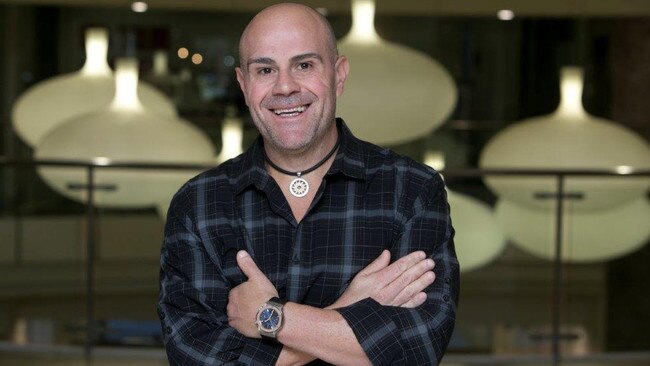

Coffee baron Phil Di Bella reaches confidential settlement with RFG to walk away from consulting gig

There’s been a bitter split between Brisbane coffee kingpin Phil Di Bella and one of Australia’s biggest retail groups.

City Beat

Don't miss out on the headlines from City Beat. Followed categories will be added to My News.

CAFFEINE HIT

A bit of drama has played out recently behind the scenes at Di Bella Coffee and its struggling parent company, Retail Food Group.

We’ve learned that Gold Coast-based RFG quietly handed out pink slips to a number of senior Di Bella executives around the country in the past few weeks.

That follows RFG’s acrimonious recent parting of the ways with Phil Di Bella, who launched the self-named business in a Brisbane garage in 2002.

Di Bella sold the business, now Australia’s second biggest supplier and roaster of primo coffee, to RFG for $47 million in 2014 but he has spent plenty of time consulting for the new owners since then.

That consulting gig came to what appeared to be an unexplained but amicable end in late December if you believe the happy videos posted on social media by Di Bella, who said he would now turn his focus solely to his privately-held business in the US.

In fact, the two sides almost ended up in court but have just inked a confidential settlement that bars either party from talking about the split. Predictably, neither Di Bella nor RFG would comment yesterday.

But City Beat spies tell us that RFG chairman Peter George had effectively tapped Di Bella to serve as the coffee business CEO early last year after the departure of former top gun Darren Dench.

Di Bella, who was still only being paid about $30,000 month for his consulting work, was then offered an RFG board position a few months later but turned the offer down.

Somehow, despite Di Bella supposedly increasing efficiencies and cutting costs in a bid to turn around the consolidated coffee business, the relationship soured.

RFG cut him loose just before the new year even though we understand Di Bella had a commitment that his services would be required until June 2020. That triggered a bitter stoush over six months of unpaid consulting fees.

A spin doctor for RFG, which suffered a $149 million net loss in the last financial year, said she couldn’t discuss Di Bella’s exit because the company was in a “blackout period” pending the release of its first half accounts.

Meanwhile, we understand more potential litigation is on the horizon for RFG from a former senior executive as well as one of their Gloria Jean’s franchisees. Donut King, Michel’s Patisserie, Crust Pizza and Brumby’s Bakery outlets also operate under the RFG umbrella.

FARMING WIN

The son of the late Premier Joh Bjelke-Petersen is among the locals in Kingaroy knocking back some of the good stuff.

They’re celebrating the withdrawl of a widely-criticised mining lease application for an open cut coal mine on prime farming land just 6km south of the town.

Brisbane-based mining minnow Moreton Resources has shelved plans for the $200 million project which it first flagged in 2015.

“The Kingaroy area contains some of the best farmland in Queensland and a mine here would have destroyed agricultural businesses, damaged water resources and put the health of the local community at risk,’’ John Bjelke-Petersen said.

While loss-making Moreton still holds a mineral development license for the site, the company has made clear that it is “exploring divestment opportunities’’ as it focuses on a project in the Granite Belt.

That hasn’t stopped environmental activists calling on the Queensland Government to extinguish the remaining license and amend planning laws to prohibit mining on top-grade agricultural properties.

PRICE SLASHED

It’s not just the feared coronavirus keeping Corporate Travel Management boss Jamie Pherous awake at night.

His house broker, Morgans, slashed the price target of CTM by 17 per cent this week to $19.40, just ahead of the Brisbane company’s release of half-year results on Wednesday.

That’s still way ahead of its closing price yesterday of $16.19, less than half the high it reached in late 2018.