Brisbane construction giant wins court case to recover more than $431,070 from a former employee

They say no good deed ever goes unpunished and Hutchinson Builders has learned that lesson the hard way - via court.

City Beat

Don't miss out on the headlines from City Beat. Followed categories will be added to My News.

THEY say no good deed ever goes unpunished and Hutchinson Builders has learned that lesson the hard way.

The Brisbane construction giant has just won a District Court case to recover $431,070 and another $13,703 in interest from a former employee who borrowed the money informally to pay for his legal fees but refused to pay it back.

Nathan Burden was a project manager-turned-contractor who worked for Hutchies for nearly nine years when he was charged with unspecified criminal offences in late 2016 following a “marriage breakdown resulting in disputes in relation to child access and property settlement,’’ according to court documents.

City Beat has learned that Burden pleaded guilty in April last year to “negligent acts causing harm – domestic violence offence”, and was released upon entering into recognisance in the amount of $2,000 conditional upon him being of good behaviour. No conviction was recorded.

To help fight the case, Hutchies “team leader’’ John Berlese made nine payments to Burden from September 2016 to March last year, with five of those dubbed “invoices’’ in reference to work at a South Brisbane project site.

Managing director Greg Quinn agreed to loan even more money after that but Burden left the company in May last year and then failed to repay the huge sums advanced to him. Burden fought the lawsuit, saying there was no specific loan contract in writing and the money had been paid not to him but to his wholly-owned company Savcon Services, which has subsequently been deregistered for failing to pay tax.

Burden, who now works as a manager at Broad Construction in Brisbane, declined to comment this week and Hutchies boss Scott Hutchinson told us the money had still not been clawed back.

Defending the unorthodox practice of loaning money to employees, Hutchinson said his company is decentralised. That meant “team leaders’’ had broad leeway to assist staff facing personal problems, as well as rewarding those who perform well.

The largesse even extends in some cases to buying homes for staff, whose average stay at the company is about 16 years, he said.

“We look after our own. That’s key to a loyal work force. That’s how we work,’’ he said.

DAYDREAM BOAT

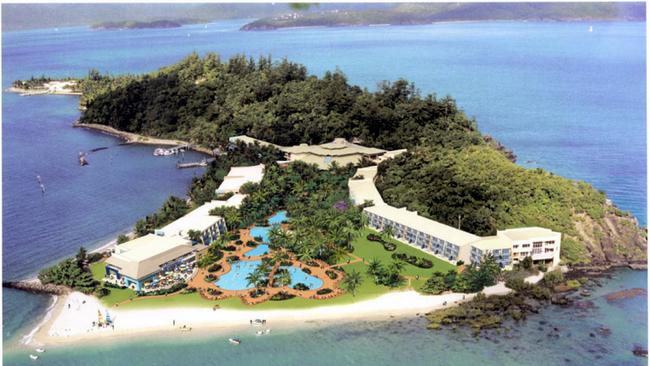

MANY of Vaughn Bullivant’s eccentric design elements on Daydream Island are now gone, thanks to a $100 million renovation under way by new Chinese owners who have spent nearly two years repairing the damage wrought by Cyclone Debbie.

“Less Disney and more educational,’’ is how marketing boss Jayson Heron described the changes yesterday as he and his team ramp up interest in the island ahead of plans to re-open in mid-April.

But Heron tells us that Bullivant’s rather gaudy “Champagne Princess’’ cruiser, complete with top deck jacuzzi, still remains moored there even though it’s gathering dust for lack of maintenance.

The boat was part of the sale package when the former vitamin king offloaded the island for $30 million in early 2015 to the China Capital Investment Group.

LOSING FAITH

Nick Mather’s loss-making Armour Energy quietly suffered what could be interpreted as a vote of no confidence in the Brisbane-based gas explorer this month.

A cornerstone investor, Sydney fund manager MH Carnegie, gave notice that it was seeking the early redemption of convertible notes worth $15.2 million plus interest.

Armour must now either redeem the notes or source a third party to purchase them within 60 days.

Carnegie controls a third of Armour’s 373 million notes, which are valued at just over $41 million.

Armour said it was already in talks with third parties to acquire some or all of the Carnegie notes.

The setback follows Armour reporting an $11.5 million net loss in the last financial year and suffering negative cash flow.