Billionaire QCoal boss Chris Wallin has dramatically boosted his holding in a WA gold miner

A Queensland mining titan has more than tripled his stake in Perth-based Venus Metals to become one of the company’s biggest shareholders

City Beat

Don't miss out on the headlines from City Beat. Followed categories will be added to My News.

One of Queensland’s richest mining kingpins has more than tripled his stake in a struggling Western Australian outfit aiming to take advantage of soaring gold prices.

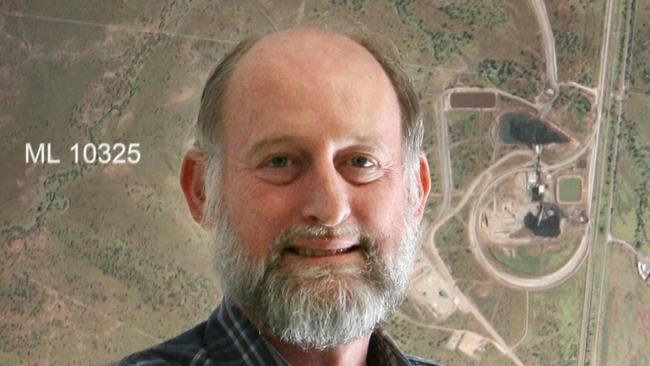

It emerged this week that QCoal founder and boss Chris Wallin (illustrated) had boosted his holding in Perth-based Venus Metals from 5 per cent to 17.25 per cent to become one of the company’s biggest shareholders.

Wallin shelled out $1.2 million for an initial stake of 6 million shares earlier this year and he’s now dug deep again, forking out $4 million to snare another 20 million shares.

Of course, that’s all really just pocket change for Wallin, the former state government geologist who launched privately-held QCoal in Brisbane in 1989 and is now worth an estimated $2 billion or so.

But he’s clearly spotted some unrecognised value in Venus, a minnow now on the hunt for gold, copper and iron ore, as well as vanadium and lithium, which have become hot commodities for the rechargeable batteries sector.

Even with gold hitting record highs earlier this year, Venus has been doing it tough of late.

It suffered a $2.2 million net loss last financial year and $1.7 million of red ink in 2018. Highlighting a working capital deficiency of nearly $500,000, auditors have cautioned investors about a “material uncertainty’’ over the company’s ability to stay afloat.

TO THE RESCUE

Closer to home, Wallin wraps up his year satisfied in the knowledge that he saved Bounty Mining from likely collapse.

His QCoal lobbed a $90 million refinancing deal which Bounty finally agreed to in early October after initially knocking it back in favour of an inferior plan from its biggest single investor.

Under the scheme, QCoal stumped up $60 million in cash and another $30 million facility to help Bounty pay down debts and inject working capital in to its assets in the Bowen and Laura basins.

For his troubles, Wallin now has a 6.5 per cent stake in Bounty, as well as two top lieutenants on the board.

Few could have predicted that Bounty would need a white knight so soon after its IPO, which saw it raise $18 million in June last year.

With Millennium Coal founder Gary Cochrane at the helm, Bounty focused on acquiring distressed assets, picking up the Cook Colliery near Blackwater for $31.5 million, as well as other sites from Glencore for an additional $10 million.

But a cascading series of dramas exacted a huge toll and Cochrane quit in February after 10 years as chairman and CEO. Bounty suffered a jaw-dropping $34.4 million loss in the last financial year as negative cash flows hit nearly $28 million and current liabilities blew out to $35 million.

In a triumph of understatement, new chairman Rob Thomas told shareholders at the AGM last month that the company “has had quite a rough journey’’.

He pinpointed “lower than expected productivity, poor plant and equipment reliability, and more recently falling coal prices and two rock falls’’. Yes, even rock falls!

BRANCHING OUT

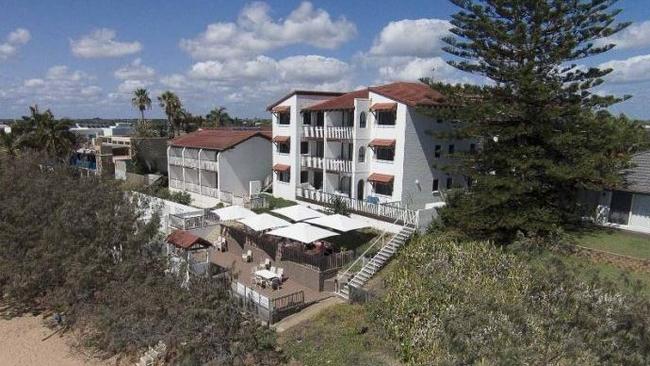

The boss of Queensland’s biggest independent operator of hotels and bottle shops has branched out into resorts.

The Star Group, headed by wealthy investor Steven Shoobridge, has shelled out $3.85 million to acquire the Don Pancho Beach Resort at Bargara.

The dated Mediterranean-style property previously operated under a time share arrangement that is currently being wound up in court by the participants.

The 44-room complex, on a 3500 sqm beachfront block 14km outside the Bundaberg CBD, is ripe for redevelopment.

Shoobridge told City Beat yesterday that renovation plans were still being worked out for the 3.5-star hotel, which continues to trade. “It’s a wonderful piece of real estate,’’ he said.

And Shoebridge knows property. He coughed up $10.1 million to buy the old Christoper Skase mansion “Bromley” in Brisbane early last year and previously offloaded a riverfront penthouse to former PM Kevin Rudd and Therese Rein, for $8 million in 2016.