Aus Ships boss Tommy Ericson ran a marine firm that collapsed in 2014 with nearly $24m in debts following a shipyard fire

How closely did the Brisbane City Council examine the track record of the local boat builder who is now churning out the next generation of double-decker CityCats?

City Beat

Don't miss out on the headlines from City Beat. Followed categories will be added to My News.

MARINE DISASTER

How closely did the Brisbane City Council examine the track record of the local boat builder who is now churning out the next generation of double-decker CityCats?

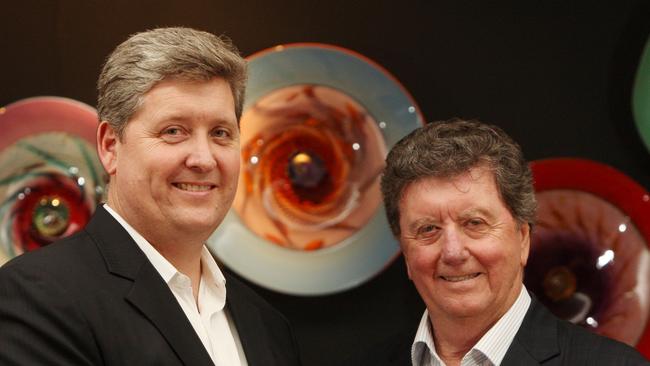

That remains unclear. But City Beat has learned that Tommy Ericson, who is the sole director and owner of Aus Ships, previously oversaw a marine firm that collapsed six years ago with nearly $24m in debts.

After a 3½ -year stint, he left his role as general manager of Aluminium Boats Australia just a month before it went to the wall in November 2014.

Liquidator Kelly Trenfield confirmed this week that none of the 275 unsecured creditors recovered a cent from the wreckage. A fire which gutted a $54m Australian Navy patrol boat under construction at the ABA shipyard in August 2014 played a large part in bringing down the company.

That’s not all. Questions are now being asked about a high-speed passenger catamaran built by Aus Ships and which helped demonstrate the firm’s bonafides to manufacture the new CityCats, each priced at nearly $4m.

Aus Ships launched its flagship Sun Harmony catamaran in April last year and it went into service at Hamilton Island, where it ferried passengers to Hayman Island after the resort’s reopening a few months later.

But last month a marine surveyor performing a routine annual check found substantial buckling and other damage on the hull which forced the 21m vessel to undergo extensive repairs at Airlie Beach.

A spokesperson for the Australian Maritime Safety Authority confirmed this week that the damage occurred as a result of the craft “being operated at speed in rough weather conditions in the Whitsundays’’.

With repairs completed, the boat can return to service albeit with speed and weather restrictions.

But it’s understood a dispute remains between boat operator Cruise Whitsundays and Aus Ships over what caused the problem.

Was it a design and construction issue or mishandling of the vessel? We don’t know but multiple sources in the marine industry told your diarist that it’s highly unusual for a boat built for those waters to need such repairs so soon after starting service.

Ericson, who just splashed out on a flash new home in Balmoral last month, did not return a call seeking comment on Wednesday.

Earlier this month City Beat revealed that some of the mandatory criteria specified in the CityCat tender documents were not met.

As a result, the new vessels, which have started playing the Brisbane River, are too heavy and too wide, which exacerbates issues with wash and berthing. The council accepted them anyway.

“Shaft brakes’’ were also required in the tender but later dropped as an essential feature.

A BCC spin doctor said this week that efforts were made to assess “the capacity, experience and ability” of all tenderers to meet Council specifications.

“Aus Ships offered the best outcome for Brisbane ratepayers and was therefore awarded the contract,’’ she said.

GAS POWERED

It’s been a cracking week for Brisbane resources outfit State Gas.

The company, chaired by industry pioneer Richard Cottee, was one of four players which won tenders to expand their existing holdings in Queensland.

State Gas revealed on Wednesday that the green light will increase its acreage by more than eight times, providing huge prospects for both conventional and coal seam gas.

The growth will create a “super-gas region” and expressions of interest have already come in from potential customers.

The firm is already seeing encouraging drilling results from its flagship Reid’s Dome project in the Bowen Basin, which is considered one of the state’s biggest and most promising natural gas fields.

But State Gas is still in cash-burn mode, piling up annual losses and continuing to go cap in hand to the market before it can start making money.

In that spirit, the company also announced that it had raised $9.5m in a private share placement from sophisticated investors, including Rich Lister energy baron Trevor St Baker. They hope to rustle up another $2m as well.

That cash fill-up will help blunt the impact of a $3.55m net loss in the last financial year, more than double the red ink in 2019.

State Gas competitors Senex, Comet Ridge and Denison Gas also won tenders to explore areas close to their existing holdings in an effort to get more of the fuel to the market quickly.

That’s consistent with the PM’s call this month for a “gas-led recovery’’ out of the COVID-19 downturn.

BATTERY CHANGE

There’s been quite a shake-up inside fast-growing Brisbane battery materials and testing mob Novonix.

The company announced on Wednesday that Philip St Baker will depart as managing director to pivot to the chairman’s job of NSW-based energy retailer Delta Electricity.

He’ll be stepping into the role now held by his dad, power industry titan Trevor St Baker, who will in turn take up a board position at Novonix since his energy innovation fund is already a major stakeholder in the firm.

Sounds like a game of corporate musical chairs!

That’s not all. Company co-founder Dr Chris Burns has been promoted to group CEO, while Nick Liveris (son of former Dow Chemical supremo Andrew Liveris) will take on the job of group CFO.

The restructure comes as Novonix, which already has a toehold in both the US and Canada, flagged plans to expand into Europe as global demand for lithium-iron batteries continues to soar.

Launched in 2012, the company announced a breakthrough in June in efforts to create an ultra-long-life battery for electric vehicles which helped drive the share price up dramatically. Speculation also continues that a deal with Tesla is in the works.

While Novonix continues to post huge annual losses ($20m of red ink in the last financial year alone), it rustled up $58m in May to help stay afloat.

BEER ON THE WOOD

They’re back!

For the first time since we locked down in March, kegs of the classic XXXX beer on the wood are returning to the Breakfast Creek Hotel starting this week.

Footy legends Johnathan Thurston and Kevin Walters have been tapped (so to speak) to spike the first barrel at noon Thursday.

The classic watering hole is one of the last places in Australia still serving coldies from a wooden keg, which are churned out at the Castlemaine Perkins brewery in Milton.

The Creek, which first starting serving the special lager in 1977, went through 18 to 20 barrels a week before the pandemic.

It’s not just a thirst quencher either, venue boss Lance Burrows pointed out.

“Tradition has it that your first drink as an 18-year-old is a XXXX woody barrel, with father and grandfather in tow. We expect to welcome a few delayed celebrations with that in mind,’’ he said.