China export shock threat to QLD economy

Queensland is facing a “potentially devastating” shock from China’s increasingly hostile trade war. This is what you need to know.

QLD Business

Don't miss out on the headlines from QLD Business. Followed categories will be added to My News.

Queensland’s economy faces a “potentially devastating” shock from China’s increasingly hostile trade war which threatens 8 per cent of the state’s annual production.

Some of the state’s most important export money spinners including coal, beef and seafood have already faced sanctions and fears are growing that a prolonged war could drag in other valuable sectors such as LNG.

Tensions remained fever-pitched yesterday as Australia hit back with its strongest retaliation yet by referring China’s tariff strike on the $2.5bn barley export industry to the global trade umpire.

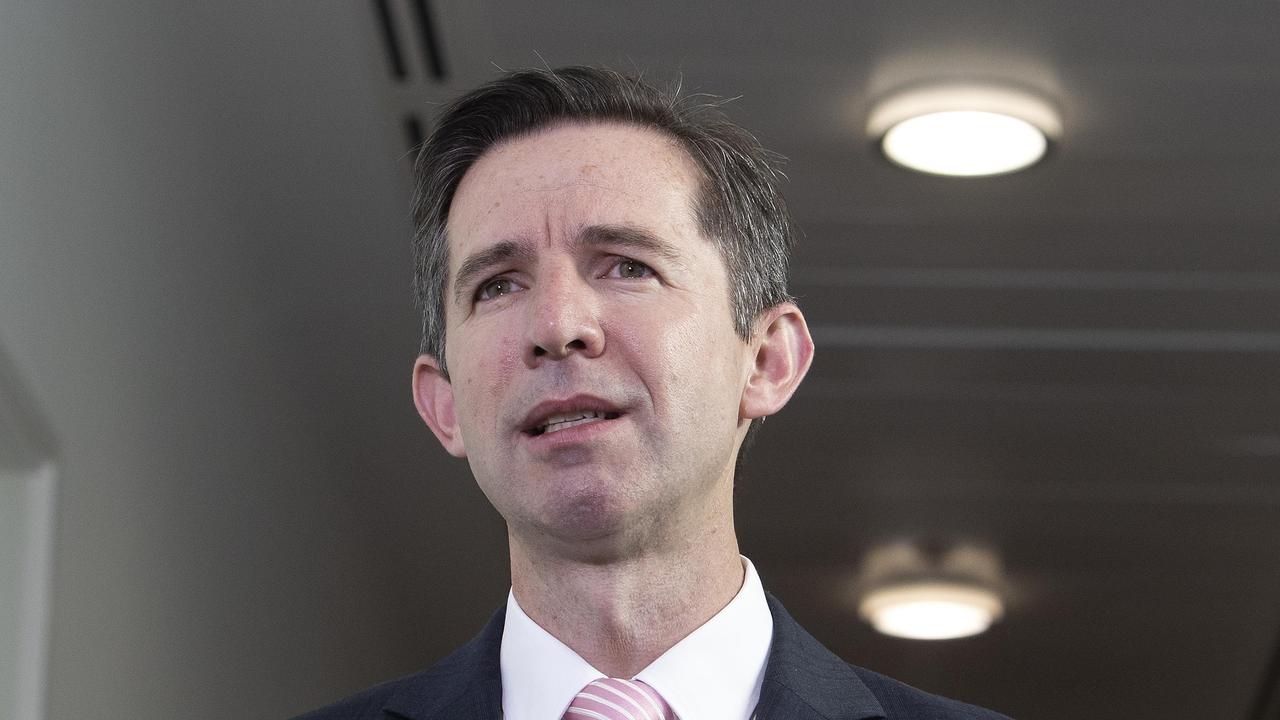

Trade Minister Simon Birmingham said the World Trade Organisation was the “logical and appropriate next step” for the government as relations with Beijing continue to sour.

Australian barley and wine have both been slapped with crippling tariffs following accusations of dumping, which have been rejected by Senator Birmingham.

Queensland’s $7bn coal export industry is the latest to find itself in China’s sights following unconfirmed reports that the product had been black-listed, following months of slow downs at ports.

The Morrison government has been left scrambling to confirm the reports following a breakdown of ministerial-level contact this year after Beijing refused to return calls from Canberra.

The latest black-listing appears targeted at the cheaper thermal coal exports used for power generation which account for less than $1bn of Queensland’s coal trade to China.

Queensland’s total export trade to China reached $28bn in 2019-20, accounting for nearly 8 per cent of the $363.5bn gross state product.

About 36 per cent of the state’s exports ended up in China, leaving Queensland heavily exposed to the worsening tensions.

Only Western Australia, which sent more than 50 per cent of exports to China due to its iron ore production, was more dependent on that trade.

Adept Economics director Gene Tunny said trade tensions could create a “substantial shock” for Queensland if they continued.

“There is a risk that if these trade tensions escalate, and it’s possible they will, then we may lose that contribution to growth and we need to adjust and that adjustment could be painful in the short term,” he said.

According to ABS trade data, the value of Queensland exports to China plunged nearly 25 per from February to October compared to the same period last year.

However the volume of exports only dropped 3.9 per cent with the sharper decline in values linked to falls in prices for commodities such as coal and gas in recent months.

Mr Tunny has estimated a complete ban on Queensland thermal coal could cost the state budget $100m to $170m if exporters can’t find alternative customers with impacts on other tax revenues and potential job losses.

“The impact would be much worse obviously if the more valuable coking coal exports were also affected, so we’re lucky the ban apparently only applies to thermal coal at this stage,” he said.

Acting Premier Steven Miles said the state’s exports had taken a hit in 2020 which had not been helped by trade tensions with Queensland’s largest trading partner.

“I hope that these issues can be resolved as quickly as possible by the Federal Government because open trade means more jobs both here and abroad,” he said.

“We’re working hard to support Queensland companies to target new markets – particularly in the Asia-Pacific region.”

Senator Birmingham said referring China’s barley sanctions to the World Trade Organisation was the “logical next step” for the government but he warned the process was “not perfect” and could “take longer than would be ideal.”

But he also flagged using the WTO to break open the long list of disputes growing between the two countries.

“It is possible that there could be further actions, and certainly I would reserve all of Australia’s rights in that regard,” he said.

“We have a series of different actions that China has taken during the course of the year and each of them come with slightly different criteria for how you might respond in the WTO.”

2019-20

QLD exports to China – $28bn (36 per cent of commodity exports)

QLD GSP – $363.5bn

QLD coking coal exports to China $6.14bn

QLD thermal coal exports to China $870m